Disclaimer: The findings of the following analysis are the sole opinions of the writer and should not be considered investment advice

Binance Coin is the exchange token of the largest cryptocurrency exchange by volume, Binance. On the charts, Binance Coin has had a bullish outlook in the past couple of weeks as it climbed past the $390 level on the back of good demand. In the next few days, BNB can be expected to climb toward $460, with resistance levels at $435 and $445. On longer timeframes, BNB looked to be en route to $505.

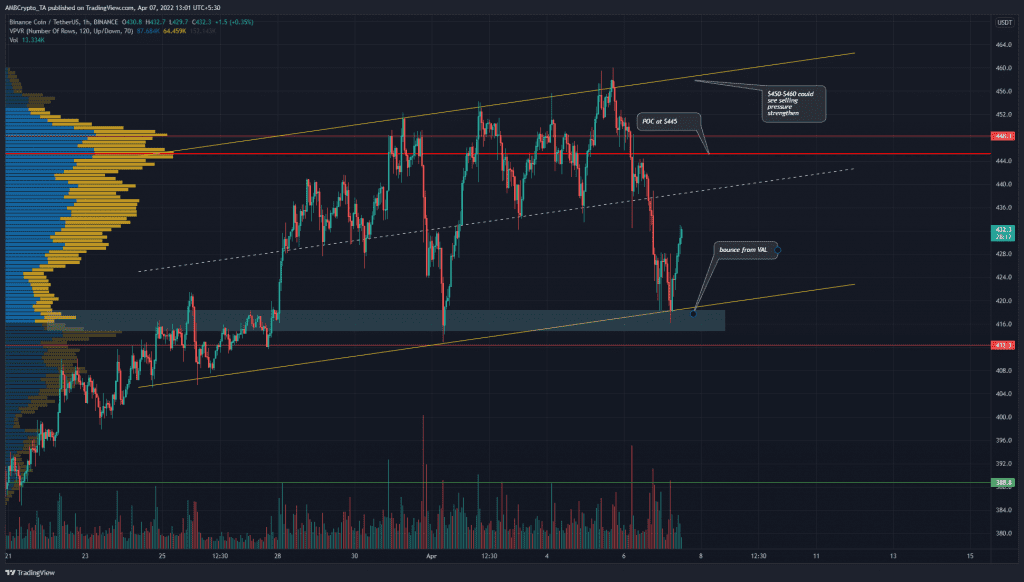

BNB- 1H

The Volume Profile Visible Range for the past two weeks showed the Point of Control lay at $445. It also showed the Value Area Lows and Highs to lie at $415 and $460 respectively.

Alongside these observations, it can be seen on the hourly chart that the price has been trading within an ascending channel (yellow) since the last week of March. In the past few hours, the lower boundary of this channel had confluence with the Value Area Lows and saw Binance Coin bounce toward $430.

This move would likely continue higher, toward the mid-range and the range highs at $460, with the POC expected to offer some resistance.

Rationale

The RSI had been falling from neutral 50 the whole of the previous day. It reached 21.5 before recovering, however in the past few hours it was able to climb past the neutral 50 line again. It stood at 53.4 to show momentum was shifting toward the bullish side.

This meant that bullish momentum has been strong, and could propel prices past $435 and $445. Moreover, even though the OBV declined, it was able to hold on to a level of near-term importance. The OBV and the price action showed that the $415 area has been defended well on this bearish move.

Conclusion

In the next couple of days, it was likely that Binance Coin could see a move toward $460. On the way there, the $445 level could pose stiff resistance. A move below $415 would signal that $405 and $390 could be next on the bearish agenda.