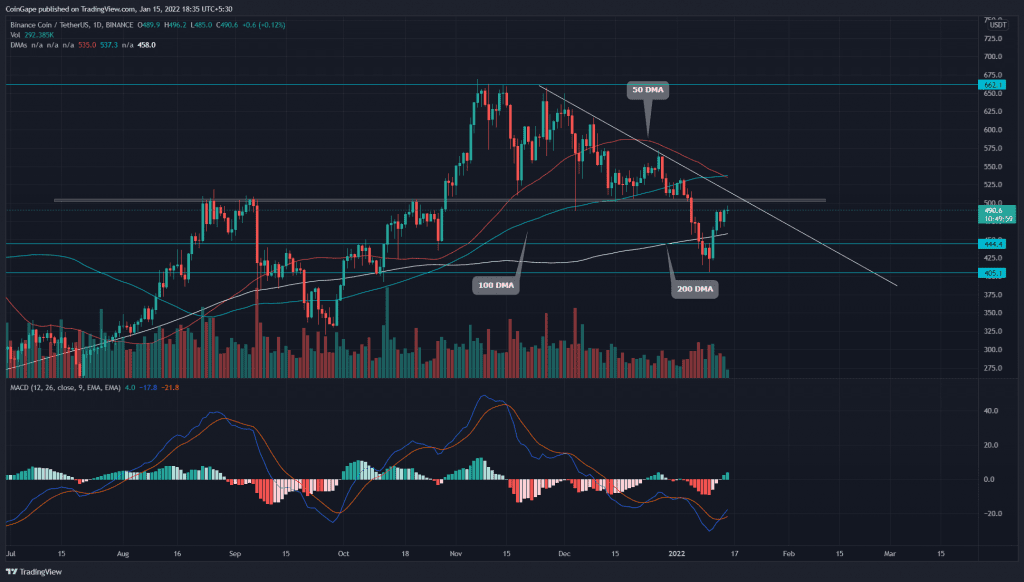

During the last two months of 2021, the $500 mark was critical support for BNB coin bulls. However, entering 2022, the bear overpowered this coin and extended the correction rally below $500. Obtaining strong support from the $400 mark, the BNB price is rallying back to the $500 level, but this time as potential resistance.

Key technical points:

- BNB price chart shows a bearish crossover of the 50-and-100 DMA

- The MACD indicator shows a bullish crossover below the neutral line

- The 24-hour trading volume in the Binance Coin is $2.07 billion, indicating a 49.5% loss.

Source-Tradingview

Previously when we covered an article on Binance Coin, the BNB/USD pair breached a significant support level of $445. The bear attack continued, and the price dropped to $400 as warned.

However, the intense demand pressure from this support immediately rejected the coin price, indicating a bullish reversal. This V-shaped recovery in price is now charging straight to $500 as new resistance.

The Moving average convergence divergence provides a bullish breakout among the MACD and signal line, projecting a buy signal for crypto traders.

This recent recovery has reclaimed the 200 DMA line, indicating its bullish trend. However, the chart also shows a bearish crossover of the 50 and 100 DMA, inviting more sellers to this coin.

BNB Price Faces Combined Resistance From $500 And Descending Trendline

Source- Tradingview

The Binance coin price is currently trading at the $492 mark, indicating a 21% growth from the $400 support. Furthermore, the price will soon challenge a combined resistance of $500 and a long coming descending trendline.

Though this technical level could provide strong rejection to the coin price and extend the correction rally, a breakout from this overhead resistance could bring an excellent bullish opportunity.

The average directional movement index shows a sudden drop in its value, indicating the decreasing bearish momentum in this coin. However, a further increment in coin price could initiate an upward rally in the ADX slope.

- Resistance levels: $500, $570

- Support levels: $445, $400