BNB Chain’s NFTs may haven’t experienced the same traction as NFTs built on other platforms. However, this scenario may change. The BNBchain NFT community may start showing signs of growth as chain’s top NFT collections witnessed some traction.

PancakeSwap Squad and Mobox observed significant growth in the past few days. This could lead to a change in BNB Chain’s NFT front.

__________________________________________________________________________

Here’s AMBCrypto’s Price Prediction for BNBChain [BNB] for 2022-2023

__________________________________________________________________________

NFTs to the rescue

DappRadar’s data shows that the PancakeSwap Squad NFT collection showed a lot of growth over the past week. Its volume increased by an astonishing 84.32% and its sales grew by 93% as well in the last seven days.

The recent growth in these NFT collection’s volume could be attributed to PancakeSwap’s private sale allocation of their IFOs to Squaddie holders.

However, despite the growth in their NFT space, there were other concerning factors that could hinder BNB’s growth.

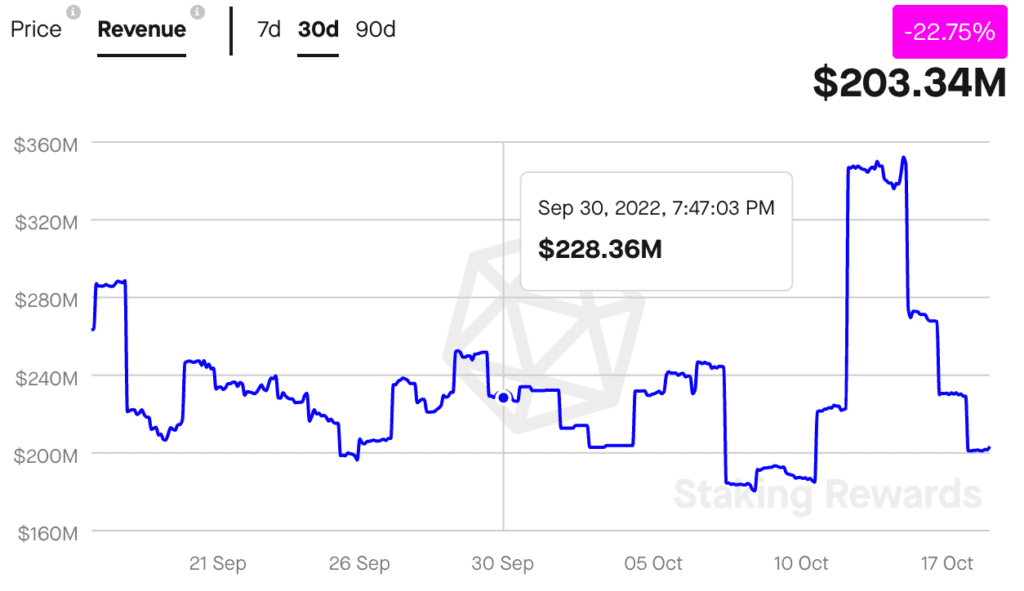

One of the developments that could get in the way of BNB’s growth would be the decline in stakers revenue. As can be seen from the image below, the staker revenue decreased immensely over the last month. The revenue generated by stakers saw a depreciation of 22.75% since the last 30 days.

Decreasing staker revenue could increase sell pressure on the stakers and could result in BNB’s prices being affected negatively.

The decline in staker revenue was not the only bearish indicator for the BNB chain. At the time of writing, the velocity on the BNB chain witnessed a sharp fall. This indicated that the frequency with which the BNB was being exchanged on addresses dropped.

Along with that, there was a decline observed in the development activity as well. This could be an indicator of slow progress in terms of technological developments and advancements on the BNB network.

These two factors coupled with a declining Market Value to Realized Value (MVRV) ratio could indicate a bleak outlook for BNB chains future.

Sunshine after the storm

However, there were some silver linings to these dark clouds. BNB’s market cap dominance, despite all the bearish indicators, witnessed a lot of growth. At press time, BNB had captured 4.67% of the total market.

Its volatility also swindled over the past week indicating that it would be less risky for investors to buy BNB.

The BNB coin was trading at $273.72 at the time of writing and had appreciated by 1.31% in the last 24 hours. Its volume appreciated by 20.83% as well in the same time period.