Bitcoin, the largest cryptocurrency by market capitalization, crossed the $40,000-mark after a sudden surge. But soon returned to its pre-surge price in less than two hours. At press time, the largest cryptocurrency was trading at the $40,200 mark with a 4% increase over the last 24 hours. It’s interesting to note that Bitcoin holders reacted to this development in a very bullish manner.

Whale pods

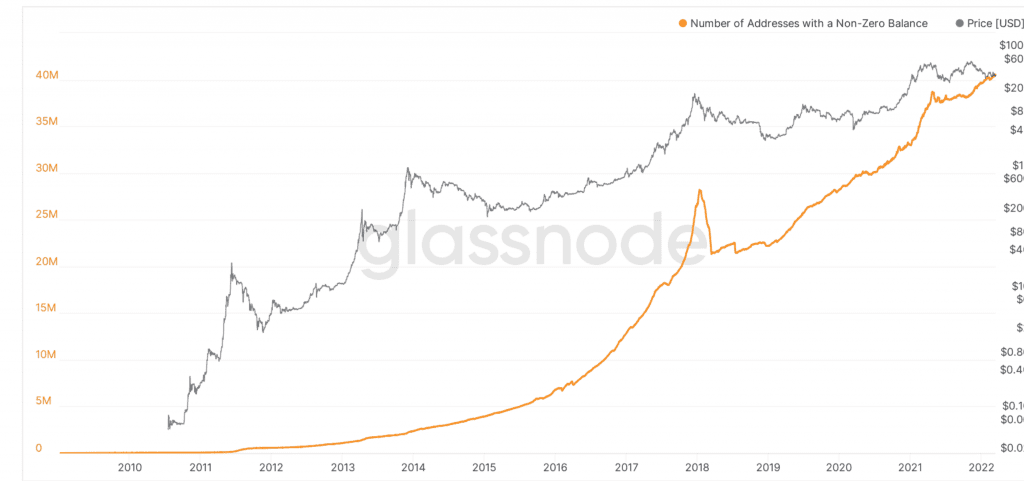

In this context, it’s important to note that the total number of non-zero BTC addresses has increased since March 2018.

Notably, a sharp sell-off began in December of 2018, this further accelerated in March 2019. However, Bitcoin defied the bearish trend.

It is here to be noted that as per Glassnode’s chart below, the number of addresses with a non-zero balance has increased sharply after 2019.

Source: Glassnode

In addition, the number of addresses with more than 1,000 BTC and more than 10,000 BTC varied widely. It seems to have fallen down a little from the count of 2021.

In addresses with more than 10,000 BTC (yellow), the bulk of the increase occurred in September 2021. However, for those with more than 1,000 BTC (red), the majority of the increases occurred at the beginning of March 2022.

In fact, the BTC supply held by long-term holders (LTH), was at its most deflationary stage in history. The LTH Market Inflation/Deflation Ratio suggested that Bitcoin was directly proportional to the supply held by the long-term holders. On Chain researcher, David Puell shared this metric on 15 March.

Our analysis suggests that #Bitcoin, proportional to supply held by long-term holders (LTH), is at its most deflationary in history.

1/ Introducing LTH Market Inflation/Deflation Ratio, created in collaboration with @_Checkmatey_ (Glassnode). pic.twitter.com/bwfobQRbUY

— David Puell (@dpuellARK) March 15, 2022

Given the current geographical uncertainty, Bitcoin’s reign as a deflationary asset had increased tremendously. On the other hand, USD had suffered due to the unprecedented inflation hike amounting to more than 4%.

I want IN

To put further support to this narrative, consider this chart below,

Source: Twitter

The aforementioned plot shed light on Bitcoin’s URPD activity. A huge amount of the Bitcoin supply changed hands between 38k to 39.5k. The last time this amount of coins changed hands was during the Covid crash between 3k to 4.5k. Overall, it suggested that a lot of investors jumped straight inside the Bitcoin pool regardless of the price.

To do so, crypto exchanges experienced a significant exodus of BTC last week. US-based crypto exchange giant Coinbase witnessed this outflow. According to data from Glassnode, BTC held on Coinbase dropped over 36% over the last two years.

#Bitcoin held on Coinbase has declined by 375.5k $BTC (36.6%) since the ATH set in April 2020.

This was driven lower by ~31k $BTC last week after a large net outflow occurred.

We explore this further in latest edition of The Week On-chain newsletter.👇https://t.co/yA55i1eG0L pic.twitter.com/eu15PGDs9o

— glassnode (@glassnode) March 14, 2022

This remains a strong signal that investors increasingly saw Bitcoin as a relevant asset in modern portfolios. One could interpret the aforementioned metric as a positive sign for Bitcoin adoption.