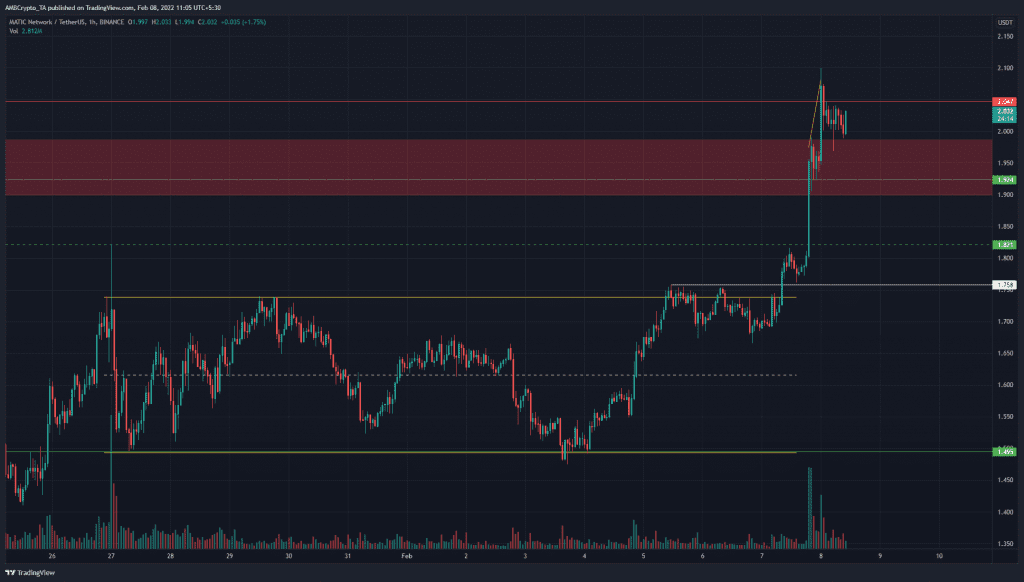

Key Support levels: $1.6, $1.4

Key Resistance levels: $1.8, $2

MATIC’s price saw a sharp drop after hitting the $2 resistance and fell all the way to $1.6 at the time of this post. If the correction continues, then the cryptocurrency can rely on good support at $1.4. The current resistance sits at $1.8.

Chart by TradingView

Technical Indicators

Trading Volume: In the past five days, the volume has closed in red, singling a strong pullback after buyers failed to push MATIC above $2. Bulls do not seem to be very interested in MATIC right now, and they might be waiting for lower levels to participate.

RSI: The daily RSI is falling in line with the price. The question is if MATIC can stop the correction here or if the price will continue to fall to $1.4. Either way, it is important for the RSI to not make a lower low.

MACD: The daily MACD is quickly approaching a bearish cross. Therefore, it is important for buyers to defend the price at $1.6 otherwise, this correction will likely continue for some time.

Chart by TradingView

Bias

The current bias for MATIC is bearish. There is very little buy pressure or interest from buyers at this time.

Short-Term Price Prediction for MATIC

MATIC has good support at $1.4 and will likely test this level again if bulls do not step up their game. The price action remains bearish and the indicators do not give a lot of hope right now for a reversal.

SPECIAL OFFER (Sponsored)

Binance Free $100 (Exclusive): Use this link to register and receive $100 free and 10% off fees on Binance Futures first month (terms).PrimeXBT Special Offer: Use this link to register & enter POTATO50 code to receive up to $7,000 on your deposits.Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Cryptocurrency charts by TradingView.