The cryptocurrency market continues to be the prime victim of different headwinds (regulations, war, et al) as prices decline. At press time, the crypto market suffered a fresh 5% correction as it stood at the $1.2 trillion mark. New investors remained skeptical to join this niche asset class given the bearish run.

But, cheer up!!

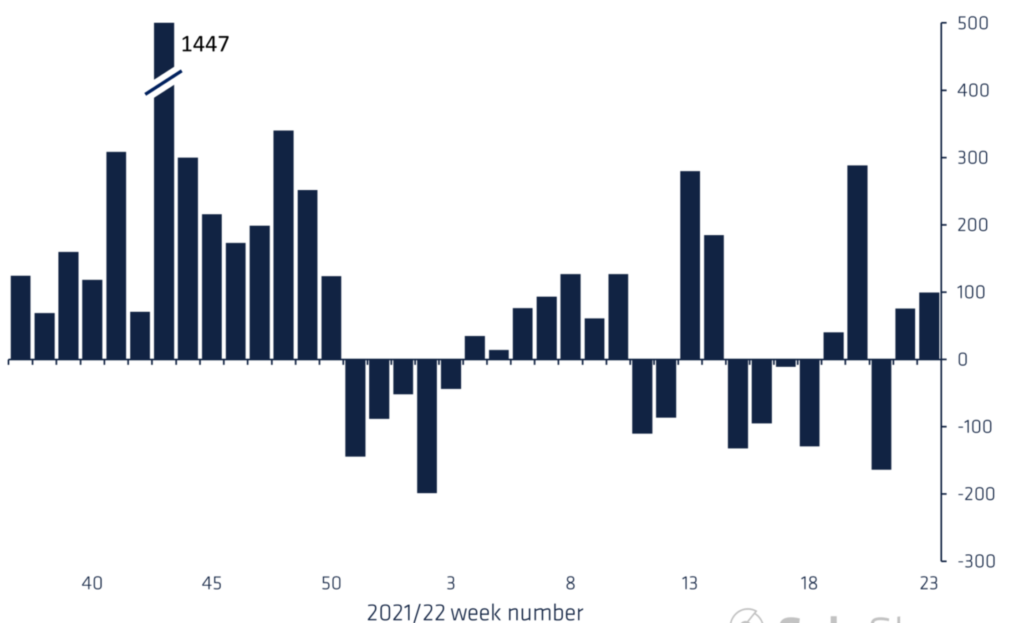

In the recently released Digital Asset Fund Flows Weekly report, CoinShares revealed that digital assets witnessed inflows last week despite the bearish run. This inflow amounted to $100 million bringing the total assets under management (AuM) to $39.8 billion.

Source: CoinShares

James Butterfill in the Volume 83 report stated,

“Digital asset investment products saw inflows totalling $100m last week, despite crypto prices range trading. The flows bring total assets under management (AuM) to $39.8bn.”

Geographically speaking, Americans maintained an optimistic narrative as compared to European holders. America totaled $88 million in last week’s fund flows in digital asset investment products. On the other hand, European flows totaled just $11 million. Ergo, European investors have been more bearish in 2022.

Moving on to specific coins, Bitcoin clearly dominated this race as signified in the table below. Bitcoin saw inflows totaling $126 million last week, bringing total inflows year-to-date to just past the half a billion mark at $506 million.

Fair to say the top crypto asset by market cap witnessed significant demand from investors/institutions regardless of price corrections. In fact, short Bitcoin saw inflows too, totaling $1.3 million last week.

Interestingly, despite the record, assets favoring long Bitcoin still far outweigh short Bitcoin products. The $55 million in short products is 30% of the total assets under management in long Bitcoin products.

Heaven to Hell, the journey continues

Important to note that altcoins didn’t quite paint the same picture, rather a grim one. Altcoins saw virtually no inflows last week highlighting the fact that investors are flocking to the relative safety of Bitcoin.

Ethereum saw its ninth straight week of outflows, signaling negative sentiment on the top smart contract platform by market cap. Here outflows totaled $32m. However, since the outflows began in December 2021, they only represent just under 7% of total AuM.

That said, Solana (SOL) and Ripple’s native asset (XRP) recorded a small uptick coming in at about $100,000 and $200,000 respectively. Multi-asset investment products saw inflows totaling $4.3 million. Thus, showcasing consistent inflows during this bout of negative price action.

While it might be a ‘life-changing’ status check for BTC and altcoins, institutional capital flows were overall significantly higher than in the previous two weeks.