On 15 September, Ethereum underwent the much-anticipated Merge. The feat demonstrated the exceptional skills of the devs contributing to Ethereum’s code and vision. However, despite the hype associated with the network, the question is – Did the outcome match its set goal(s)?

Opportunity costs intact

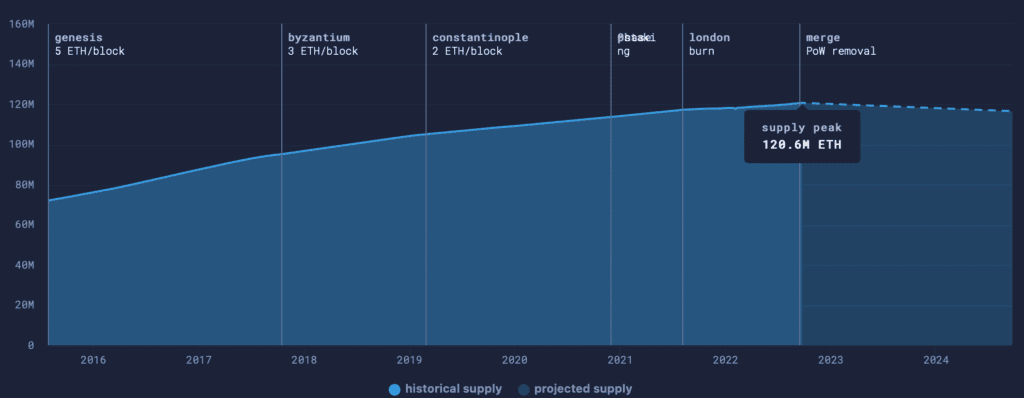

The Merge involved the most significant technical update since its inception, a move from proof-of-work (PoW) to proof-of-stake (PoS). Post-Merge, ETH issuance would fall to about 0.6 million per year, with a similar 2.7 million ETH burned.

Simply put, a net 2.1 million ETH burned per year, or -7% in yearly ETH supply.

The transition would not only help scale the network, but also bring down the energy consumption by 95%. Also, the merge spurred substantial changes for miners as well who could be out of business officially once the difficulty bomb hits.

Not just that, there would be a significant decrease in ETH inflation, which means less ETH to go around. This is indeed the case now.

According to data from ultrasound.money, on Proof-of-Stake, ETH supply decreased to only 425 ETH issued (to date) — a 98% decrease in issuance.

Source: Ultrasound.money

In fact, according to the same platform, 21,117 new ETH would have been issued if Ethereum still operated on Proof-of-Work. The so-called opportunity costs, that is. Unfortunately, that wouldn’t be the case as executives have envisioned future plans for this new member.

Ethereum’s co-founder Vitalik Buterin recently commented about the king of altcoin’s next steps. The exec admitted that transactions could get slightly lower once Ethereum passes the Surge stage.

Looking beyond

Moving on to the price front, ETH dropped by 14.4% since the Merge while the strength of the U.S. dollar surged. At press time, ETH was down by >8% on the charts as it traded around the $1.3k-mark.

Meanwhile, the Merge brought on a shift in large address behavior. Herein, addresses holding 1k to 10k $ETH dropped 2.24% of their cumulative holdings. On the contrary, 100 to 1k addresses dropped around 1.41%.

In fact, the number two crypto lost 25% of its market value over the past week. This propelled many to believe that the event turned into what traders describe as a “buy the rumour, sell the news” trigger.

Having said that, perceptions could change as well. As the supply decreases and (if and when) ETH shows high demand, there could be a price hike. Even so, caution is to be maintained at all times.