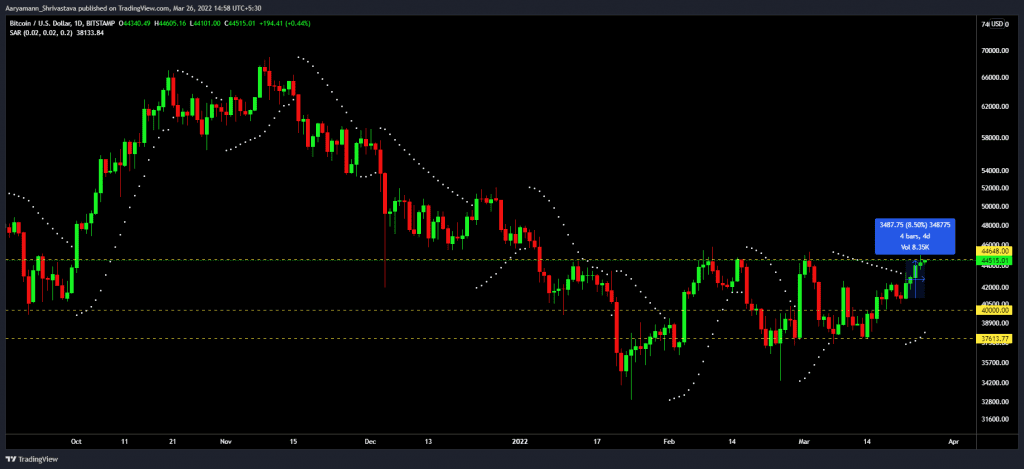

Bitcoin is back to test the critical resistance that has remained unbroken since the beginning of the year. With the first quarter of 2022 coming to an end, BTC is testing the $44.6k level for the fourth time today, but whether or not it will be successful in doing so is a different question since historically, this boss level has remained undefeated.

Bitcoin Price Action | Source: TradingView – AMBCrypto

Bitcoin products take the W

To add to that, the overall institutional and retail interest has reduced significantly over the month. Beginning October 2021, the ETP trading volume has observed a significant decline from $800 million to $259 million in March.

The aggregate daily volumes across all digital asset investment product types fell by an average of 29.6% from February to March, with Grayscale’s Digital Large Cap fund taking the biggest hit of 54.2%

ETPs trading volumes | Source: CryptoCompare

Despite the underlying assets’ (ETH and BTC) price action being equally volatile, GBTC’s trading volume hasn’t observed a drawdown as terrible as Grayscale’s Ethereum trust. This indicates that investors’ confidence in Bitcoin’s recovery is remarkably higher than Ethereum’s. And the same is being proved by the fact that while Bitcoin is back to its year-to-date highs, ETH still isn’t.

This is quite surprising since Ethereum is exceeding Bitcoin, in terms of profitability, on all fronts.

Bitcoin vs. Ethereum

Spent Output Profit Ratio or SOPR shows the status of supply in terms of profit or loss. When the indicator is above 1.0, the amount of coins sold is said to be in profit since it was bought at a lower price.

When it comes to Bitcoin, the SOPR on 26 March peaked at its 2-month highs of 1.01 as BTC inched closer to establishing a new local top. On the other hand, Ethereum, despite not creating any new highs, stood at 1.02.

Bitcoin and Ethereum SOPR | Source: Glassnode – AMBCrypto

Furthermore, the net unrealized profit/loss also exhibits similar results where Ethereum is much closer to the bullish zone of belief while the king coin is still far below it.

Bitcoin and Ethereum NUPL | Source: Glassnode – AMBCrypto

This shows that technically Ethereum investors are back in profits, but Bitcoin’s store of value tag is helping it maintain its demand among both retail and institutional investors.