The world of digital assets has come crashing down in recent weeks. The NFT markets have taken the brunt. However, the markets are attempting a reversal with a recent surge in NFT sales.

Now, you may ask who will be the new winner of the revamped NFT market? A shining light in this pool of crimson is the BNB blockchain.

Build and build!

Among the new leading faces of the NFT world is the BNB blockchain by Binance. Nowhere near the top before the Terra and 3AC crashes, BNB has radically grown in recent weeks. Call it luck, call it good timing but BNB has managed to ramp up its game at great timing in the crypto space. On the last week’s chart, it ranked third in the sales of NFT blockchains behind Ethereum and Solana.

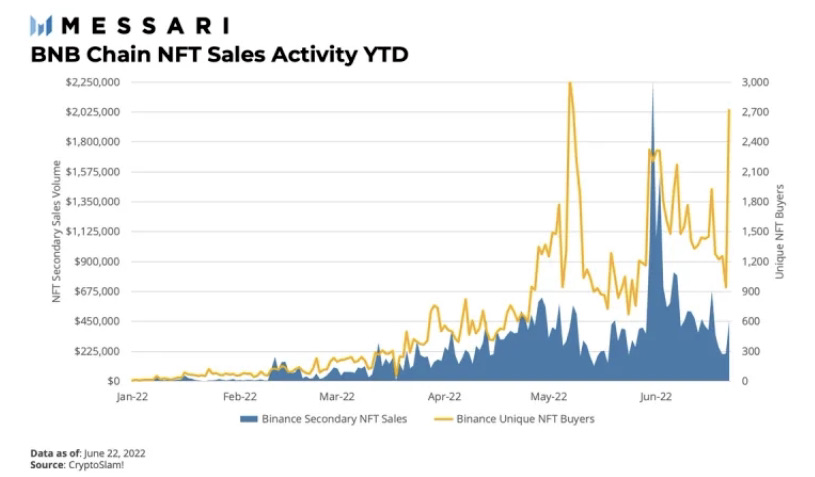

Headwinds across the crypto sphere have played in BNB’s favor. The BNB chain reached its all-time high in sales on 31 May when sales peaked at $2.25 million. Interestingly, it was able to keep afloat during the crash in June. Towards the end of the month, BNB recorded more than 4,000 unique buyers and over $1.6 million in sales. The data here shows a very positive chart for BNB with its new web3 ambitions.

BNB prodigies

Two NFT collections on BNB have stood out in the last week. The ‘Day of Right club token’ and “FGDNFT” have ramped up sales to rank in the top 15 NFT collections of the week.

The Day of Right club token collection is up a whopping 195% during the week. The sales of the collection amount to $2.85 million pushing it into the top 10 on the list. This collection was launched in early June 2022 but managed a decent $3.15 million in its inaugural month.

On the other hand, the FGDNFT is another BNB collection making huge strides in the marketplace. It was up by a massive 532% over the week with over $1.86 million in sales.

This collection is also in its infancy having been launched in May only. However, it has grown multifold over the past weeks. The average sales in July, at $3.7 million, are already higher than that of May and June.

The BNB ecosystem has had a breakout year in 2022. It comes at a time when the wider crypto market is reeling under bearish pressure.