Bridge Mutual starts the new year with a bang by releasing its V2 on February 2, 2022, after spending 2021 rapidly growing its community, collaborating with tier 1 projects like Tether and Sushi, and setting action plans to roll out on multiple chains.

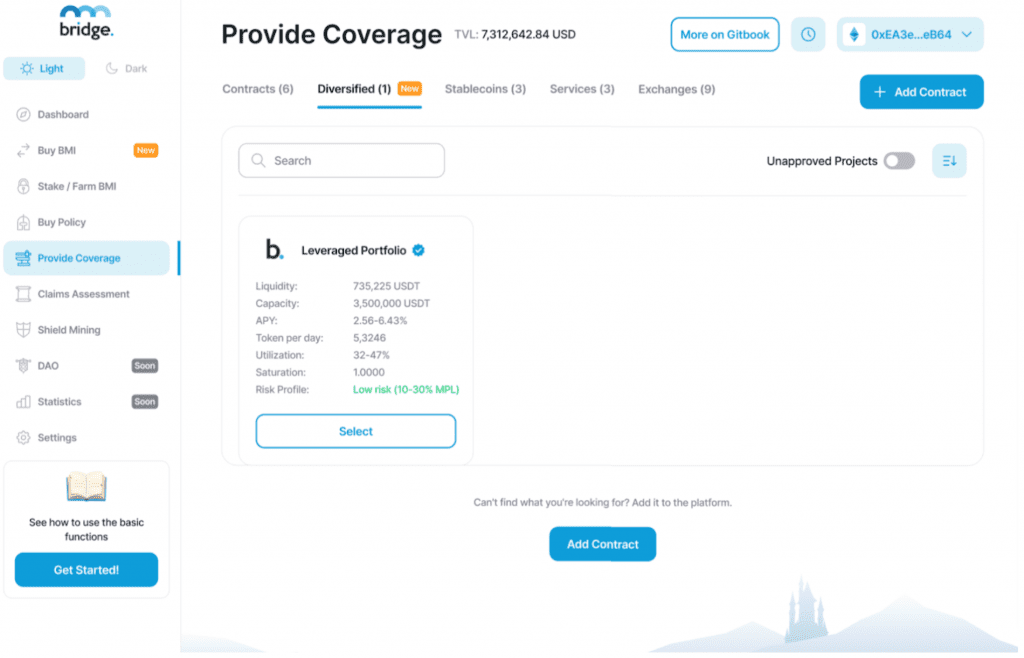

Bridge Mutual V2, a major platform upgrade brings in new features such as Leveraged Portfolios, Shield Mining, Capital Pool, and more. Bridge also plans to stay engaged with its partners by integrating a one-of-a-kind DeFi risk coverage widget into partner sites to enable its users to purchase coverage directly without any extra hassle.

Decentralized Finance has become a leading sector of crypto with many DeFi crimes immensely following the space. According to CoinTribune, approximately 200 DeFi hacks have taken place since January 2021 with over $1B estimated loss. Acknowledging the current situation of cyber threats in the space, Bridge Mutual is stepping in to adhere to the growing demand for DeFi insurance.

Bridge Mutual V2 Leveraged Portfolio

Leveraged portfolios are one of the major upgrades to version 2 of the Bridge Mutual protocol that is designed to enable users to experience a high-reward/ high-risk yield farming scenario on their stablecoins. The Leveraged Portfolios themselves act as a leveraged coverage provider and offer a much higher APY than regular coverage provision. Users participating in leveraged portfolios get rewards in stablecoins, BMI tokens, and Shield Mining tokens.

As the DeFi industry evolves, Bridge Mutual insurance intends to keep up with more projects and types of insurance available. Currently, the Bridge Mutual application already enables anyone to submit a coverage pool on its site, which offers desired users and projects an advantage for covering their valuable assets. Insurance accessibility has a positive correlation with users’ willingness to provide more liquidity. The platform adopts a full No-KYC approach, allowing anyone, anywhere to become a policyholder or an insurance underwriter.

DeFi is a lucrative industry with users from all over the world. In the near future, Bridge Mutual will also launch on Solana, BSC, and Matic, allowing their respective communities to protect themselves against hacks and rug pulls Being functional on other chains will enable Bridge Mutual to scale dramatically and push its DAO plans forward.

About Bridge Mutual

Bridge Mutual, a decentralized coverage platform, is on a mission to become the #1 crypto-armorer of Decentralized Finance and equip everyone with protection against universal crypto threats. We are a fully decentralized, p2p/p2b discretionary risk coverage platform covering smart contracts, stablecoins, centralized exchanges. Our platform allows users to provide coverage, decide on policy payouts, share profit, and get compensated for adjudicating claims. Users can get protection and provide one in exchange for yield. We focus on great product design, pro-community business objectives, and synergy with other web3 innovations.

🌐 Website|🔔 Telegram| Ⓜ️ Medium| 🕊 Twitter| 🔷 CoinGecko| 🔴 Youtube| 🔺 Gate.io | 🟢 Bitfinex| 〽️ Discord.

Disclaimer: Any information written in this press release does not constitute investment advice. CoinQuora does not, and will not endorse any information on any company or individual on this page. Readers are encouraged to make their own research and make any actions based on their own findings and not from any content written in this press release. CoinQuora is and will not be responsible for any damage or loss caused directly or indirectly by the use of any content, product, or service mentioned in this press release.