BNB was on fire over the last few days as its high burn rate attracted the crypto community. During the last seven days, BNB tokens worth $574,800,583.92 were burnt. To date, over 42 million tokens have been burnt, which reflects BNB’s efforts to support the token’s deflationary characteristics.

Burn #BNB burn… 🔥

Get your own overview of the deflationary token in action, and keep watch is at it burns in real-time ⤵️https://t.co/8fJCsN2SyE pic.twitter.com/IQGIS4dbMI

— BNB Chain (@BNBCHAIN) October 30, 2022

_____________________________________________________________________________________

Here AMBCrypto’s Price Prediction for BNB for 2023-2024

_____________________________________________________________________________________

Furthermore, BNB also launched a DeFi Savings account by combining staking and offering liquidity in a single-sided BNBx pool. The BNB DeFi Savings account seeks to provide consumers with a low-risk method of earning an income on their BNB without a lockup.

Introducing our first offering of the BNBx Portfolios

⚡️BNB DeFi Savings Account⚡️BNB DeFi Savings account is a low-risk strategy.

Earn high yield on your #BNB with no lockup using

Staking + liquidity in a single-sided BNBx poolLearn more👇https://t.co/lE35tblGOO

— Stader.BNB (@stader_bnb) October 28, 2022

What’s up with BNB’s NFT space?

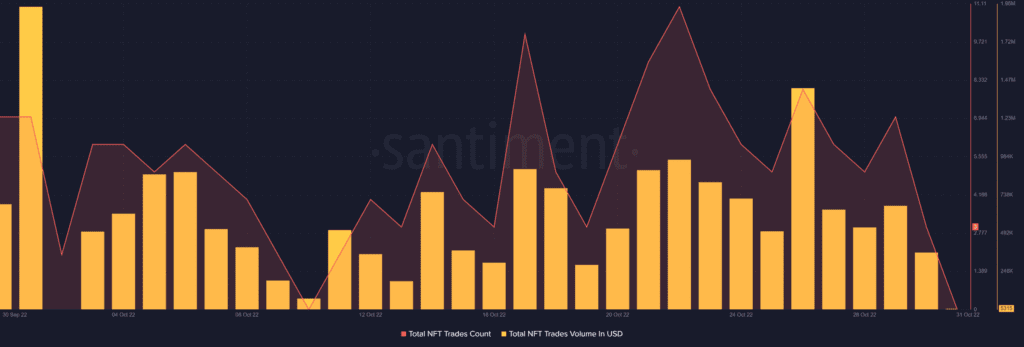

Apart from the aforementioned developments, BNB’s NFT ecosystem also witnessed some traction last month. Santiment’s data revealed that BNB’s total NFT trade volume in USD also spiked last month. This reflected the growth of the BNB NFT ecosystem. According to Rareboard, PancakeSwap and Tofu NFT had the highest market share in BNB Chain’s NFT space.

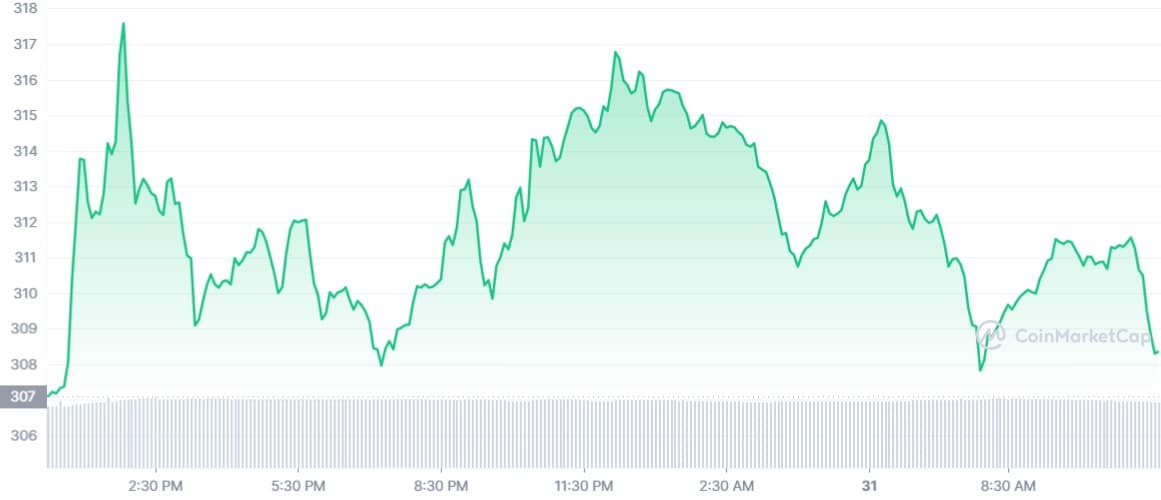

Interestingly, BNB’s price action also witnessed some promising growth as it registered over 13% weekly gains. At the time of writing, BNB was trading at $308.30 with a market capitalization of over $49.3 billion.

Though the bulls seemed to have an advantage in the crypto market, things might turn around soon for BNB, as suggested by several on-chain metrics.

Caution is recommended

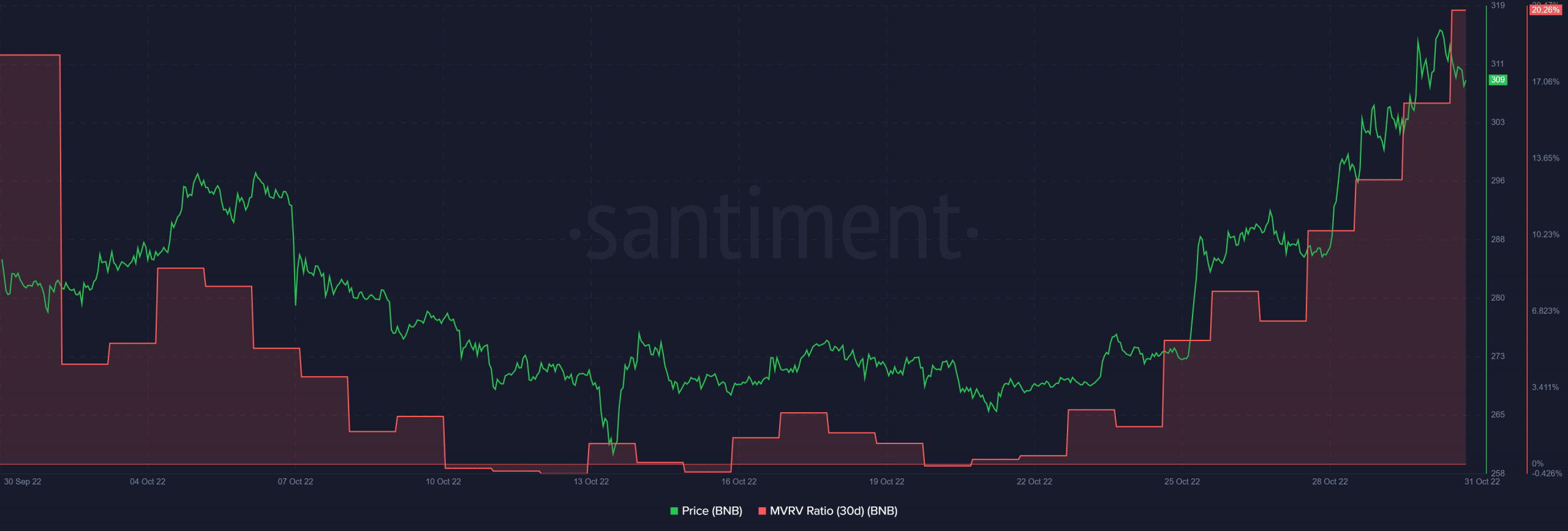

CryptoQuant’s data revealed that BNB’s price was in an overbought position, indicating a trend reversal in the coming days. Furthermore, BNB’s Market Value to Realized Value (MVRV) Ratio skyrocketed recently, which might be a possible market top indicator, increasing the chances of a price plummet.

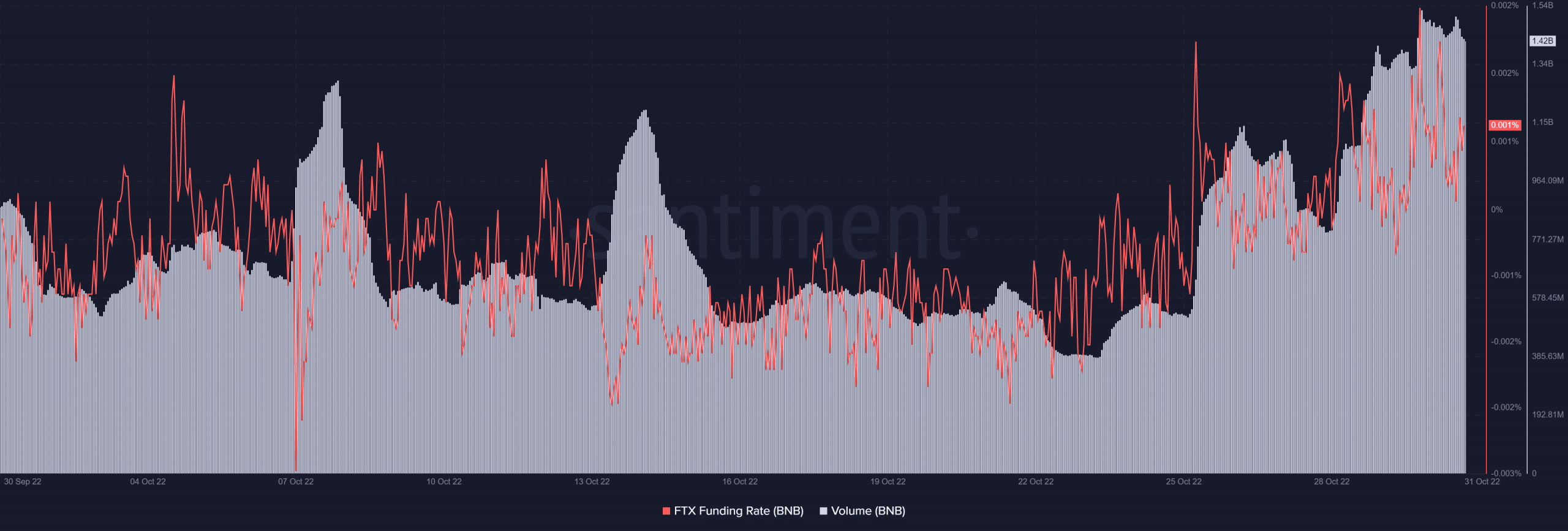

However, a few of the metrics were also working in favor of BNB, providing some relief to the investors. For instance, BNB’s FTX funding rate went up over the last few days, reflecting higher interest from the derivatives market. Moreover, BNB’s volume also went up recently, which was a positive signal amidst the price surge.