Pros

- Easy to get started

- Liquidity guarantees for all traders

- Purchase crypto via credit card

- Leverage, futures, and options trading

- Low trading fees

Cons

- Newer platform

- Doesn’t support as many cryptocurrencies as some competitors

- Better suited for more advanced users

If you’re in the market for a crypto exchange not named Binance, Coinbase or Kraken, FTX might be worth a peek. This crypto exchange has made a name for itself in the crypto market as a platform with a wide range of features, products, and cryptocurrencies. Our FTX review will shed light on this intriguing exchange.

When did FTX launch and what does it have to offer crypto investors and traders? Let’s take a closer look at FTX and dig deeper into how it works.

Who is FTX?

While FTX officially launched in 2019, the exchange was founded in 2018. Gary Wang and Sam Bankman-Fried are the pair behind FTX. Wang was a software engineer for Google and Bankman-Fried was a Jane Street Capital trader.

Some of the more notable investors in FTX include Binance, One Block Capital, Grelock Partners, FBG Capital, Kenetic, and Proof of Capital. As you can see, FTX is backed by multiple high-profile crypto ventures. Plus, you can find anything you want to know about its founders as their profiles and career history are available to the public.

Traders and investors can access FTX from around the world, so long as they don’t reside in a restricted country. However, for United States citizens, the platform offers FTX.US. Keep in mind that the fees and services available on FTX.com may not be available through FTX.US.

Trading Options

At this time, FTX offers plenty of products that allow users to trade more than twenty different assets and forty-five tokens. These cryptocurrencies can be traded and exchanged in a variety of ways. Here are some of the trading products FTX has to offer.

Options

Options give traders the choice to buy or sell at a certain price by a certain date and time. With FTX, traders can customize their options to meet their needs. This includes the ability to set the strike price and expiration date as they see fit.

Traders on FTX have access to open call or put options. These are essentially “right to buy,” or “right to sell” positions. Users have the option to go short or long on the options contracts, which works the same way as futures on FTX.

Futures

FTX gives its users access to both perpetual and quarterly futures on several popular digital assets, including Bitcoin (BTC), Ethereum (ETH), and Binance Coin (BNB). Traders also have access to market segments as well. So if you want to trade futures for large-cap coins, mid-cap coins, small-cap coins, privacy tokens, oil contracts, or regional baskets, you can do so through FTX.

Leverage

Traders and investors on FTX have 101x leverage while on the platform. However, FTX initially places a 10x leverage cap on all new accounts for safety reasons. Regardless of your leverage amount, you’ll have the ability to trade over forty-five tokens, which is a great way for users to get started.

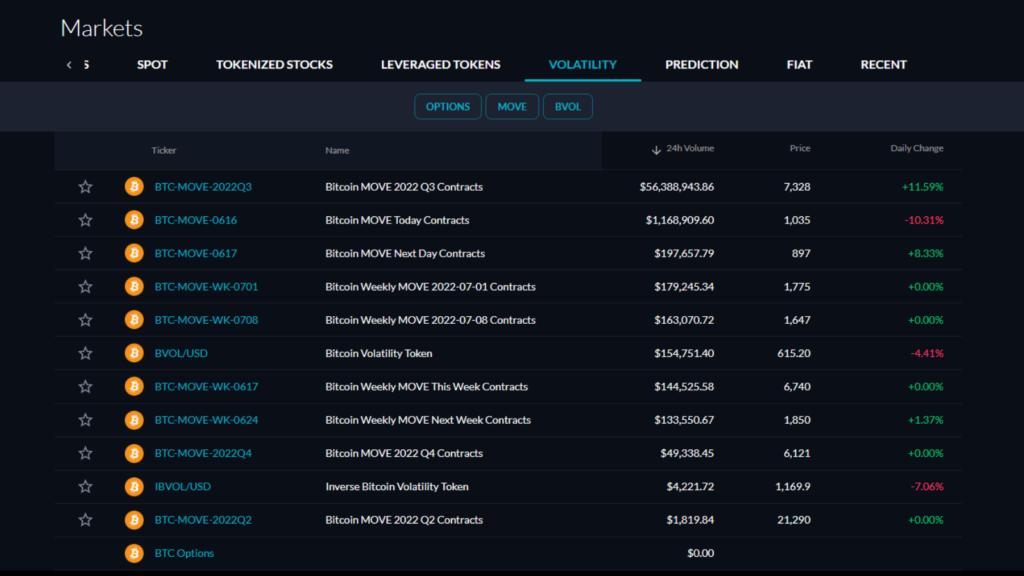

Move

One product available on FTX that you won’t find on other exchanges is its MOVE smart contract functionality. With MOVE, FTX allows users to enable futures using BTC. These funds can be moved for a set period of time, including daily, weekly, monthly, or quarterly.

Currencies & Payment Methods

Even though FTX hasn’t been around very long, the exchange supports a wide variety of fiat and cryptocurrencies. Users can buy, sell, trade, withdraw, and deposit using any of the available FTX currencies. Here are the fiat currencies available through FTX:

- AUD

- CAD

- CHF

- EUR

- GBP

- HKD

- SGD

- USD

- ZAR

While FTX offers a long list of supported cryptocurrencies, here are some of the more popular options you can buy, sell, and trade on the platform:

- Bitcoin (BTC)

- Ethereum (ETH)

- Binance Coin (BNB)

- Bitcoin Cash (BCH)

- Litecoin (LTC)

- Dogecoin (DOGE)

- Algorand (ALGO)

- Cardano (ADA)

- Cosmos (ATOM)

- ChainLink (LINK)

Fees

When using crypto, there are no deposit or withdrawal fees, plus, FTX doesn’t charge for futures settlements. If you want to perform trades or move funds within your wallet, you can do so at no cost as well.

On the other hand, leveraged tokens are subject to fees, with a redemption and creation charge of 0.10%. If you decide to increase your leverage, 50x will run you 0.02% and 100x will be 0.03%. These fees go straight to the FTX insurance fund, which we’ll speak about next.

Limit

If FTX supports a fiat currency, you can make a deposit or withdrawal using that currency. However, also allows its users to make deposits and withdrawals using certain cryptocurrencies. These include:

- Bitcoin (BTC)

- Ethereum (ETH)

- Binance Coin (BNB)

- Bitcoin Cash (BCH)

- Litecoin (LTC)

- Stablecoins backed by USD (USDT, BUSD, HUSD, PAX, and USDC)

FTX users pay no fees for their withdrawals or deposits, so long as they’re cryptocurrencies. If you want to withdraw fiat currency, anything under $10,000 will be subject to a $75 fee. However, fiat deposits are free.

Fiat transactions on the FTX platform are performed by a third-party entity, mainly because only Tier 3 users who have been KYC verified have access to the fiat features.

You’ll find there are three different account tiers when using FTX. Each tier requires more stringent KYC requirements, so if you don’t want to submit to verification, you won’t have access to higher tiers.

Tier 1 allows you to withdraw up to $9,000 in a 24-hour period without the need for verification and identification documents. Tier 2 accounts have unlimited withdrawals on their crypto, whereas Tier 3 users are allowed unlimited on crypto and fiat through the FTX OTC desk.

Security

To date, FTX has managed to steer clear of any malicious attacks, hacks, or significant security setbacks, despite launching just a few years ago. This is in large part due to how closely FTX protects its security protocols, which means they’re taking the safety and security of user funds to heart.

One way that FTX keeps user funds safe is through the SSL (Secure Sockets Layer) encryption used on its entire website. Additionally, all users are required to use two-factor authentication. This is completed through apps like Google Authenticator or Authy, or through an SMS verification process.

As we mentioned previously, the FTX insurance fund exists to protect customers in the event that a malicious party access the platform. With this fund, FTX can quickly liquidate its assets, as well as any open positions on the site.

Lastly, FTX has partnerships with significant players in the crypto market, including Binance, Circle, Proof of Capital, FBG Capital, and Paxos. With these partners, FTX inspects a large part of the deposits and withdrawals that take place on the exchange to ensure validity. Some feel this is an invasion of privacy, but FTX says that it’s to protect everyone on the exchange from hackers and malicious attackers.

Customer Service

FTX isn’t known for its customer service, which is an area many crypto investors and traders complain about. While the exchange is trying to make changes, contacting support isn’t as easy and seamless as it should be.

However, there is a self-help section, which FTX has curated to provide comprehensive answers to some of the more commonly asked questions. These are particularly relevant to those who are new to the platform, or to trading in general.

The exchange also has contact availability through social media platforms like YouTube, Facebook, and Twitter. If you’re familiar with WeChat and Telegram, you can reach out through those apps as well. These customer support features are nice, but with a Trustpilot rating of 2.2/5, it would appear that FTX has its work cut out for it in this area.

Alternative exchanges

Binance

Investors and traders will have a difficult time finding something terribly wrong with Binance. As one of the oldest crypto exchanges on the market, this platform offers a bevy of features and functionality not matched by many others in the industry.

This remains true when comparing the number of crypto assets supported. While FTX can hold its own by supporting hundreds of coins, Binance is far and away the winner as it offers trading for thousands of cryptocurrencies on its platform.

When it comes to fees, you’ll get the best deals on FTX. While you can get maker and taker fees for as little as 0.1% on Binance, FTX traders can pay as little as 0.070% on taker fees and 0.020% on maker fees, so long as they do less than $2M in trading over a 30-day period.

Coinbase

Like Binance, Coinbase has been around the “crypto block” a few times. It’s one of the most popular exchanges for those new to the crypto space. This well-established and well-known platform is known as one of the best crypto exchanges for amateur traders and investors.

Founded in 2012, Coinbase is one of the oldest crypto exchanges out there, providing the features necessary to make buying, selling, and trading popular digital assets quick and easy. When it comes to supported currencies, FTX offers support for more than 250 while Coinbase only has a little over 100.

Coinbase has some of the highest fees in the market, charging users 0.5% no matter whether you’re a maker or a taker. However, the more you trade on Coinbase, the lower your fees. Compare this to FTX, where you’ll pay much less (up to 7x less) while trading your favorite cryptocurrencies.

How to open an account

If you’re wondering how to create and set up an account with FTX, here are the steps to completing the registration process.

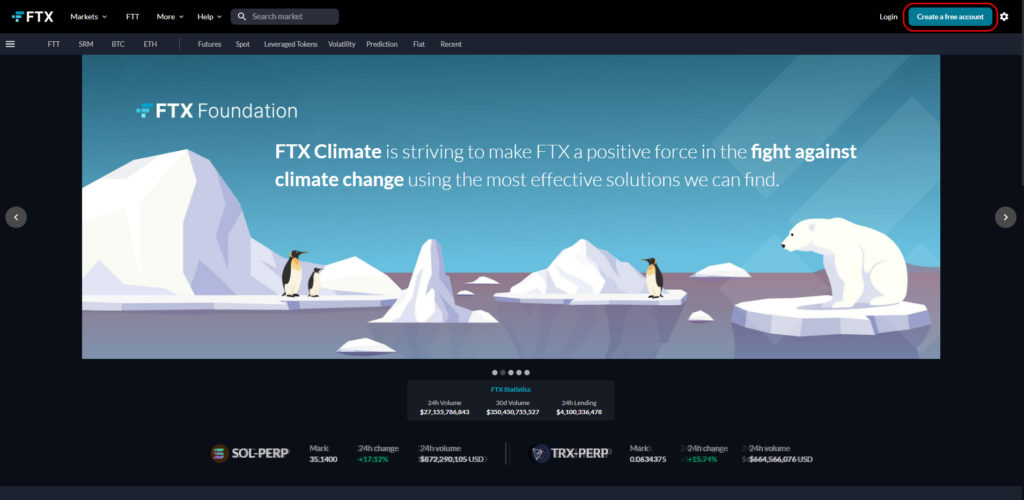

- Step 1: Head to the FTX website and click the “Create a free account” button. It’s located in the top right corner.

- Step 2: Type your name and address in the corresponding fields.

- Step 3: Choose a secure password.

- Step 4: Verify that you’re not a box with the captcha, then select the box that says you agree to the terms and services.

- Step 5: Choose “Sign Up” when the registration window opens.

- Step 6: Navigate to your email and wait for the confirmation email from FTX.

- Step 7: Confirm your email.

- Step 8: Complete your two-factor authentication through either Google Authenticator or SMS.

- Step 9: Now you can deposit funds! If you want higher withdrawal limits, you’ll need to provide further documentation to verify your identity.

FAQs

There are many questions about FTX and what it has to offer. Here are a few of the more commonly asked ones:

Is FTX Exchange Legit?

Yes, FTX is a legitimate cryptocurrency exchange. It’s based in Hong Kong and was founded in 2019 by Sam Bankman-Fried and Gary Wang.

How Does FTX Exchange Work?

FTX is a cryptocurrency exchange that allows its users to buy, sell, and trade a variety of digital assets. The platform also offers futures contracts and leveraged tokens.

How Safe Is FTX?

FTX is considered a safe cryptocurrency exchange. It uses SSL encryption, two-factor authentication, and has partnerships with major players in the crypto space. Additionally, it has an insurance fund to protect user funds in case of an attack.

Has FTX Ever Been Hacked?

No, FTX has not been hacked. The exchange takes security seriously and has implemented a number of measures to protect its users.

Worth a Look

If you’re looking for a reliable and safe cryptocurrency exchange, then FTX is definitely worth considering. The platform offers a wide range of features and benefits, plus it has the added bonus of being one of the newer options on the market. It’s a platform worth considering if you’re in the market for a fresh, new exchange.