The year 2021 can undoubtedly be characterized as the year of cryptocurrencies and the decentralized space, owing to its growth in terms of price and adoption. The buzz created by the space, a result of Bitcoin’s inception, has completely engulfed investors, regulators, speculators, and dissenters alike.

Now that the year itself is nearing its end, it does in no way mean that the buzz would come to an end too. In all actuality, the crypto-space will not only continue to grow but also evolve. Thanks to its decentralized core, the space has placed itself at the center of a digital revolution on all fronts, leading the metaverse.

This year, NFTs were the most highlighted topic, with the word itself securing the title of ‘word of the year 2021’ by Collins Dictionary. Notably, people often associate non-fungible tokens with the disruption of the art world as we know it. However, it is imperative to understand that it is not its only promising area.

As things stand, NFTs have started to gain prominence in the gaming sector too. And, at the forefront of leading this run is Binance, one of the largest cryptocurrency exchanges in the world.

The emergence of another dope version

Binance has been at the front line of pushing the growth of the crypto-verse since its inception, with the team dedicated to providing the foundation required to take the digital space ahead. This time around too, the platform has by no means been behind the race of revolution.

In June this year, Binance announced the launch of its own NFT platform, after noticing that there was a growing call for it. Interestingly, the platform, unlike most others, opened its doors for not just artists but also game developers.

This initiative has seen not only an immensely positive response from game developers, but also from gamers and crypto-enthusiasts alike. The overwhelming response, in turn, has resulted in the platform launching something called Initial Game Offering [IGO].

In its blog post, Binance stated that this move was in line with its vision of building a home for NFT gaming, and “a step forward into the Gaming Metaverse.”

The curious case of Initial Game Offering

The Initial Game Offering [IGO] initiative by Binance allows people to access the “core gaming NFT assets from top tier gaming projects.” These NFT assets are exclusively available only on Binance’s NFT platform. Interestingly, the platform aims to be the foundation for gaming metaverse, connecting top-tier blockchain games and NFT assets to crypto-enthusiasts around the world.

These NFT assets could be anything related to the game. Think of it as the gun in Counter-strike, purchased from its built-in buy menu. Or, the special skins you bought to customize your game character on Steam. Except, in this case, Binance will be taking over the role of Steam.

Moreover, the IGO is turning out to be almost the need of the hour. Recently, Steam – a video game digital distribution service – banned all blockchain, NFT, and crypto-games from its platform. This has essentially led to the exclusion of blockchain game developers from participating in the gaming industry.

Leading the revolution

Interestingly, Initial Game Offerings have thrived on Binance since their launch. In order to drive this force further, the platform has partnered with Binance Labs, Binance Smart Chain [BSC] fund, venture capitalists, guilds, and influencers. All partnerships aimed at the sole purpose of on-boarding new players to NFT gaming, part of a vision to take a step forward into the gaming metaverse.

These efforts have put Binance at the center-point of driving the revolution, with more and more gamers choosing Binance NFT. The platform has, so far, launched five IGO drops, and all of them have sold out, recording a great response from the crypto-community. The platform has also recorded a whopping $8 million in trading volume for NFT drops, and over 40x growth in just 24 hours.

The key standpoint of Binance NFT is that it has taken over as the world’s largest gaming NFT trading platform. This was made possible as the platform recorded over 1 million gaming NFTs in supply, in addition to its $130 million in trading volume and 60 gaming project NFT drops.

Moreover, the platform is also accredited as the fastest-growing platform since it generated over $40 million in trading volume in just a month with IGO drops. The platform also saw its most expensive gaming NFT sold for $1,937,600 [close to 2 million].

The first and last stop of gaming metaverse

While it can be perceived that Binance is trying to boost the NFT space by creating a platform, in reality, it is much more than that. Binance aims to be much more than just a mere place where one can buy, see, and trade NFTs. Its platform is “an immersive experience where everyone can come together under one digital space, from traders and collectors to gamers and creators alike.”

Binance has achieved the said goal by being the single centralized stop for everyone looking to tap into gaming NFTs. The platform has a team dedicated to looking into the most promising blockchain game projects, which are then consolidated to be presented to its users in a seamless manner.

Notably, as a part of its gaming vision, Binance will once again be leading the new age of the digital world by launching its own NFT virtual world. The setting stone for gaming metaverse will enable users to “walk around and enjoy curated NFT art in a completely digital space.”

Disclaimer: This is a paid post and should not be considered news/advice

Category Archives: BSC News

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

See full terms and conditions.

Binance is partnering with the Dubai World Trade Centre Authority (DWTCA) to help develop regulations for the fledgling cryptocurrency center.Sponsored

Sponsored

The world’s largest cryptocurrency exchange by volume signed a Memorandum of Understanding (MoU) with the DWTCA, according to a post on the company’s blog. Binance said it would “help advance Dubai’s commitment to establishing a new international Virtual Asset ecosystem.”

Having collaborated with global regulators after coming under scrutiny this year, Binance plans to share this experience with the DWTCA to facilitate the development of the country’s regulatory regime. Another stated goal was to assist in the licensing of “crypto exchanges, businesses that offer blockchain and Distributed Ledger Technology (DLT) services, and a wide range of digital currencies.”Sponsored

Sponsored

“Through our leadership position and expertise, combined with the long-term vision of Dubai, we plan to develop a regulatory framework appropriate to fit the fast-moving and progressive nature of virtual assets,” said Binance CEO Changpeng “CZ” Zhao.

Crypto zone

Earlier this week, the Dubai Media Office declared that the Dubai World Trade Centre (DWTC) would become a crypto zone, as well as regulator for cryptocurrencies and other virtual assets. Amid intensifying regional economic competition, the DWTCA is working to establish an international virtual asset ecosystem in an effort to attract new business.

A “free-zone” within the United Arab Emirates (UAE), the DWTCA had agreed to the framework enabling it to approve and licence crypto-related financial activities in September. Meanwhile, another freezone, Dubai International Financial Centre (DIFC) established an initial regulatory framework for digital tokens in October.

Binance in UAE

The move contributes to growing speculation that Binance intends to establish a headquarters in the UAE. Last week, Binance executives met with officials from special economic zones within the UAE about a prospective move. Zhao had said last month that Binance had chosen a location for its global headquarters but would only announce it after communicating with regulators.

There are other indicators pointing to the UAE as Binance’s choice. For one, Binance recently acquired former senior officials from a few of the economic zones. Additionally, Zhao had earlier praised the UAE as being “pro-crypto,” along with France and Singapore, and recently bought his first home there as well.Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.

Share Article

Nick is a data scientist who teaches economics and communication in Budapest, Hungary, where he received a BA in Political Science and Economics and an MSc in Business Analytics from CEU. He has been writing about cryptocurrency and blockchain technology since 2018, and is intrigued by its potential economic and political usage. He can best be described as an optimistic center-left skeptic.

Follow Author

RELATED NEWS

Advertisement     With banks around the world increasingly joining the race to develop their own Central Bank Digital Currencies, Binance’s founder Changpeng Zhao, commonly known as “CZ” is already predicting their demise if certain conditions are not met. In a Tuesday post, while applauding CBDCs for being a strong validation of blockchain technology, he[Read more…]

Image courtesy of Binance Twitter page

The UAE has announced plans to develop a crypto hub based in the Dubai World Trade Centre (DWTC).

The blend of crypto regulation and innovation has pulled Binance to consider the country as its possible first headquarter, and fostered its latest regulatory deal with the DWTC Authority.

The United Arab Emirates has plans to develop a new crypto-dedicated economic sphere in Dubai. According to a Dec. 20 announcement by the Dubai Government Media Office, the new crypto hub will be based in the Dubai World Trade Centre (DWTC). The DWTC will serve as the official regulator of cryptocurrencies and other virtual assets in the hub. The region also overlooks other financial products, blockchain operators, and crypto exchanges.

The new crypto hub presents values that align with those of the Dubai Blockchain Strategy (DBS) – a blockchain adoption roadmap launched by Dubai’s Crown Prince, H.H. Sheikh Mohammed bin Rashid Al Maktoum, in 2016. The DWTC, on the other hand, plans to develop a “comprehensive ecosystem” for the growth of blockchain and crypto within a legislative framework. The initiative also furthers the DWTC’s four-decade narrative of growth and innovation.

UAE plans crypto hub establishment in Dubai

The Dubai Government Media Office stated;

The Dubai World Trade Centre will collaborate with the private sector and relevant entities in Dubai to create an attractive environment for the sector, and enforce rigorous standards for investor protection, Anti Money Laundering (AML), Combating the Financing of Terrorism (CFT) compliance and cross border deal flow tracing,”

This, according to the Office, is a significant milestone in the global city’s mission of digital transformation and blockchain adoption. The crypto hub would give Dubai a key role in “facilitating and broadening cross-border operations and ecosystem innovation.”

This development among other reports goes on to suggest a regulated but crypto-friendly air in Dubai and the greater UAE. Such an environment is likely what has motivated Binance to enter into a cooperation deal with the DWTC Authority (DWTCA). The exchange said in a statement today that it would assist in the development of digital asset regulations in Dubai. The nation’s crypto-friendly attitude might also have been factored in Binance’s consideration of the UAE as a candidate for its very first headquarter office.

Binance relations with the UAE

According to anonymous sources, Binance executives have been negotiating with officials from Dubai and Abu Dhabi on the same. Last month, CEO Changpeng Zhao said the giant crypto exchange had picked out a global headquarters, but would only reveal it following discussions with regulators.

Binance may also have chosen the UAE since some of its new hires are former senior officials from some of the nation’s economic zones. One of them is Mark McGinness from the Dubai Financial Services Authority. CZ has praised the UAE for being pro-crypto, along with Singapore and France. He even recently purchased a new home in the UAE.

Furthermore, the exchange has been under great regulatory pressure, with several consumer warnings being issued against it in a number of countries. Binance now intends to establish multiple regional headquarters, with further announcements on the same to be made next year. Its new partnership with the DWTCA may also vindicate it in the eyes of regulators in other jurisdictions, to its advantage.

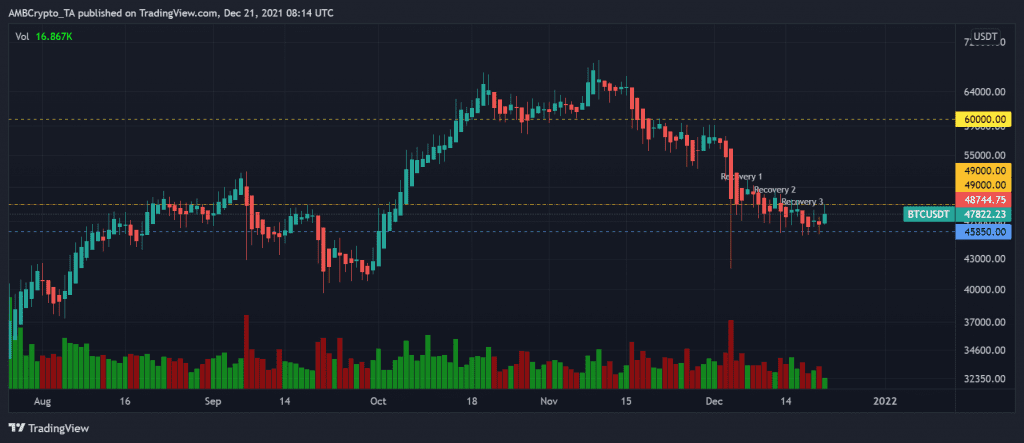

A much-awaited relief came to the larger market as Bitcoin gained 4.70%. Thus, trading at $48,438 at the time of writing. On the back of the sudden BTC gains as a new week took off, the same pulled the global crypto market cap up by 3.51% in one day giving way to a much-needed recovery.

Hold-up though, is it in fact a recovery?

Well, after the 4 December fall, a couple of days later BTC’s price saw a 6% rise. However, failed to maintain and soon fell further in just a day. Likewise, another close to 5% price recovery was seen on 12 December, then on 15 and 16 December.

Interestingly, on 19 December 19 as well. Thus, each time a single-day recovery took place over the last fortnight the same failed to sustain. So, questioning the most recent recovery absolutely makes sense.

Source: TradingView

What changes this time?

Firstly, the recent price uptick took BTC up from the lower $45,850 bounds to above $48K within a day. In addition to that, the loss realization by Short-Term Holders was tapering and setting higher lows, in tandem with a tightening of price action which was a bullish divergence indicating exhaustion of seller interest at these prices.

Source: TXMCTrades

Further, NVT Signal for Bitcoin which generally doesn’t signal “oversold,” very often, was giving an oversold signal at the time of writing This could mean that a reversal from the lower price range was incoming.

Source: WillyWoo

Earlier, each time the NVTS noted oversold, its recovery from the zone. Also, pushed prices. So, the pertinent question here – Is this a recovery indeed?

A wave of volatility awaits…

Another striking change in BTC metrics was a jump in the 14-day % change in BTC Futures Open Interest which was over 10%. Interestingly, OI change values reaching 15% and above have historically brought on volatility for the coin.

Additionally, Binance Futures Open Interest had risen steeply by over 30% in recent days, alongside a +7.4% jump in its BTC exchange balance.

Source: TXMCTrades

Although funding remains neutral, this move could signal incoming volatility, as Binance now owns over 25% of total market Open Interest.

Source: TXMCTrades

Alongside rising volatility, there’s also been a slowing down of activity as on-chain transfer volumes have dropped precipitously since 4 December from around $10-11 billion daily down to $7.2 billion.

Source: Glassnode

Thus, while the macro setup could still turn out to be short-term bearish, there are still bullish signatures on-chain for Bitcoin. Further with the year-end inching closer, BTC could swing either way, which will be interesting to watch.

Binance says that it will assist, foster and facilitate the establishment of a pronounced crypto presence within the Dubai World Trade Centre Authority.Leading crypto exchange Binance recently disclosed a cooperation deal with the Dubai World Trade Centre Authority (DWTCA). The world’s largest crypto trading platform made this known the day after DWTCA made an initial official announcement to create a new comprehensive crypto hub in Dubai, and become its regulator.Now, according to the Binance partnership, the prominent crypto exchange platform will assist the Dubai governing authority in outlining its crypto vision. According to Binance, this encompasses fast-tracking the establishment of the new crypto industry hub for global virtual assets. In addition, Binance stated that it would also help push Dubai’s resolve to set up a new international digital asset ecosystem. This is to foster sustained economic growth aided by digital innovation. The Changpeng Zhao-led organization issued a statement on the Dubai initiative, which read in part: “Binance believes that Dubai’s new agenda will contribute to the growth of the global economy. The goal is to assist crypto exchanges, businesses that offer blockchain and distributed ledger technology services, and a wide range of digital currencies and assets to become licensed in Dubai.”Binance is also one of the first crypto exchange platforms to tap into the new DWTCA project. The desert city is part of the broader scheme by the United Arab Emirates to become a crypto mainstay.Furthermore, Dubai happens to be at the epicenter of the regional competition looking to attract new businesses. The ‘free zone’ DWTCA agreed to a framework in September which allowed it to approve and license crypto-related financial activities. About a month later, another Dubai free zone, Dubai International Financial Centre (DIFC), made its own move. The specialized economic zone disclosed the first part of its planned regulatory framework for digital assets.Binance Possibly Envisions New Beginnings with Dubai World Trade Center InitiativeBinance’s newly-established working relationship with the DWTCA could prove to be a welcome boon for the crypto exchange. Having weathered intense scrutiny on the global front, the platform has struggled to establish relationships with several financial regulators. At the height of its embattlement, Binance even had to shut down or suspend some of its services in several European countries. These include Germany, the Netherlands, and Italy.Furthermore, the regulatory authorities of several other countries flagged the crypto exchange platform for a number of infractions. Back in July, the Italian Companies and Exchange Commission said the Binance Group had no permission to operate in Italy.Also, around the same period, the US Securities and Exchange Commission filed a criminal complaint against Binance for operating without a license. The SEC chose to go this route after the crypto exchange ignored its earlier ‘cease and desist’ warnings. A month earlier, The UK’s Financial Conduct Authority (FCA) had revoked Binance’s ability to trade in Britain. This came amid a sweeping regulatory crackdown on crypto exchanges in the country. Altcoin News, Business News, Cryptocurrency news, News Tolu is a cryptocurrency and blockchain enthusiast based in Lagos. He likes to demystify crypto stories to the bare basics so that anyone anywhere can understand without too much background knowledge.

When he’s not neck-deep in crypto stories, Tolu enjoys music, loves to sing and is an avid movie lover. Thank you!You have successfully joined our subscriber list.

Multichain is planning to use the capital from the seed funding round to grow its teams and ecosystem. In addition, Multichain will strengthen its ties with Binance Smart Chain. The latter will promote Multichain and recommend it as one of the bridges.Soon after rebranding from Anyswap to Multichain, the company behind the cross-chain protocol has raised as much as $60 million in a seed funding round. Notably, Binance Labs, the venture capital and incubation arm of Binance, has led the round. Other participants included Circle Ventures, Tron Foundation, Sequoia China, IDG Capital, Primitive Ventures, Three Arrows Capital, DeFiance Capital, Hypersphere Ventures, Magic Ventures, and HashKey.Anyswap RebrandingAnyswap is a fully decentralized cross-chain swap protocol, based on Fusion DCRM technology, with automated pricing and liquidity system. It is running on the Fusion, Binance Smart Chain (BSC), Ethereum (ETH) and Fantom (FTM) blockchains. With over 300,000 users, over 1,000 crypto assets circulating among different mainnets, and roughly $4.8 billion in total value locked, the protocol is one of the most sought-after decentralized exchanges that provide cross-chain trading. Initially, Anyswap was designed to enable cross-chain swaps and trading. Last week, Anyswap announced a rebranding that came with a new vision. Now, the company (already Multichain) aims to provide top-notch cross-chain infrastructure to the cryptocurrency market, enabling interoperability through a variety of ways.Future Plans of Multichain after Its Seed Funding RoundMultichain is planning to use the capital from the seed funding round to grow its teams and ecosystem. It will also follow the mission of routing the Web3. In particular, Multichain will expand its R&D unit, especially the crypto algorithm research team, the security Audit team and the Service team that helps new users and blockchain ecosystems integrate with Multichain.Zhaojun, the Co-founder of Multichain, commented:“Multichain now is the cross-chain infrastructure that connects more public blockchains and crypto-assets than anyone else, with lower transaction fees, shorter bridging time, and higher security levels. Aligning with our plan to improve Web3, Multichain will integrate NFT Cross-Chain Bridge and our new any call solution for arbitrary cross-chain contract calls, supporting innovative NFT and DeFi DApps in cross-chain ecosystems. We will remain on the frontline of cross-chain research.”In addition, Multichain will strengthen its ties with Binance Smart Chain. The latter will promote Multichain and recommend it as one of bridges. Meanwhile, it will also support Multichain to bridge bToken across networks, as well as explore deeper technology and liquidity integrations with the company. According to Binance, they are also excited about collaborating with Multichain. As Investment Director at Binance Labs Peter Huo stated, they see Multichain as “a key contributor to the multi-chain future for crypto.” Currently, Binance Smart Chain and Multichain are considering a strategic partnership that will bring more technical advancements. Blockchain News, Business News, Cryptocurrency news, Editor’s Choice, Investors News Daria is an economic student interested in the development of modern technologies. She is eager to know as much as possible about cryptos as she believes they can change our view on finance and the world in general. Thank you!You have successfully joined our subscriber list.

The world’s largest cryptocurrency trading platform, Binance, is among the first crypto exchanges to join a new crypto hub established by the Dubai World Trade Centre Authority (DWTCA).Binance officially announced it had signed a memorandum of understanding with the DWTCA the next day after the latter had officially announced the launch of a comprehensive zone for crypto in Dubai on Monday.As part of its membership in the DWTCA’s initiative, Binance will help the authority outline the vision of “accelerating the set-up of a new industry hub for global virtual assets,” the company said in the announcement.Binance will also help advance Dubai’s commitment to establishing a new international digital asset ecosystem to enable long-term economic growth with digital innovation, the firm said, adding:“Binance believes that Dubai’s new agenda will contribute to the growth of the global economy. The goal is to assist crypto exchanges, businesses that offer blockchain and distributed ledger technology services, and a wide range of digital currencies and assets to become licensed in Dubai.”Binance CEO Changpeng Zhao has recently grown interested in regulatory developments around crypto in Dubai. He was among the first people in the crypto community to report on DWTCA’s new crypto initiative on Monday. Zhao also reportedly bought his first home in Dubai in October.Dubai https://t.co/yzTbV76geb— CZ Binance (@cz_binance) December 21, 2021Binance’s cooperation with the DWTCA could be meaningful for the crypto exchange, as the company has been struggling to establish relationships with several global financial regulators that have scrutinized the exchange earlier this year.Related: Binance plans to become registered UK firm despite regulatory setbacksAs previously reported, Binance had to suspend some of its services amid dozens of global financial regulators issuing warnings against the crypto exchange. Some of the countries that flagged Binance’s operations include Germany, Italy, the United States, the United Kingdom, Canada, Japan, Poland and others.

Binance, the world’s leading cryptocurrency exchange, has signed an agreement with the Dubai World Trade Centre Authority (DWTCA) to lay down the vision of accelerating the set-up of a new hub for the digital asset industry.

CryptoPotato reported earlier that Dubai authorities declared that the Dubai World Trae Center will become a comprehensive zone, as well as a regulator for digital assets – including cryptocurrencies, products, and exchanges.

Today, Binance – the world’s leading cryptocurrency exchange – announced that it had signed an agreement with the Dubai World Trae CEntre Authority (DWTCA) – the newly formed entity – to establish a hub for the digital asset industry.

The document – a Memorandum of Understanding (MoU) – will allow Binance to help Dubai advance its commitment to establishing an ecosystem for virtual assets that will generate long-term economic growth.

The move seems entirely in line with the previous announcement, which stated that “the Dubai World Trae Centre will collaborate with the private sector and relevant entities in Dubai to create an attractive environment for the sector and enforce rigorous standards for investor protection, Anti Money Laundering (AML), Combating the Financing of Terrorism (CFT) compliance and cross-border deal-flow tracing.”

SPECIAL OFFER (Sponsored)

Binance Free $100 (Exclusive): Use this link to register and receive $100 free and 10% off fees on Binance Futures first month (terms).PrimeXBT Special Offer: Use this link to register & enter POTATO50 code to get 50% free bonus on any deposit up to $1750.

You Might Also Like: