The collapse of Terra [LUNA] foisted upon the general cryptocurrency market ‘extreme market conditions’ that have forced many major crypto lenders to declare bankruptcy.

Furthermore, the past few months have been marked by the suspension of withdrawals and deposits across several cryptocurrency exchanges, with some permanently put out of business.

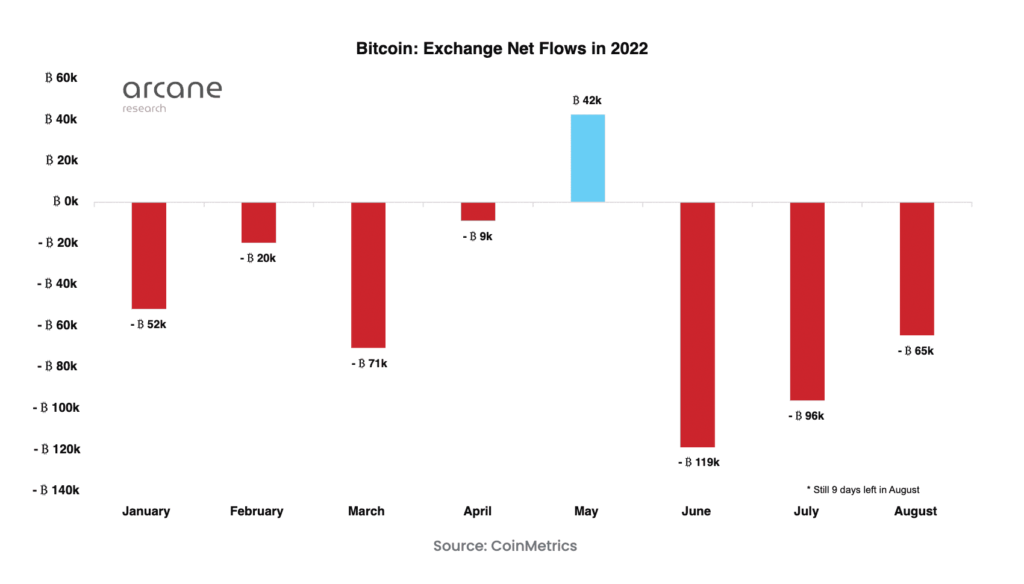

All of these have resulted in investors taking their Bitcoin [BTCs] out of exchanges, as per new research from Arcane Research.

King of outflows

According to the report, Arcane Research found that for most of 2022, Bitcoin has been taken out of exchanges. The year started with negative exchange net flows but saw a temporary relief in May as the king coin logged huge net inflows.

However, since the Terra incident occurred, 280,000 BTCs have since been taken out of exchanges. As of this writing, there was 2.1 million Bitcoin deposited at exchanges.

Moreover, in the last 22 days, 65,000 BTCs were withdrawn from exchanges.

In its latest edition of its Digital Asset Fund Flows Weekly Report, CoinShares found that Bitcoin, in the last week, posted a third consecutive week of outflows, which amounted to $15 million.

Ethereum [ETH], on the other hand, logged inflows of $3 million, bringing its nine-week run of inflows to $162 million.

According to CoinShares, digital asset investment products registered minor outflows of $9 million in the past week.

This led market volume to decline by 55% off the year average to its second-lowest position this year.

All hail leading alt, Ether

As for Ethereum, CoinShares noted that in the last week, the leading altcoin saw inflows of $3 million. Noting that the last nine weeks have been a turn-around in sentiment for Ethereum.

“At the mid-point in June Ethereum investment products had seen year-to-date outflows totalling US$459m. Since this point, as there has been improving clarity on the Merge, Ethereum has seen a 9-week run of inflows totalling US$162m.”

With $3 million in inflows last week, Ethereum’s month-to-date inflows stood at $19.7 million, according to the report.

With regards to regions, CoinShares reported that the USA, Germany, and Sweden logged outflows of $10 million, $2.4 million, and $2.1 million, respectively.

Brazil and Switzerland saw outflows of $2.5 million and $1.9 million, respectively.