In the last 24-hours, the world’s largest cryptocurrency Bitcoin has registered a major bounce back! As of press time, Bitcoin is trading 8% up at a price of $22,108 and a market cap of $422 billion.

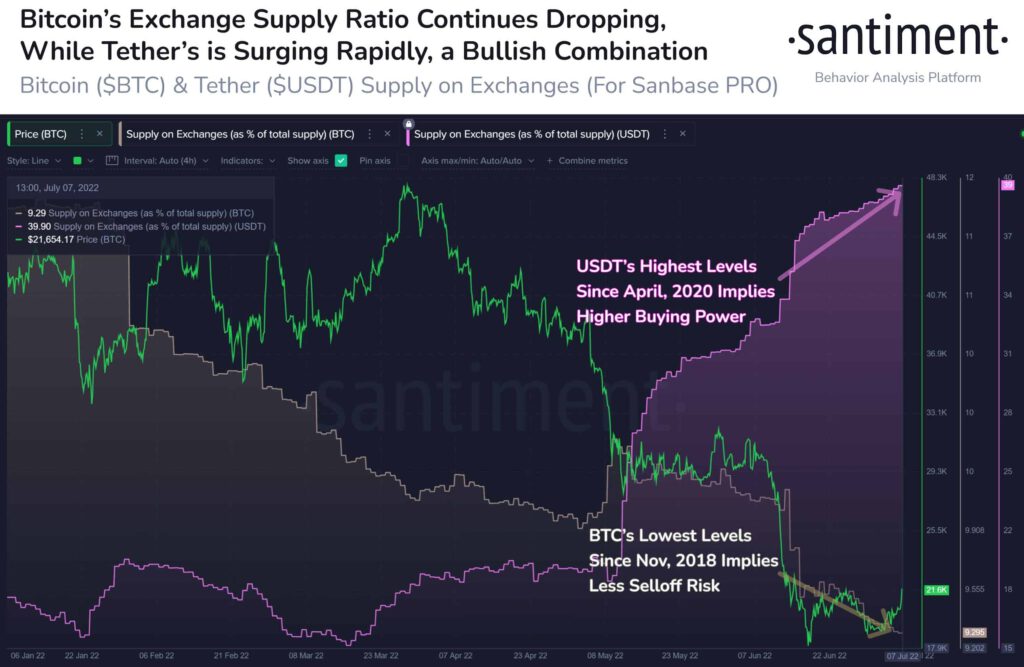

While Bitcoin has been under major selling pressure over the last three months, the supply of Bitcoin at the exchanges has been on a decline. As on-chain data provider Santiment reported:

Bitcoin dominance is back on the menu on a healthy Thursday price surge. We’ve seen $BTC continue to moving from exchanges for nearly 4 years, and this trend hasn’t stopped even with the 8-month price retrace. Meanwhile, $USDT buying power is rising.

While the on-chain indicators are hinting at a bullish momentum, we need to see what the technicals have to say. On the four-hour technical chart, Bitcoin (BTC) has faced a rejection at 200 EMA and this could very much turn out to be a dead cat bounce.

#bitcoin getting rejected at 200 EMA on the 4 hour. pic.twitter.com/oBApXNWgMT

Trending Stories

— Lark Davis (@TheCryptoLark) July 8, 2022

Why It’s A Good Time to Buy Bitcoin?

Analysts have been arguing that for long-term holders, it could be the right time to add BTC to their kitty. One can continue to do dollar-cost-averaging (DCA) in BTC if they are willing to hold for a period of four years and more.

Jordan Belfort, popular as the Wold of Wall Street recently shared his optimistic view on Bitcoin. He said:

If you take a three or maybe five-year horizon, I would be shocked if you didn’t make money because the underlying fundamentals of Bitcoin are really strong.

On the other hand, Bloomberg’s senior commodity strategy Mike McGlone said that Bitcoin could kickstart one of the great bull runs in history during the second half of 2022. He also added that the Bitcoin adoption is likely to grow further.

The Bloomberg strategist also added that the downside for Bitcoin and crypto looks limited from the current levels. He said: “The about 80% drawdown in the Bloomberg Galaxy Crypto Index is indicative of limited further downside and the proliferation of crypto dollars”.