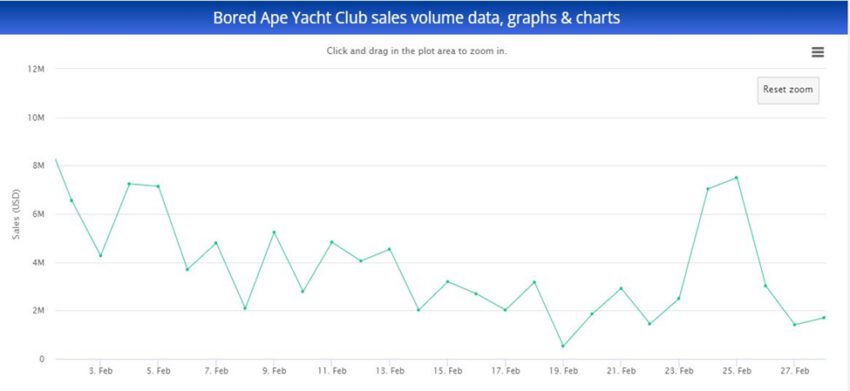

Bored Ape Yacht Club waned in sales volume in Feb after the non-fungible token marketplace saw a 64% dip in total liquidity from the previous month.

NFT marketplaces experienced a strong hit of negative sentiment that deepened towards the end of Feb after the invasion of Ukraine.

According to Be[in]Crypto research, Bored Ape Yacht Club generated approximately $110 million in February 2022. Although that looks relatively high when compared to the sales volume of other NFT marketplaces, Bored Ape Yacht Club was down approximately $311 million, representing a $200 million fall in volume in 28 days.

Bored Ape Yacht Club reached an all-time high in single-day sales volume in Aug 2021, hitting approximately $55 million.

At its Jan peak, BAYC recorded 815 unique buyers and a total transaction count of 1,063. However, those figures failed to be repeated the following month, with 301 unique buyers of Bored Ape Yacht Club’s collectibles resulting in a total of 352 transactions.

This means that Feb’s unique buyers and total transaction count decreased by 63% and 71% respectively.

This tumbled by 53% to approximately $25 million on Nov. 16, 2021.

The single-day high sales volume in 2022 was generated on Jan. 30, when BAYC saw liquidity in the value of approximately $36 million in its NFTs. Unfortunately, there was a steep decline in this figure as it descended by 73% on Feb. 1, when BAYC generated approximately $9.58 million.

Creators of BAYC, Yuga Labs, announced this week they had acquired NFT marketplaces Meebits and CryptoPunks from Larva Labs, meaning the team behind BAYC now owns two of the top five NFT marketplaces by sales volume.

The official BAYC token, called ApeCoin (APE), was launched last week. Opening at $1, it reached an intraday high of $39.40, before plunging 78% at the close.

Yuga Labs will be adopting ApeCoin “as the primary token for all new products and services.” This will include a blockchain game it plans to launch later this year.

Ape Foundation board members include Reddit co-founder Alexis Ohanian, head of ventures and gaming at FTX, Amy Wu, and co-founder and chairman of Animoca Brands, Yat Siu among others.

The first exchange to embrace the ape was Coinbase, which announced a listing on March 17 under the “experimental asset label.” This special category is for low liquidity assets and the company advises caution over trading them.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.