On-chain data shows the Bitcoin open interest has once again risen to high values, suggesting that a liquidation squeeze may be near for the crypto.

Bitcoin Open Interest Has Climbed To High Values Recently

As pointed out by an analyst in the CryptoQuant post, leverage has increased in the BTC market over the past week as the open interest has risen to high values again.

The “open interest” is an indicator that measures the total amount of Bitcoin futures positions currently open on derivative exchanges.

When the value of this metric rises up, it means more futures contracts are opening up on exchanges. This leads to a higher amount of leverage in the market, and can cause more price volatility.

On the other hand, a decline in the open interest suggests investors are closing up their positions either because they want to exit the market or due to liquidation. Periods following such trends generally have lower volatility.

When there is excess leverage in the market, a large swing in the BTC price can lead to a cascade of liquidations, further amplifying the move. Such a mass liquidation event is called a long or short squeeze (depending on if longs are being liquidated, or shorts).

Related Reading | Bitcoin Correlation With Wider Crypto Market Nears ATH As Investors De-Risk

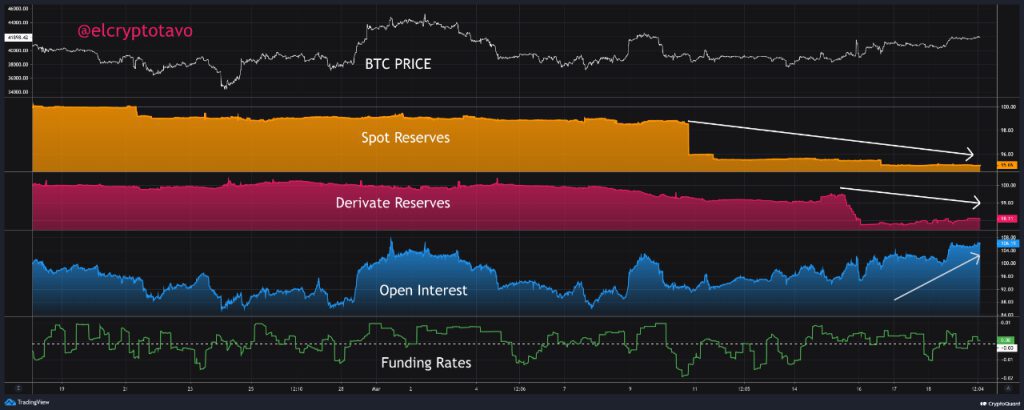

Now, here is a chart that shows the trend in the BTC open interest over the past month:

Looks like the value of the indicator has sharply risen recently | Source: CryptoQuant

As you can see in the above graph, the Bitcoin open interest has once again increased to high values in the past week.

The chart also shows the trend in the spot reserves and derivative reserves. It looks like both these exchange supplies have gone down recently, which is usually a positive sign.

Related Reading | El Salvador’s Bitcoin Adoption Far Lower Than Expected, Survey Shows – A Blunder For Bukele?

However, the open interest going up means leverage is also going up in the market. The funding rate is currently nearly neutral, which means there are as many longs as shorts right now.

This implies that a leverage flush can go either way, both a long squeeze and a short squeeze are on the table. The former can crash the price, while the latter can propel it instead. So the trend in the coming days could be worth looking out for.

BTC Price

At the time of writing, Bitcoin’s price floats around $41k, up 6% in the past week. The below chart shows the trend in the price of the crypto over the last five days.

BTC's price has held strong above the $40k mark over the past few days | Source: BTCUSD on TradingView

Featured image from Unsplash.com, charts from TradingView.com, CryptoQuant.com