Over the past few weeks, Bitcoin (BTC) price has suffered some substantial losses, with the most dramatic drop occurring this week following the Federal Reserve’s decision. The BTC price has devalued by 50% from the November high of $68,789 and is still under the descending trendline influence leading the correction rally. Nevertheless, Arizona state senator Wendy Rogers has introduced a bill to make Bitcoin legal tender within the state.

Key technical points:

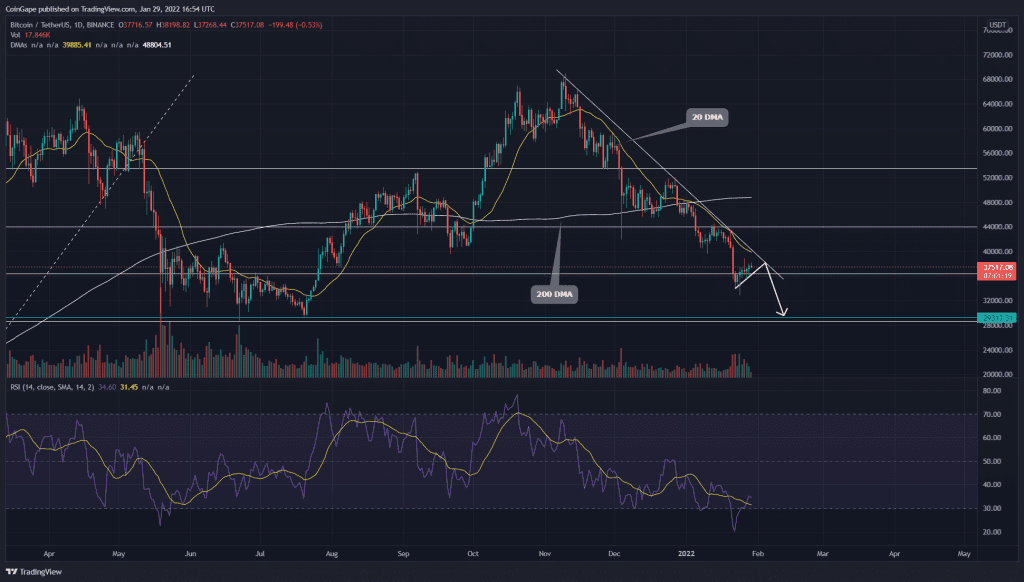

- The BTC price provides dynamic resistance to 20-day EMA

- The intraday trading volume in the BTC is $16.9 Billion, indicating a 28.6 % fall.

Source- Tradingview

Previously, in our Bitcoin price analysis, the BTC/USD pair plunged below the 0.5 Fibonacci retracement level, hinting to extend the correction rally. However, buyers immediately stepped in around the $33000 mark and pumped the price above the $36000 mark.

This recent price jump registered a 14% gain in the last six days and is gradually approaching the combined resistance of the long coming descending trendline and 20-DMA.

With the volume activity diminishing during this relief rally, the coin chart suggests a higher possibility for the BTC price to reject from this overhead resistance.

- Resistance level- $40000, $44000

- Support level- $36500, $29500

Technical indicator

The BTC price trading below the crucial DMAs(20, 50, 100, and 200, signals a bearish trend. Moreover, the 20 EMA line acts as dynamic resistance for the coin price. However, the RSI(34) slope roaming in the bearish territory shows a striking recovery from the oversold region.

On-chain Points to Ponder

- The percentage of BTC supply held by long-term holders registers a new high since March 2020.

- Bitcoin Fear and Greed Index currently at 24 out of 100, indicates fear sentiment among the market participants.

- The MVRV Z-score dropped to 0.85 on January 24th, typically signaling a bearish market. Therefore, the buyers would need to put significant efforts to reverse the current low performance or the bear would continue to dominate.