Positive developments around the BNB Chain helped BNB coin climb the ladder during the last month. However, things seemed to have changed as BNB’s performance in the last few days did not look promising.

The altcoin registered over a 5% seven-day decline in its price and at press time, it was trading at $270.12.

Nonetheless, BNB still left no stone unturned to add more value to the network. The most recent value addition is the arrival of Pyth Network on the BNB chain.

This new development may help in providing high-quality real-time market data for crypto feeds available via Pyth network.

As @PythNetwork arrives on BNB Chain, learn about the new possibilities that have opened up as a result.

Get the details on how Pyth functions on #BNBChain and #Binance Sidechains.

Find out more here ⤵️https://t.co/PD2zhHFilH

— BNB Chain (@BNBCHAIN) October 9, 2022

The Pyth development could be taken in a positive light as it expands the capabilities and offerings of the BNB chain. But, will this be enough to fuel BNB’s next uptrend? A look into BNB’s on-chain metrics provided a clearer picture of what to expect from BNB in the days to come.

Here’s AMBCrypto’s Price Prediction for BNB for 2023-24

BNB investors, brace for impact

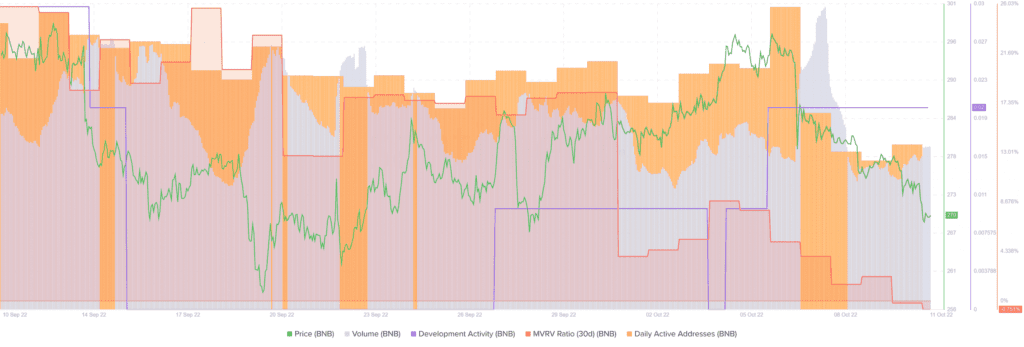

Santiment’s data revealed that things were worse than what they seemed, as several of BNB’s on-chain metrics suggested an upcoming downtrend. For instance, BNB’s 30-day Market Value to Realized Value (MVRV) Ratio went down over the last week, which was a bearish signal.

Additionally, BNB’s volume also registered a downtrend in the last few days, which was yet another red signal for the coin. Its daily active addresses also followed the same route and declined. Thus, indicating a lower number of users active on the network.

Well, the alt’s NFT space also failed to register any positive movement as the total number of NFT trade counts decreased over the last week.

However, Santiment’s chart revealed that BNB’s development activity registered an uptick, which was, by and large, a positive signal for the blockchain.

Moreover, despite the price plummeting, BNB’s social dominance remained unaffected and witnessed a spike.

Bulls vs Bears: Who will win?

The daily chart pointed out an ongoing battle between the bears and the bulls, which could lead the market in any direction in the coming days.

For instance, the Exponential Moving Average (EMA) Ribbon indicated a tussle for more than a month as the 20-day EMA and the 55-day EMA were in a brawl to flip each other.

Interestingly, BNB’s Money Flow Index (MFI) registered a downtick and stood at a neutral position, at press time. The Relative Strength Index (RSI) slipped past the neutral market touching the 40 level.

However, BNB’s Chaikin Money Flow (CMF) went up, giving a slight hope for better days to come. The Bollinger Bands (BB) revealed that BNB’s price was in a crunched zone, hinting that it could enter a high volatility zone soon.