Bitcoin has not been able to leverage the broader market’s bullishness this time around. But it has been able to retain the support at the $24k level. Evidently, the market is shifting its focus from altcoins.

Bitcoin season on the way?

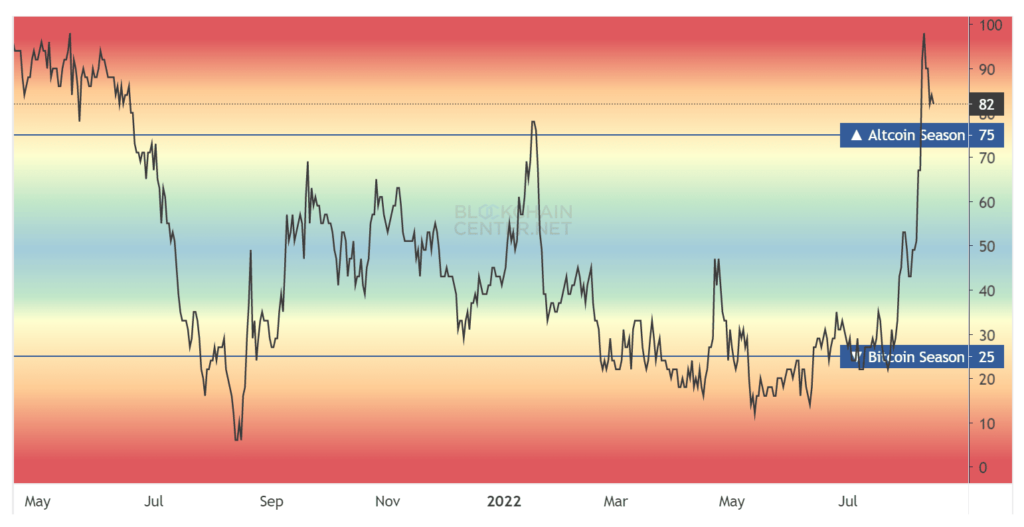

The previous prediction for the altcoin season was expected towards the end of the third quarter. But out of the blue, the last two weeks pushed every altcoin to reach new heights. Consequently, the crypto market witnessed the altcoin season this month.

Well, the market is said to be in the altcoin season when at least 85% of the top 50 cryptocurrencies perform better than Bitcoin over the previous three months.

Led by the likes of Celsius and Ethereum Classic, the altcoins gained dominance over the king coin.

But as visible on the chart, over the last five days, their dominance has dropped just as quickly as it rose.

In addition to this, the global market conditions are also improving. According to the latest reports, the consumer price index (CPI), dropped from the highs of 9.1% in June to 8.5% in July.

The fall in gasoline prices is one of the driving factors. And, the CPI this month is expected to further lower.

If that happens, NASDAQ and the S&P 500 index would recover and in line with them, Bitcoin would too.

At press time, the next critical target for BTC stood at $25.8k which if recovered will prevent a fall in prices. And, the most crucial level for a rally stands at $30k.

This is because at both these price levels lie two of the most critical market trigger indicators- the 23.6% Fibonacci level and the 38.2% Fibonacci level.

The former is necessary for establishing support. And, the latter is important to mark a rally.

Bitcoin price action | Source: TradingView – AMBCrypto

Possibly, Bitcoin’s market value is recovering from its 2-year low which it fell after slipping below the 1.0 mark.

The MVRV ratio, at press time, stood at 1.2. This reading was noted last in March 2020.

Bitcoin market value | Source: Glassnode – AMBCrypto