Binance Coin price shows signs of an upward move as it recovers above a crucial support level. This potential upswing is likely to evolve into reality as Binance exchange has acquired a $500 million stake in Twitter.

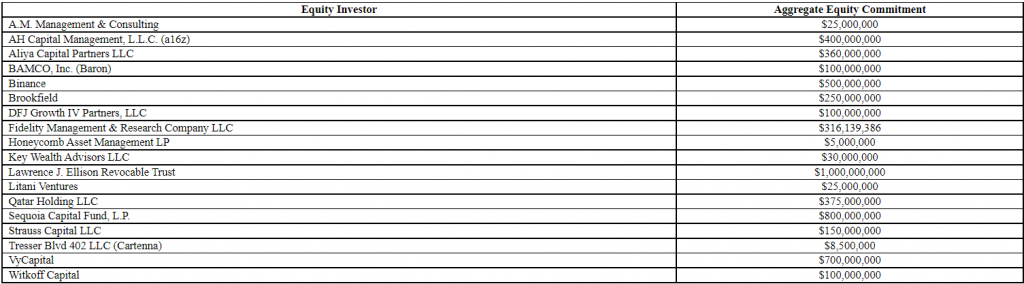

This news comes as Twitter’s board accepted Tesla CEO’s bid to buy the company at $44 billion. Investors have chimed in a total of $7.1 billion to support Musk to buy Twitter revealed Thursday’s filing at the Securities and Exchange Commission (SEC). As a catalyst, this news could hold the key to pushing the Binance Coin price to $500.

Binance Coin price receives a catalyst

Binance Coin price is traversing a range extending from $336 to $448 since 22 January. As mentioned in previous articles, range-bound price action is simple to interpret and easy to trade.

Often, the asset sweeps a limit, recovers above it and makes a run at the opposite range. For Binance Coin price, the range low was first swept on 25 February, which was followed by a 42% upswing that swept the range high at $448.

After a recent dip below the 50% Fibonacci retracement level at $392, BNB has quickly recovered above this hurdle and is making a run for the range high again, but with high ambitions.

Investors can expect a resurgence of buying pressure to trigger a 10% ascent that allows Binance Coin price to grapple with the range high. Clearing this hurdle will open the path for BNB to plan its next leg.

If the buying pressure continues to pour in, there is a good chance Binance Coin price will extend to the $508 hurdle. This move would constitute a 26% gain in total and is likely where the upside is capped.

However, in some cases, the run-up could extend all the way to $560 aka the -100% retracement level, bringing the total ascent to 38%.

Adding credence to the bullish thesis for Binance Coin price is the accumulation seen in the wallets of whales holding between 1 million to 10 million BNB tokens. These wallets grew from 10 to 11 between 22 and 23 April, denoting a massive buying activity.

This development suggests that the institutional investors are expecting a bullish outlook from Binance Coin price, which coincides with the technical perspective’s forecasts.