Celsius has withdrawn all wBTC collateral from the Aave wallet and has only a few wBTC left in the Compound wallet. Moreover, the crypto lender has paid off another 40 million in USDC for its Aave loan, making a total of 60 million in USDC repayment today.

In addition, the crypto lender has also paid off almost 35 million in DAI for its Compound loan. The total debt has now reduced to $140 million. Could we see withdrawals to resume or a bankruptcy filing from Celsius in the coming days.

Celsius Actively Repays its Aave and Compound Debt

Celsius, after completely repaying its $220 million Maker loan last week, has started paying outstanding Aave and Compound loans. Today, the crypto lender has removed all wBTC, after paying 60 million USDC in three transactions for its Aave loan. Also, the company has removed 4436 wBTC from Compound, to transfer a total of 6k wBTC worth $124 million to FTX.

Previously, Celsius had dumped over $500 million worth of wBTC on FTX after successfully repaying the Maker loan. This has helped the ongoing community-led Celsius recovery through CEL short squeeze.

The crypto lender has paid over $95 million in Aave and Compound loans today, along with liquidating other tokens. According to Zapper.fi, the Celsius Wallets Combined shows an outstanding debt of $140 million, which has reduced from $216 million since morning.

Trending Stories

The outstanding Aave debt is $90 million worth USDC and $80,000 worth REN. Also, the outstanding Compound debt is $50 million in DAI. The crypto lender also has a $3 million fUSDC loan from Notional Finance, which is to be repaid by September 25.

DeFi analyst Defiyst in a recent tweet claims:

“Have also seen people theorize that it’ll be returned to ETH depositors to give the user the option to hold til merge or sell at discount. Somewhat doubt this will happen and likely deviates from legal obligations, but we will see.”

Many people believe that Celsius want the C11 Bankruptcy snapshot to be USD denominated.

CEL Token Short Squeeze

The CEL token short squeeze is still trending as short sellers continue to purchase CEL tokens in large quantities and short sell them. Celsius has also taken part in shorting CEL tokens. The last short squeeze happened on July 10.

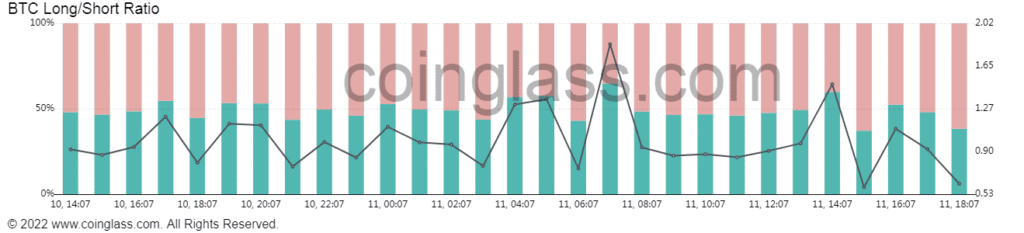

According to Coinglass, the latest long-to-short ratio shows over 60% short positions.

However, the company’s silence on its plan and the latest hiring of a new law firm for restructuring has caused customers to think about whether the company will be next to file bankruptcy after Voyager Digital and 3AC.