- DeFi problems are becoming larger in scope and more frequent in nature.

- The Bridges Exchange team wants to help clean up the “Wild West” nature of DeFi.

- The Bridges team states that DeFi has to evolve to become an ecosystem where every participant has a chance for financial freedom and security.

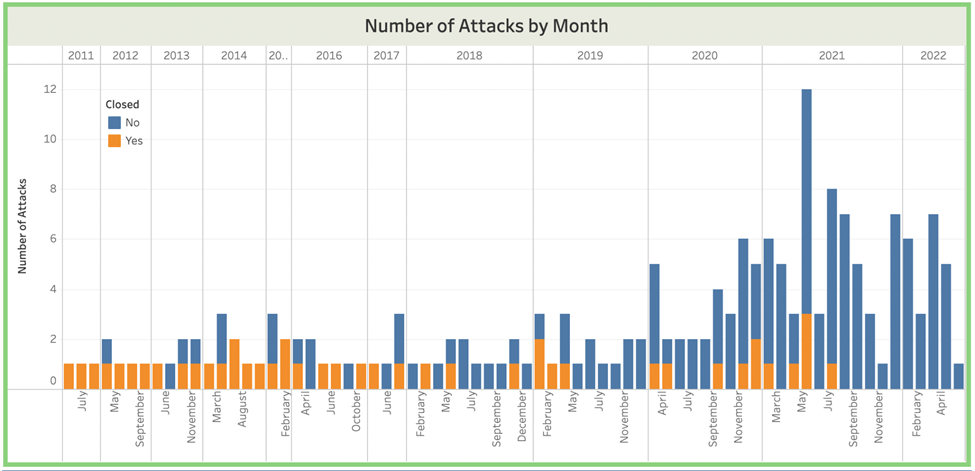

After the $400 million rug-pull on MonkeyPoxInu, crypto investors are left wondering about the state of the crypto space. Moreover, DeFi problems are becoming larger in scope and more frequent in nature, as shown in the chart below which users can view on Comparitech:

Throughout all of it, though, most participants in DeFi would probably agree that there’s been far more talk than action.

If one is old enough to remember the “I’m a Mac/And I’m a PC” television commercials that ran in 2006, they will likely recall the one that implied that Mac computers didn’t get viruses.

On the contrary, Macs were vulnerable to viruses, but Apple’s share of the personal computer marketplace was so low in 2006 (just 4.8%) that it wasn’t worth the effort to exploit them.

When the team behind Bridges Exchange first conceived of the idea, they did so with a view toward helping clean up the “Wild West” nature of DeFi. They claim that Bridges is a first of its kind: the first anti-scam, dividend-paying, decentralized hybrid exchange-aggregator.

“We created the Bridges Exchange because ‘business as usual’ in DeFi has meant nothing more than the proliferation of tokens —and with them — theft. Like others, we’ve grown tired of seeing honest investors left penniless and innovative developers whose ideas are copied at will,” says the team. They continue to add that for DeFi to realize its full potential, it has to evolve from being a safe haven for scammers to becoming an ecosystem where every participant has a legitimate chance for financial freedom and security.

Here’s how the Bridges team did it:

- Public Listing Criteria: To get good projects in, they had to keep bad actors out. Bridges has fairly stringent project listing criteria, and these are publicly available for all to see.

- Thorough Vetting Procedures: The time from application to listing on Bridges can take several weeks, which they say is simply a necessary evil. “The reputation of Bridges is only as good as the last project that we approved for listing, and while we can’t guarantee positive returns or even complete, 100% safety, we do promise that our vetting procedures are carefully and thoroughly implemented.”

- Requirement of Innovation: Safety means different things for different people. For holders, it means the avoidance of scams. For project developers, it means the protection of innovative ideas. The team says that they require approved projects to bring some form of innovation to the space, and they reject those that are pure copycats of others’ ideas.

- Anti-Whale Caps: To promote overall stability in the price of Bridge$, the native token of Bridges Exchange, anti-whale caps prevent any single investor from holding more than 1% of the total supply, equal to 1 million tokens.

“Regardless of whether you’re a holder or a developer, a novice participant in DeFi or a seasoned veteran, we invite you to join themission that Bridges represents and to be part of the action — and not the talk — about cleaning up DeFi.”

Interested users can learn more about the work of Bridges at https://bridges.exchange.

Disclaimer: CoinQuora does not, and will officially not endorse any company or individual on this sponsored article. Any information published in this sponsored article does not equal financial advice. We encourage everyone to do their own research before investing in cryptocurrencies.