The last few months have been a challenging time for the crypto market as most cryptocurrencies stood in the red. However, Binance Coin’s [BNB] chart went green recently as it registered promising gains in the past few days.

Recent bullish trends can be considered as a factor along with several other developments that happened in the BNB ecosystem. For instance, Shiba Floki Inu, a descendant of Dogecoin, recently announced a partnership with Multichain, a leading cross-chain bridge solution.

FLOKI holders will be able to seamlessly bridge FLOKI from Ethereum to the BNB blockchain.

📢 @RealFlokiInu partnered with leading cross-chain bridge solution @MultichainOrg!

Through this partnership, $FLOKI holders can now securely bridge #FLOKI tokens from the #ETH chain to the #BNBchain & vice versa.

🌐 https://t.co/Z6crB5R5mX#BNB #BSC $BNB #FlokiFi #DeFi #Web3 pic.twitter.com/AIe22j6Ah6

— BNB Swap (@BNBSwap) September 28, 2022

This development not only brought joy to BNB enthusiasts but also FLOKI holders, as the latter’s price surged by over 6% in the last 24 hours.

Though BNB’s price corresponded to these developments at press time, will the altcoin continue its upward streak in the days to come?

Metrics in play

Interestingly, while BNB’s price registered an increment, its social activity also went upwards. This was evident as BNB was among the top tokens in terms of social activity on the BNB chain on 28 September.

⚡️ @BNBCHAIN #BNBChain Ecosystem Coins by Social Activity

28 September 2022$TTC $QUACK $CAKE $FLOKI $SOKU #BABYDOGE $CATE $HERO $LEOS $BNB #BNB pic.twitter.com/ap5XVh8hbt— 🇺🇦 CryptoDep #StandWithUkraine 🇺🇦 (@Crypto_Dep) September 28, 2022

Additionally, the recent uptrend made BNB one of the top gainers in the last seven days among the top 10 cryptos in terms of market capitalization. A look at BNB’s on-chain side suggested that most of the metrics’ readings were in favor of the recent uptick.

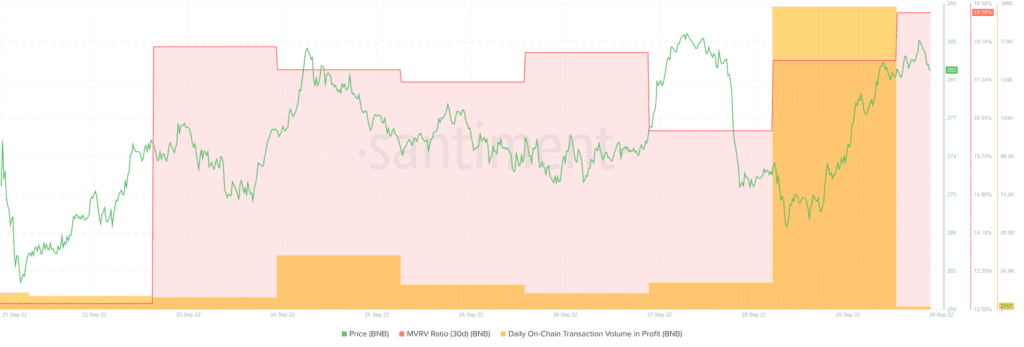

For instance, BNB’s 30-day Market Value to Realized Value (MVRV) Ratio went up last week, which might have helped the coin in its latest uptrend.

Furthermore, BNB’s daily on-chain transactions in profit also skyrocketed on 28 September, which can be considered sort of good news for investors.

Not only this, but BNB’s NFT total NFT trade volume in USD surged sharply as of 28 September.

So it’s a green signal then?

Interestingly, BNB’s daily chart painted an ambiguous picture as a few market indicators revealed the possibility of a further uptrend, while others hinted at a southward journey ahead.

For instance, the Moving Average Convergence Divergence (MACD) displayed a minor bullish crossover, following which an expectation of a short uptick can’t be ruled out.

BNB’s Relative Strength Index (RSI) was resting just above the 50-mark. With a slight bullish edge, selling pressure looked imminent.

Furthermore, the 20-day Exponential Moving Average (EMA) was below the 55-day EMA, which was a bearish signal. Moreover, BNB’s Chaikin Money Flow (CMF) also went down, decreasing the chances of a sustained uptick in the short term.