BNB has been one of the top gainers this week in the list of top cryptos in terms of market capitalization. The alt registered 5% weekly gains.

Well, the growth also sparked excitement in the crypto community as BNB was among the top five cryptos in terms of the number of searches, as per LunarCrush.

As we begin the last week of Sept 2022, these are the current top five trending searches🔍 on https://t.co/S43WsoNoxP

1️⃣ #XRP $xrp

2️⃣ #Lunr $lunr

3️⃣ #Tron $trx

4️⃣ #BinanceCoin $bnb

5️⃣ #Cardano $adaInsights: https://t.co/Bd968LfWEj pic.twitter.com/eOqPPrGDi3

— LunarCrush (@LunarCrush) September 25, 2022

However, despite outperforming others, at the time of writing, BNB’s price was 1.2% lower than yesterday (25 September) and was trading at $273.53 with a market capitalization of $44,243,914,876.

Interestingly, BNB also made it to the list of top cryptos with a bullish trend on the BTC pair. Let’s have a look at the metrics to find out what might be in store for BNB holders.

[Scan results – #KuCoin – 1d]

Top 5 bullish trends on $BTC pair

1: $TRADE

2: $BNB

3: $CV

4: $CAS

5: $ATOMTop 5 bullish trends on $USDT pair

1: $CPOOL

2: $CAKE

3: $CHZ

4: $FKX

5: $SUTERAll KuCoin results: https://t.co/I8NR485Ylt

Not buy signals. #DYOR— DYOR.net (@DYORCryptoBot) September 26, 2022

What’s cooking

These developments look promising, and several of BNB’s on-chain metrics registered interesting movements as well.

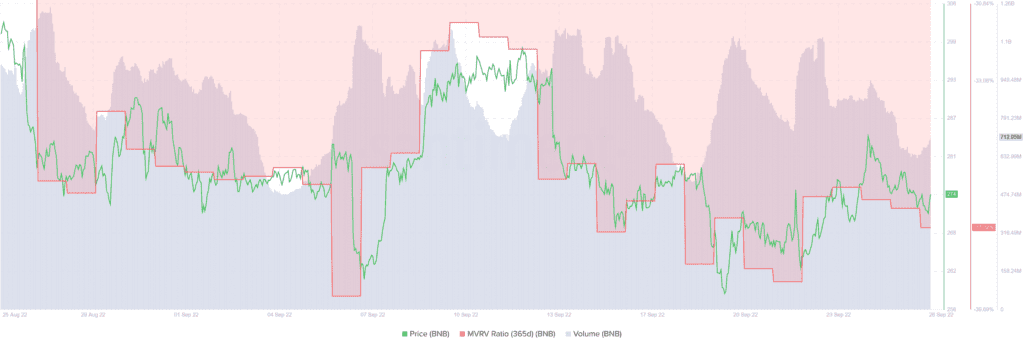

For instance, BNB’s MVRV ratio was up compared to the last week. This is a good sign as it increases the possibility of a further uptrend.

Moreover, BNB’s volume was also steady, mining the chances of any sudden price drops.

Nonetheless, not all metrics were in BNB’s favor. Daily active addresses registered a continuous decline over the last month, which is not a positive signal as it suggests fewer users are actively trading in the ecosystem.

Moreover, despite being listed on LunarCrush’s top five crypto list, BNB’s social volume also declined. Thus, suggesting less interest from investors in the token.

More so, Messari’s chart revealed a decline in BNB’s volatility, which might restrict the coin from going up in the short term.

Looking forward

Unlike several negative metrics, BNB’s daily chart painted a bullish picture as multiple market indicators supported the possibility of a northbound movement.

The Relative Strength Index (RSI) and Chaikin Money Flow (CMF) registered upticks, indicating a possible surge in the coming days.

The MACD’s findings revealed that after a long tussle between the bull and the bears, the former seemed to have the upper hand as a bullish crossover was registered.

Moreover, the Bollinger Bands showed that BNB’s price was in a crunched zone, which further increased the possibility of a breakout.