Bitcoin (BTC) sellers’ losses are mounting as the BTC price downturn shows that some investors are panicking at current prices.

Data from on-chain analytics firm Glassnode and trading suite Decentrader shows that in January, more and more BTC entities have been selling coins for less than they purchased them.

On-chain loss selling now “consistent”

While no one wants to sell an asset without profit, Bitcoin downtrends tend to see a certain cohort of market participants do so anyway — for fear of greater losses if they stay put.

This panic selling is often derided by long-term investors, who argue that stronger, more liquid players will scoop up the supply to the detriment of those who sold.

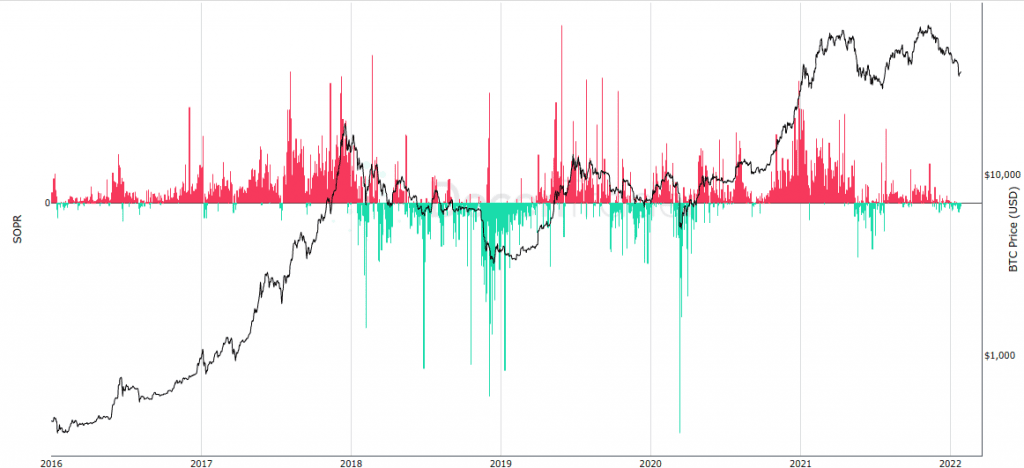

Analyzing the spent profit output ratio (SOPR) metric, Decentrader analyst Philip Swift revealed that while selling overall remains relatively low, panic has set in this year.

“SOPR (Spent Output Profit Ratio) has had a consistent patch of on-chain loss selling recently,” he summarized to Twitter followers this week.

SOPR takes the aggregate “price bought versus price sold” data for BTC in a given period to produce an overall impression of whether sellers are in profit or at a loss.

As noted by its creator, Renato Shirakashi, the psychology of selling at a loss means that only those in panic mode are likely to do so, and by extension, the shallower selling seen this month could be cause for relief.

“It’s interesting to note that the selling at a loss the past few months has been much more shallow vs. 2018/19 bear market, but much deeper than we saw in either bull run period,” Swift nonetheless added.

“Is this a bull or bear market rn?”

As Cointelegraph reported, Bitcoin price activity has suprised with its 50% retracement since November, this being somewhat uncharacteristic of what should be the most bullish part of its halving cycle.

Zooming out, the whole of 2021 arguably looks like a consolidation zone after rapid gains a year ago.

Big players dominate the transactions

Should selling be from low-volume retail investors, this would meanwhile chime with other data covering on-chain transactions.

Related: Derivatives data suggests that Bitcoin’s $39K bounce was a mere blip

As Glassnode confirmed this week, the majority of transactions now involve significant sums of $1 million or more. This, the firm concluded, points to institutions, not retail, as the driving on-chain force.

“Bitcoin transfer volumes continue to be dominated by institutional size flows, with more than 65% of all transactions being larger than $1M in value,” a tweet read.

“The uptrend in institutional dominance in onchain volumes started around Oct 2020 when prices were around $10k to $11k.”

2022 has been announced as the year in which institutions indeed return to the Bitcoin space.