The Bitcoin (BTC) price can fall below $21,000 as the bear hug tightens. The price recently touched a high of $25,135 and retraced to a low of $23,243. The downward price trend has formed a regular bearish divergence with a short-term target of falling to $21,000-$20,000.

The Crypto Market Fear and Greed Index has tumbled from 47 to 30 in just a week and 41 to 30 in a day.

Bitcoin (BTC) Price Can Decline Below $21,000 Amid Sell-Off

The Bitcoin (BTC) price has fared a bullish movement despite interest rate hikes and recession fears, making a rally above the $25,000 level. However, bulls are fading and need to show more power to keep the price in an uptrend. A slight selling pressure can negate the uptrend, pulling Bitcoin into the $21,000-$20,000 range.

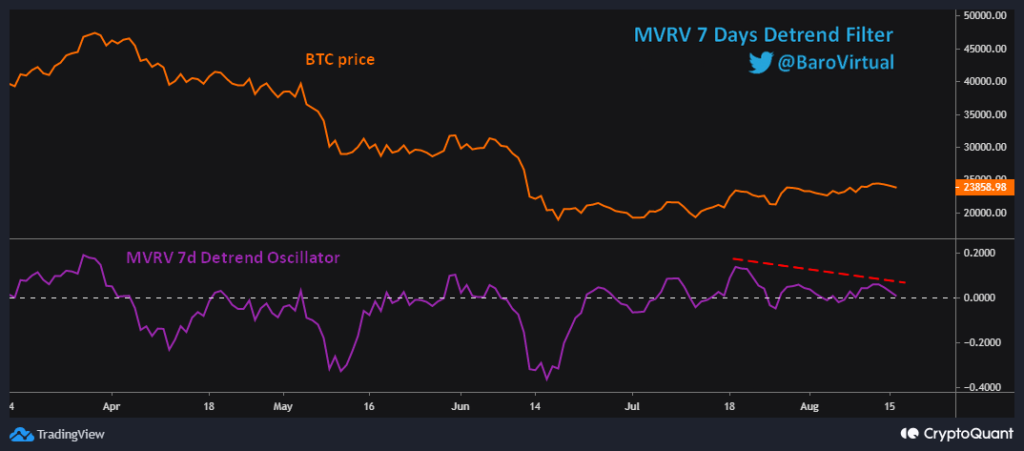

Moreover, the Bitcoin (BTC) price trend in recent weeks has formed a bearish divergence pattern in the MVRV 7-day Detrend Oscillator. It suggests the BTC price can fall below $21,000. Applying a detrend filter to the price trends helps identify market bottoms and peaks by eliminating long-term price noise.

Bitcoin (BTC) is in a downward trend for the long term, specifically since November. However, the price has shown upside movement in the last 1-month. The descending channel in a daily timeframe indicates the BTC price was preparing to break above the channel, but it fails to break the $25,000 psychological resistance level.

Trending Stories

Moreover, the price trend seems to have changed after the recent pullback to $23,243. Bitcoin has now reached an inflection point that will decide the upcoming price movement.

The 20-EMA (red) did move above the 50-EMA (blue) to confirm bullish momentum. However, the bulls failed to build momentum and seem to be fading. The 20-EMA may likely move below the 50-EMA again, which will confirm a bearish movement below $21,000.

What’s Creating the Downward Pressure?

The U.S. Federal Reserve in Wednesday’s FOMC meeting confirmed the need to continue raising interest rates to control inflation. Moreover, Bitcoin social sentiment has fallen on the negative side and exchange inflows have increased.

The profit booking on upper levels is creating selling pressure. According to crypto analyst Michaël van de Poppe, it is crucial to break above $23.7k to trigger an upside movement towards $24,000. However, a retest below $23k can be expected for an upside move to $28k.