Key Takeaways

- Since the beginning of this quarter, Polygon’s development direction has focused on Web3, DAO, NFT, Metaverse, and Scaling Solution.

- Polygon is now the perfect choice of DAO and NFTs projects for BUILD with fewer gas fees, faster and secure.

- Polygon is going green with Web3 and a $20 Million Pledge.

- Major brands, top celebrities, and leading corporations from various industries have launched NFT powered by Polygon.

- The mass collapse of lending & borrowing platforms and the liquidation of assets by hedge funds have caused money flow to run away from ecosystems and Polygon is no exception.

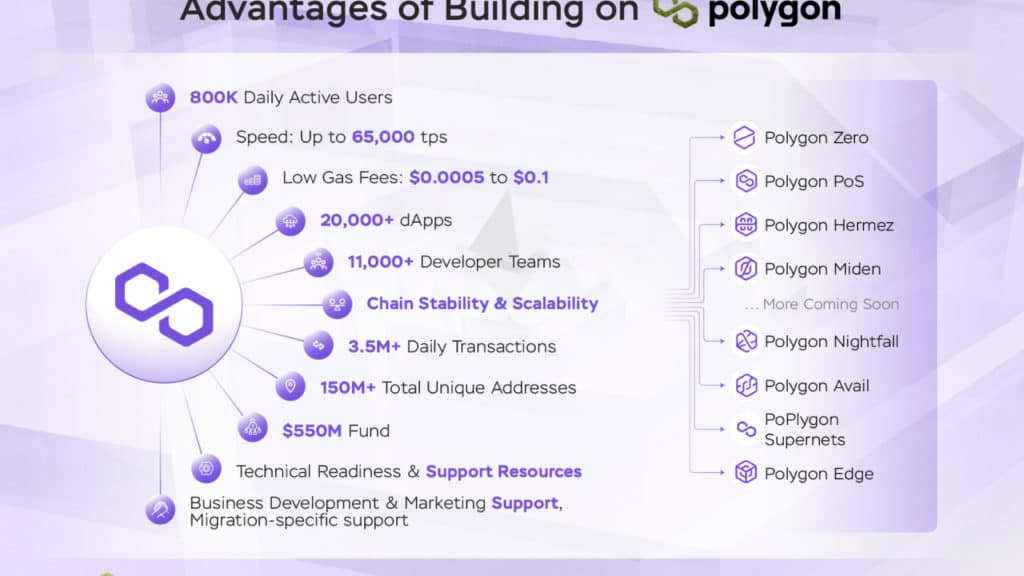

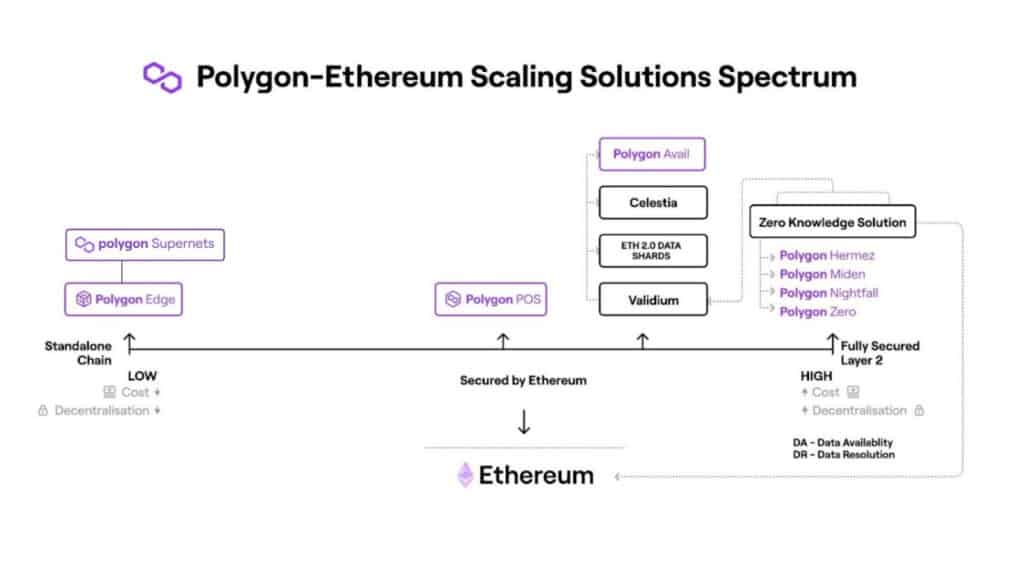

- Polygon is building a complete suite of solutions that is similar to what Amazon Web Services offers Web2 developers – a tool for every possible use case and scaling at a click of a button.

Introduction

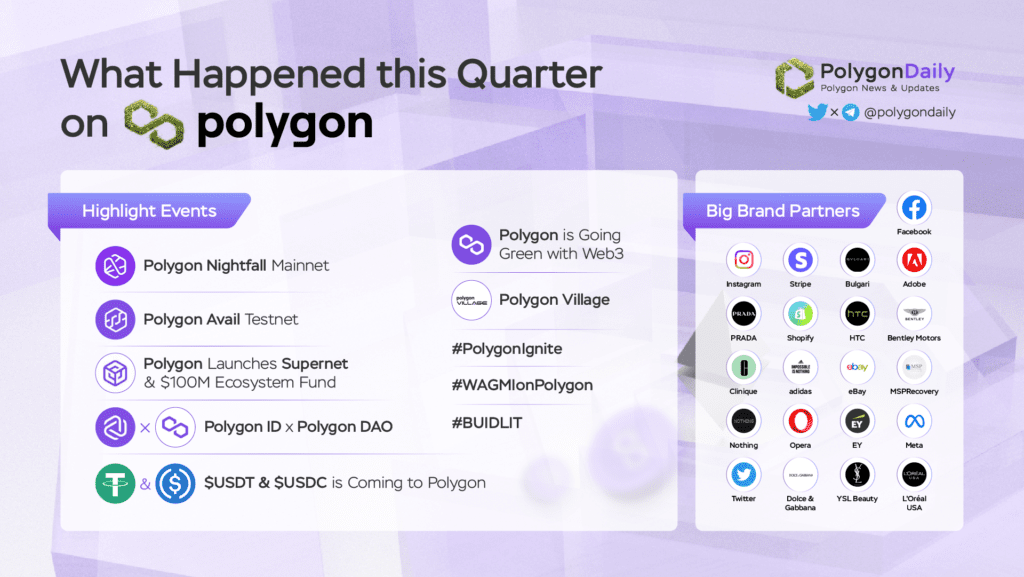

The crypto market is going through its darkest days ever. Money flows out of the market after the collapse of entities that are said to be “too big to fail”. It’s time to BUILD. Polygon Launched Polygon Supernet, Nightfall, and Avail to expand, reach more types of users, and give many options to builders now and into the future to bring mass adoption to Web3. Instead of being affected by market conditions, Polygon has actively supported Metaverse, and NFTs projects, and launched Polygon Village for developers to build and develop.

Now, Let’s dive deep into what happened with Polygon in Q2 2022

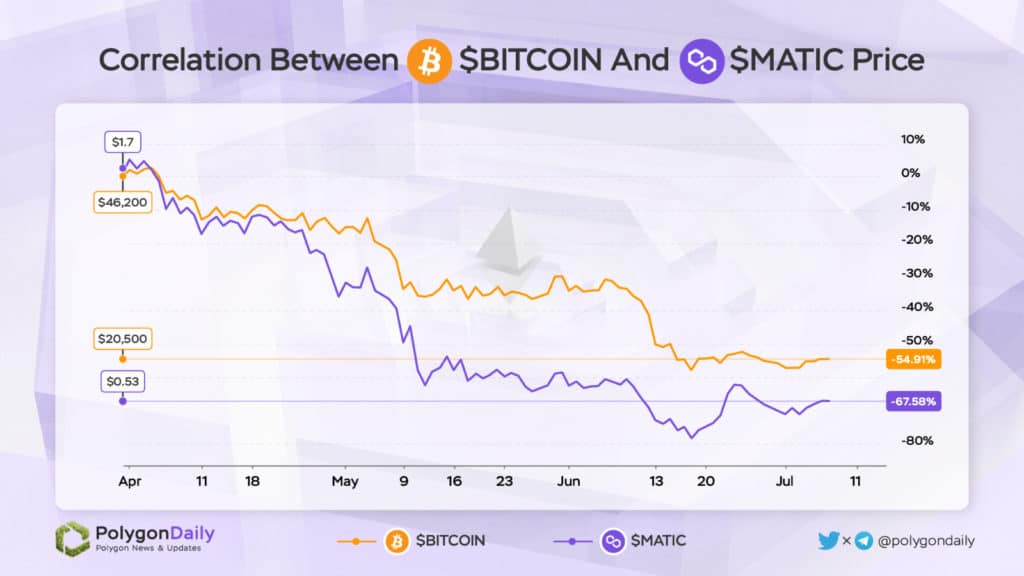

Market and Bitcoin correlation

- This quarter is probably the worst quarter of the year for the crypto market when BITCOIN lost 60% of its value, ETH lost 75%, and MATIC lost 80% of its value.

- After the collapse of LUNA, the bankruptcy of 3AC and Voyager Digital along with Celsius stopped allowing users to withdraw money led to the crypto market facing a domino crash. Users in the DeFi space have lost faith in Lending & Borrowing platforms resulting in the TVL of ecosystems decreasing deeply and not excluding Polygon.

- The effects of the global economy are likely to continue to hit financial as well as crypto markets as soaring inflation prompts central banks around the world to raise interest rates quickly and aggressively. According to JPMorgan Chase: “The recession everyone sees coming“.

Network Activity

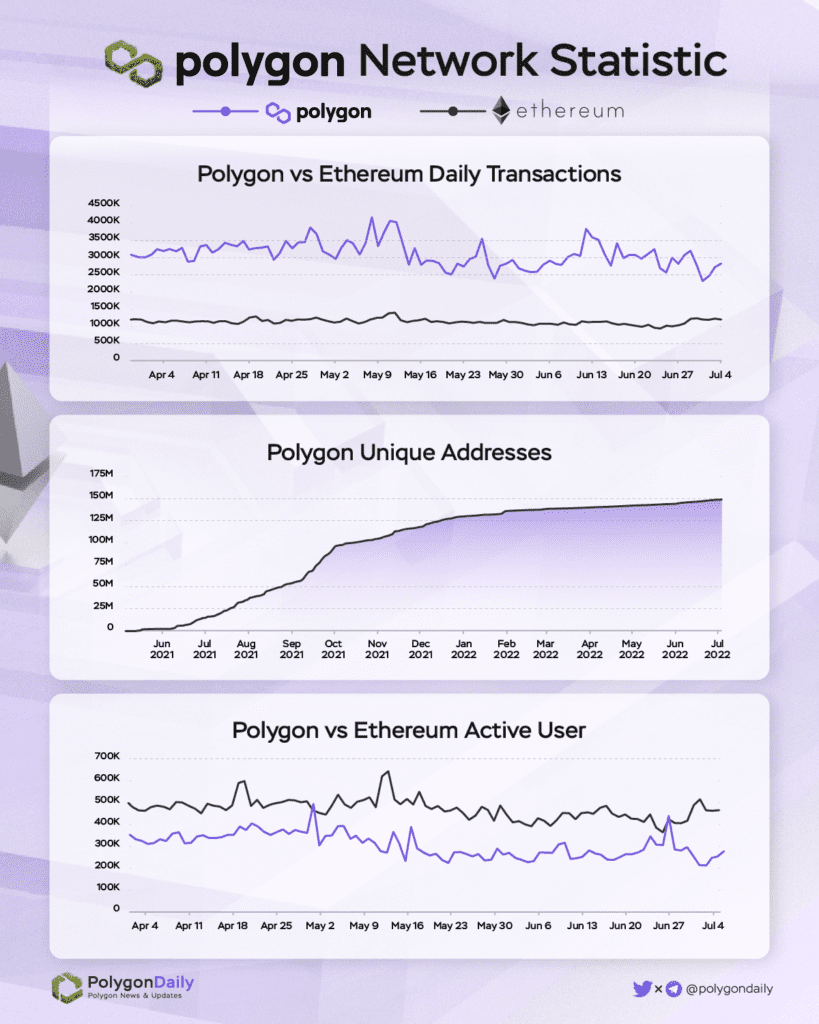

Polygon Network Statistic

Although the market is bearish, Polygon’s Daily Transactions and Active Users numbers have remained stable with 3.5M transactions per day (~ 3 times ETH) and an average of 300K daily users.

This quarter also marks the milestone of achieving more than 150 million wallet addresses on Polygon.

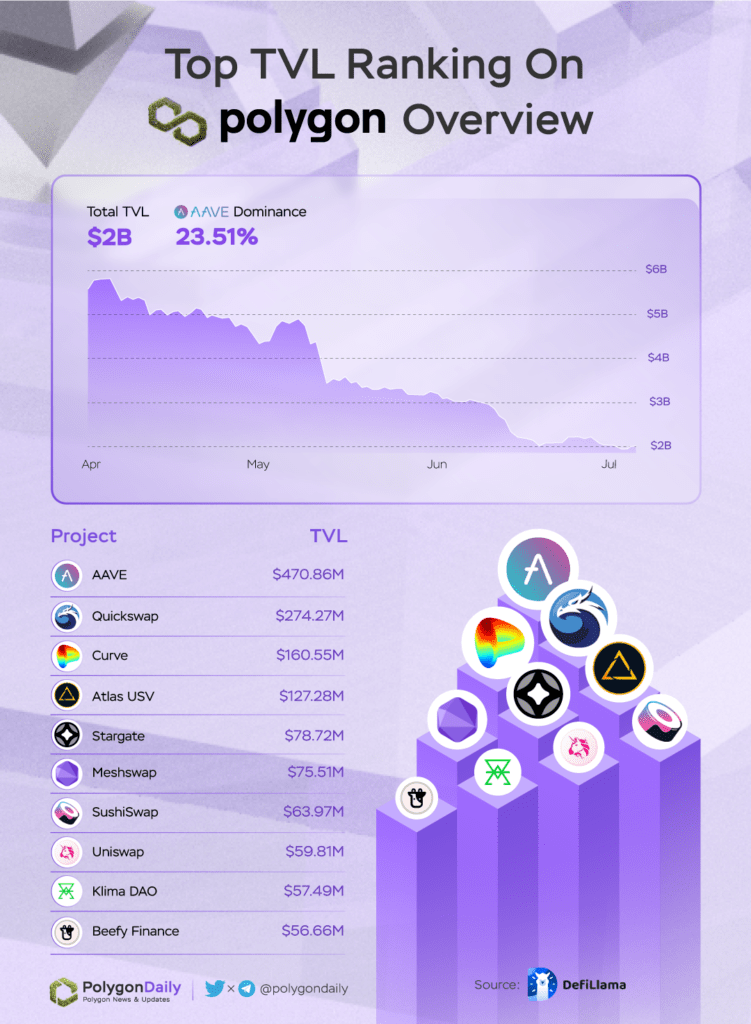

Total Value Locked

TVL in dApps and protocol is being pulled and culminating in the collapse of $UST and LUNA. A black swan event caused $4B TVL to burn this quarter and there’s no sign of the cash flow coming back yet. After the crash, AAVE and Quickswap are increasing TVL again while Meshswap, a potential DEX, hit $600M in just 1 month, lost $400M TVL, and continues to fall so far.

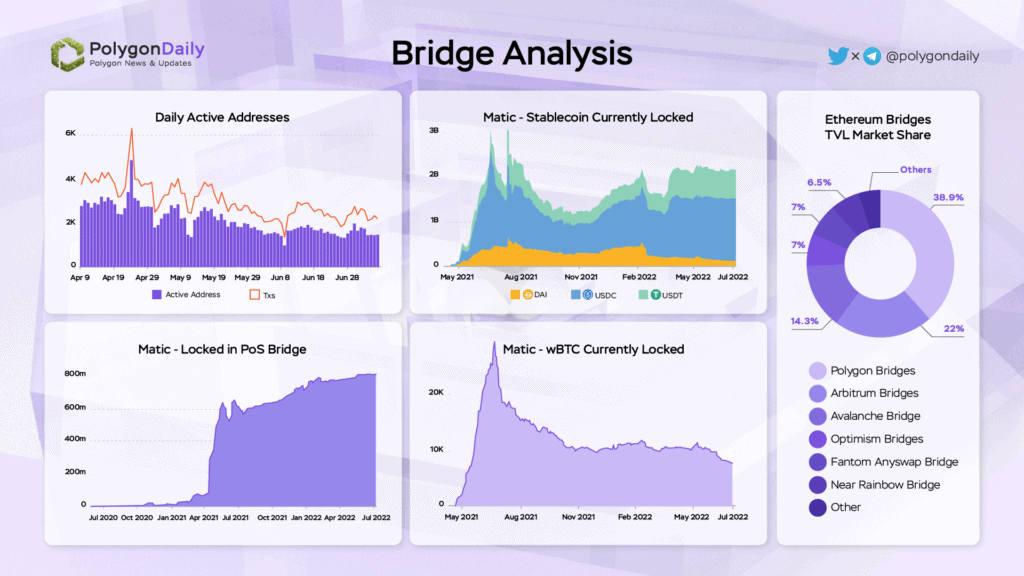

Bridge Analysis

The number of MATIC locked in PoS Bridge has reached 800 million, and the average Daily Active Users is around 3 thousand users. Polygon continues to be the largest TVL bridge from Ethereum. This shows that Polygon is a leading blockchain platform that is best suited to receive cash flows from Ethereum.

New Solutions

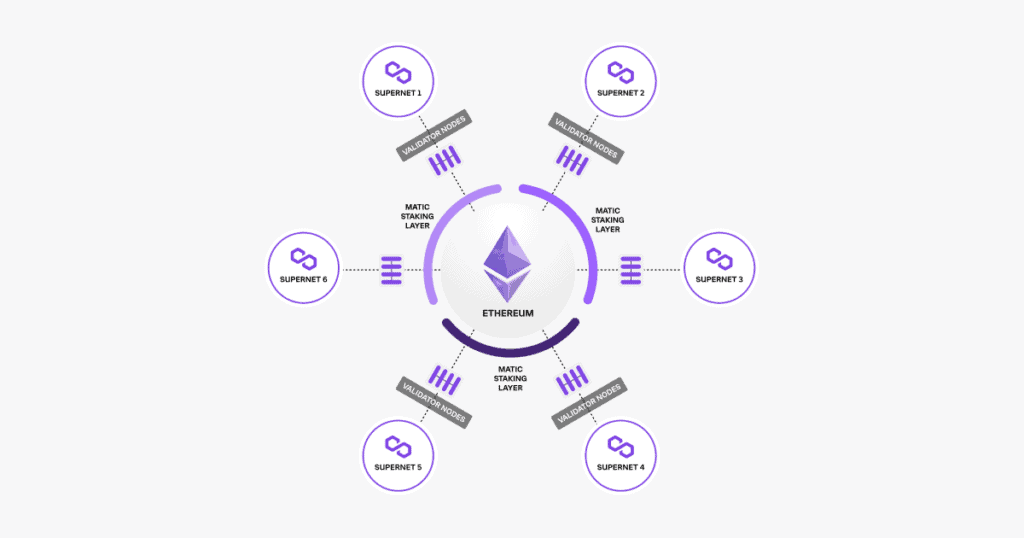

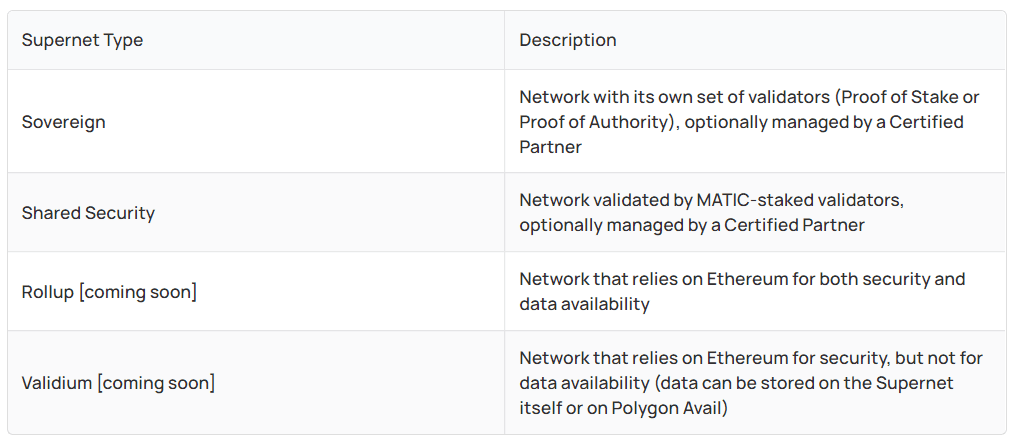

Polygon Supernets: Supernet technology allows developers to build custom networks while reducing the costs associated with the servers needed to run them.

Supernets are expected to solve complex blockchain problems such as security, protocol-level token design, and switching between different architectures. The following table covers four typical types of Supernets we expect to see in Polygon’s multi-chain ecosystem:

Polygon Nightfall: Nightfall is the most efficient blockchain solution for enterprises, enabling businesses to orchestrate private transactions for use in supply chains & other key business functions.

With a cutting-edge Optimistic-ZK hybrid approach, enterprises get:

- Security: transactions are stored on Ethereum mainnet

- Efficiency: transaction fees are the lowest possible

- Confidentiality: transactions are kept private from third parties

Nightfall aims at disrupting the $50 Trillion global supply chain industry.

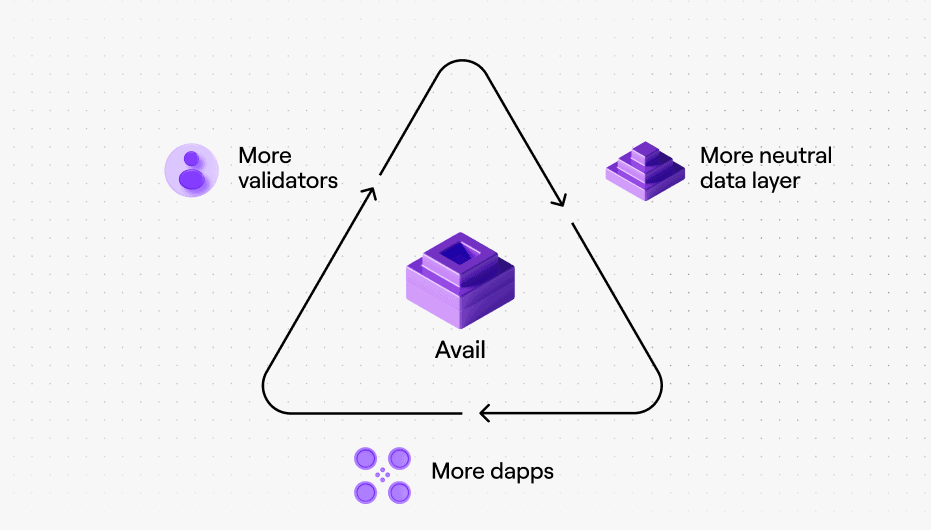

Polygon Avail: A scaling solution that allows developers to build their blockchain for their projects. Avail solves a problem that has plagued blockchain development for the last decade: the data availability problem.

Polygon Avail Launches to Turn Monolithic Chains Modular. Avail’s goal is to provide a shared security layer for the Web3 world for years to come.

Polygon Hermez 2.0 Coming Soon: zkEVM Testnet is going live this month.

Polygon ID x Polygon DAO: Polygon ID is a self-sovereign identity solution powered by ZK cryptography that brings huge potential for DAO governance.

Polygon Ecosystem

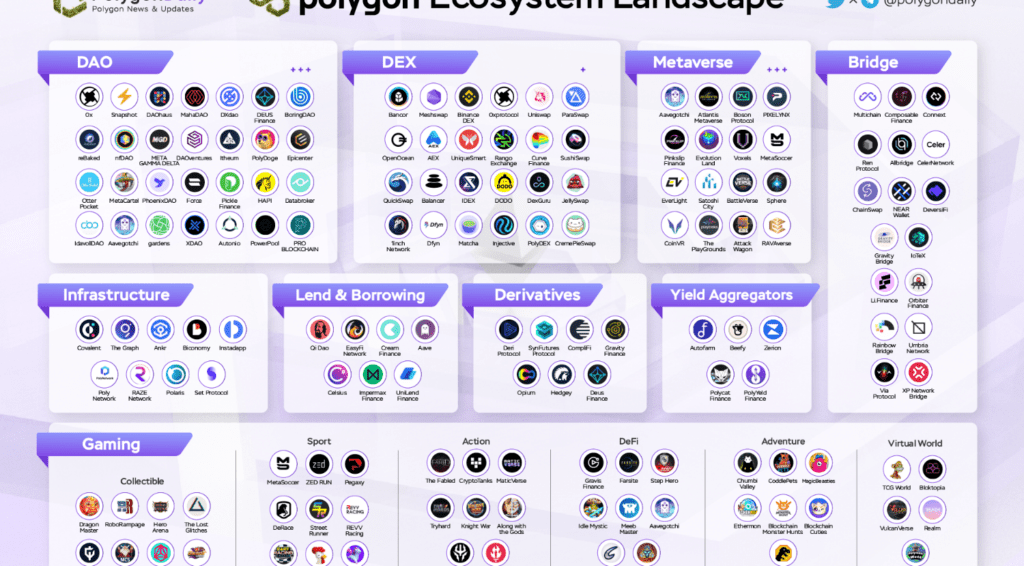

Polygon currently has over 20000 dApps, 11000+ Developer Teams, 3.5M daily transactions, 150M+ Cumulative Unique Addresses, and 800k Average Daily Active Users.

DEFI

- Polygon currently ranks 6th in Total Value Lock with $2B Locked.

- $USDT and $USDC Stablecoin are Coming to Polygon: This integration further solidifies Polygon’s role as an attractive Web3 entry point for businesses and developers, providing access to a proven, fast, composable, and highly liquid ecosystem. With over $56B USDC and $67B USDT in circulation, it will alleviate market volatility and support Polygon’s DeFi ecosystem.

- Quickswap is the highest volume native DEX that accounts for a large number of transactions on Polygon and is also a DEX applying many governance proposals to implement new features. This strengthens user trust as well as increases decentralization.

- Meshswap launched on Polygon in April and it took only 1 month to become the second-largest DEX with $600M TVL. However, due to the influence of market conditions, the current TVL of Meshswap is only around $80M.

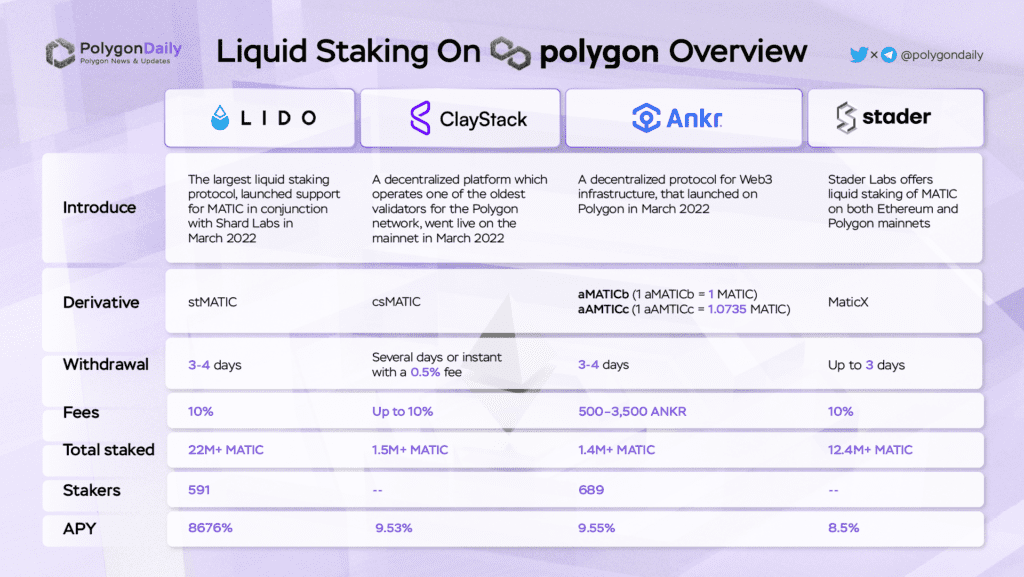

Liquid Staking on Polygon

The above 4 protocols provide derivative tokens backed by the MATIC native token to allow Polygon native token holders to earn rewards while helping to secure the network. At the same time, these tokens also help users to have many skin in game opportunities in the Polygon ecosystem such as Liquidity mining, farming, yield aggregators, borrowing, lending, and more trading opportunities.

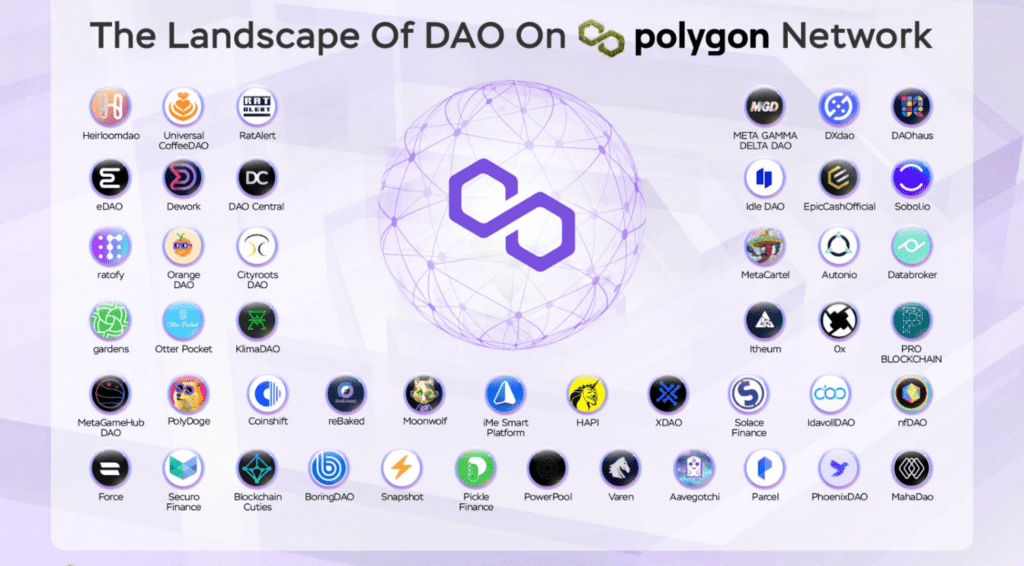

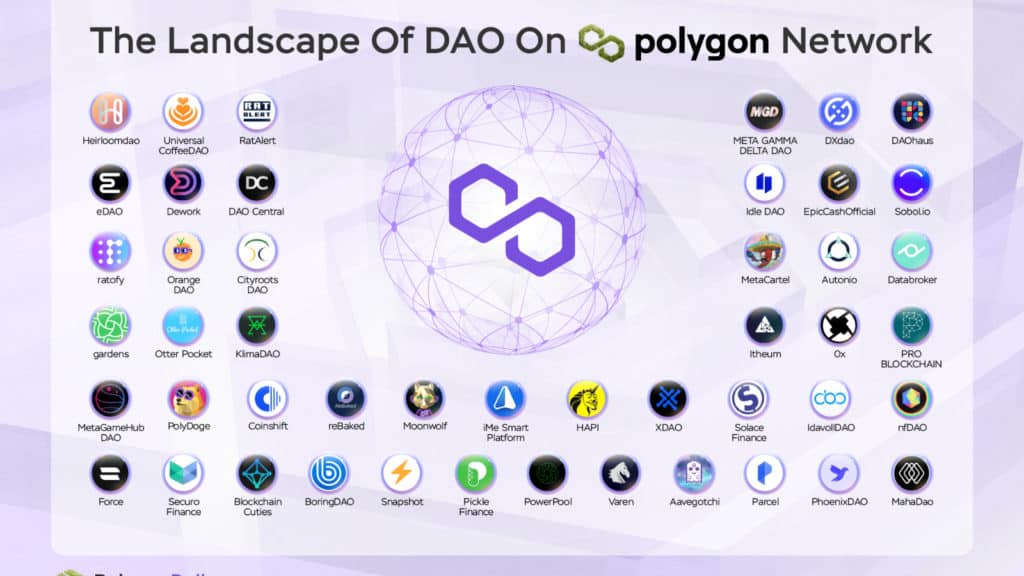

DAO

Polygon DAO announced the launch of Polygon Village, a full-stack ecosystem for developers to build and grow their projects including DeFi or NFTs, DAO or zero-knowledge proofs, tools, or anything else, any project on Polygon can apply.

The grants line is aimed at onboarding the next 1,000 projects to Polygon and is operated on a cash and voucher basis.

NFT, Metaverse and GameFi

After the collapse of the Terra Ecosystem, Terra’s NFT projects and builders lost their homes, where they built and had to find another suitable chain. Polygon has put together a multi-million dollar fund to provide relief to Terra developers to help them stay on their feet and migrate. OnePlanet, a premier marketplace, decided to come to Polygon, which became a new home for OnePlanet and whole Terra NFT projects that are migrating with them.

Currently, 48 Projects are landing in Polygon with OnePlanet, and many more are coming soon. So, what can make Polygon attract projects and builders? Let’s take a look

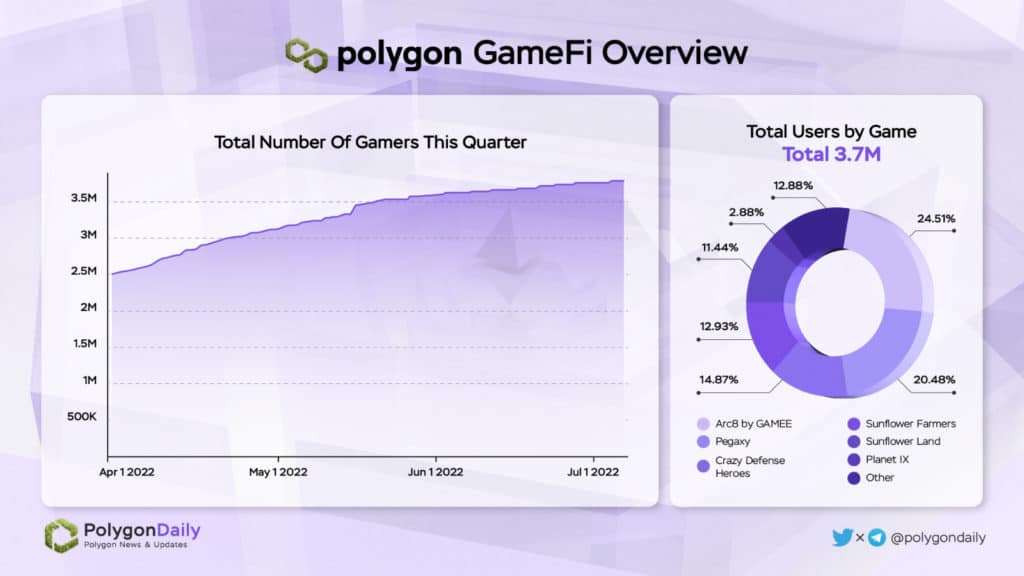

Most of the top collections on Polygon OpenSea belong to GameFi projects. With the advantage of good scalability and low fees, Polygon is becoming one of the leading blockchain platforms for the development of GameFi & NFT. Some of the top GameFi platforms on Polygon include Arc8, Planet IX Sunflower Land, Crazy Defense Heroes, Pegaxy, and Aavegotchi…

Web3 gaming and Metaverse projects are still being heavily invested, especially The Wildcard Alliance, a MOBA game that has raised $46 million and is expected to launch in 2023

Polygon Studios is actively collaborating with Web3 projects, AAA games, Metaverse, and many major game studios. We can see them at the NFT.NYC event. During this quarter, Polygon also supported major companies in launching NFTs Collection such as Meta, Instagram, Bentley, Bulgari, etc.

ReFi

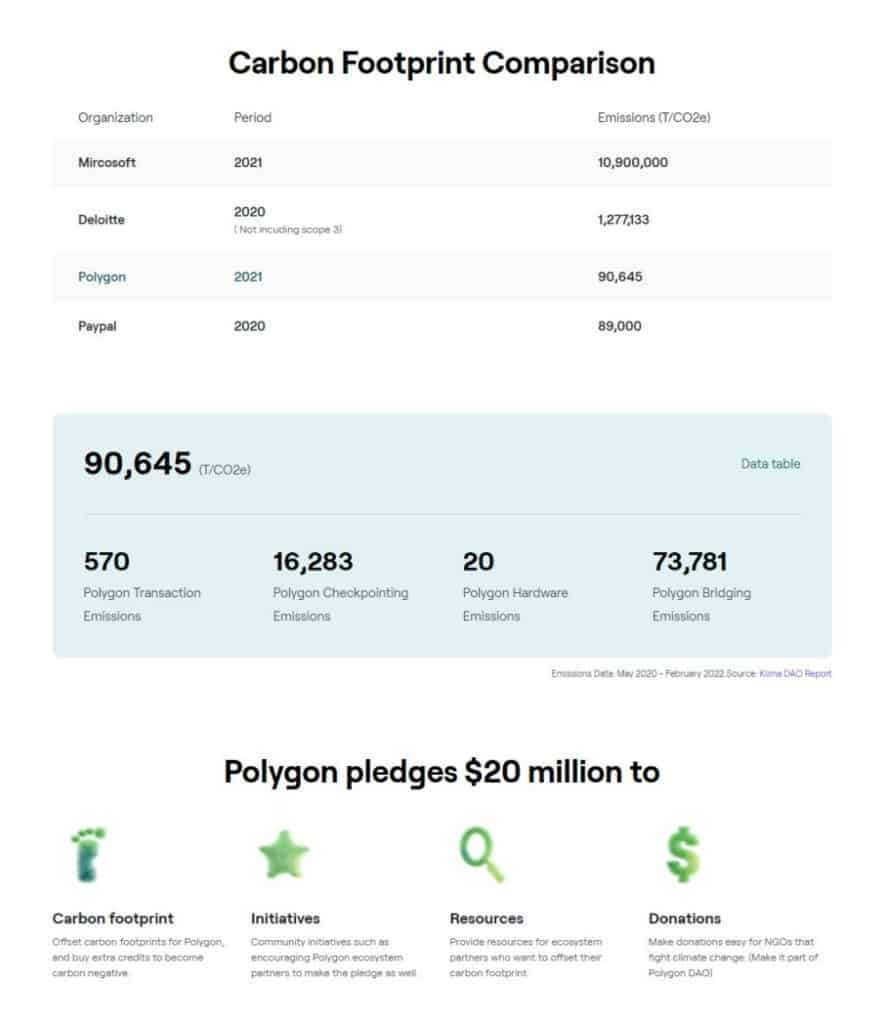

The Green Manifesto: A smart contract with Planet Earth! As of April 2022, Polygon is Carbon Neutral and pledges up to $20M to take immediate action to offset the Ecosystem’s environmental footprint entirely.

Polygon will purchase the credits via KlimaDAO‘s on-chain carbon market, and retire them using its offset aggregator decentralized app. Polygon will work on becoming the first blockchain to be climate POSITIVE.

Ecosystem Development Fund

450M Fund for mass adoption of Web3 applications and investing in ZK technology:

Polygon is building a complete suite of solutions that is similar to what Amazon Web Services offers Web2 developers – a tool for every possible use case and scaling at a click of a button.

Polygon is committing $100M for the development and adoption of Supernets. The funds are immediately available and can be used for:

- Development contracts and grants;

- Research contract and grants;

- Third-party integrations and partnerships;

- Project onboarding and migration;

- Liquidity mining;

- Acquisitions.

Highlight Events

- #PolygonIgnite: Metaverse Edition saw a whopping turnout of 834,000+ attendees. Here’s a super quick recap.

- #WAGMIonPolygon: A new series for developers available on their YouTube channel. The program will focus on educational content, expert opinions, and other developer resources.

- #BUIDLIT: The online hackathon with $500,000 in prizes. Teams have eight weeks (June 15th – August 1st) to submit a project including sectors: DeFi, NFTs, Gaming, Tooling, Infrastructure, Social Impact, Web3 Integration with Web2 Product, and Designathon.

Projecting the Polygon Ecosystem

In recent times, DeFi on Polygon has not had too much positive growth, but with many new derivative products, liquidity programs contribute to creating new opportunities for users. Following the events of stETH’s collapse, Solend whale wallet takeover plan caused users to lose trust in protocols. Quickswap has been a leader in applying governance proposals to its new features that will help the DeFi Platform regain the trust of its users. Meshswap delivered a huge hit with $600M coming to DeFi on Polygon but market conditions prevented it from reaching its full potential. This is the BUILD phase of dApps to regain user trust as well as attract new users to Polygon.

GameFi, Web3, DAOs, and NFTs are areas of particular interest with ongoing collaboration and migration with new projects. After a period of growth quickly of GameFi’s Ponzi models, it’s time for high-quality projects to build and develop in Polygon. After the fall of Terra, NFTs projects decided to migrate to Polygon, and more will come next quarter. Polygon seems to be the perfect blockchain platform to support big brands and large corporations when moving from Web2 to Web3. The launch of zkEVM in July will help Polygon expand with new platforms and will be an effective solution to solving Ethereum’s problems.

One more thing, Polygon is aiming to be the most eco-friendly blockchain. This will make it easier for projects running on Polygon to achieve ESG investment standards.

Conclusion

To sum up, the vision of the Polygon team is towards mass adoption with the simplicity and usefulness of their technologies. With significant capital ($450M+), they will innovate and rapidly develop and continue to thrive in volatility. Polygon has over 100+ roles open around the world to continue growing, and they are not adjusting their headcount forecast based on market conditions. They will continue to deploy significant capital out of their $100M Ecosystem Fund to help grow the next generation of Web3.

Disclaimer

This report is for informational purposes only. It is not a recommendation to purchase tokens or any other assets. Any investments made in the projects or assets mentioned below are done, so at your risk. This is not financial advice.