It’s yet another of carnage on Satoshi Street as the broader cryptocurrency market is down by 6% led by a steep fall in the altcoin space. The Ethereum (ETH) price crash has further intensified with ETH slipping under $1,800.

As of press time, ETH is trading an additional 9% down at a price of $1770. With this ETH is down more than 50% year-to-date eroding more than $200 billion dollars of investors’ wealth. The latest ETH price crash comes over concerns regarding the stability of its upcoming upgrade ‘The Merge’.

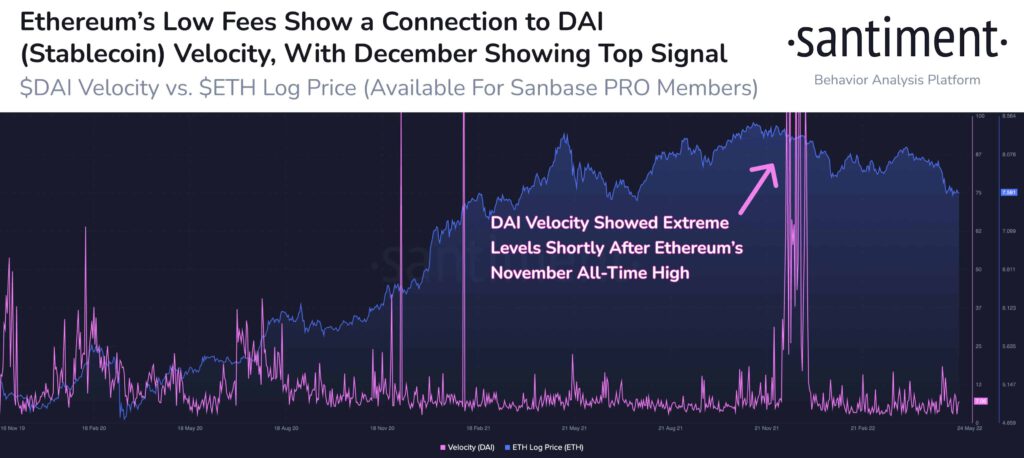

On the other hand, the ETH gas fee dropped to $2.54 earlier this week and headed even lower. On-chain data provider Santiment reported:

Ethereum continues to show extreme low fee levels, indicating very minimal activity and hints of stagnancy and fear. This #hibernation behavior also applies to $ETH‘s often paired #stablecoin, $DAI. Read our insight on #DAI‘s velocity as a top signal.

DeFi-Linked Altcoins Collapse

Apart from Ethereum, altcoins from other blockchain networks serving the decentralized finance space are seeing deeper correction over the last 24-hours. Solana (SOL) is down 12% and Avalanche (AVAX) has corrected by 18% in the last 24 hours.

Trending Stories

As per the latest Bloomberg report, the Terra collapse has led DeFi players to turn extremely cautious. The report notes:

The impact of the collapse of Terra, a blockchain ecosystem that supported one of the biggest experiments in decentralized finance, knocked an already bearish market into wild contagion this month. DeFi developers are dusting themselves off after Terra’s collapse halved the sector’s total value, and dampened markets aren’t going to help in convincing them that now’s the time to get back in the game.

Some of the other popular altcoins like BNB, Cardano, and Polkadot are also down 8-9% each. Amid all the chaos in the altcoin space, Bitcoin is so far relatively well with 2% correction.