Stablecoins are a godsend for crypto investors, they help to counter the highly volatile nature of the crypto markets.

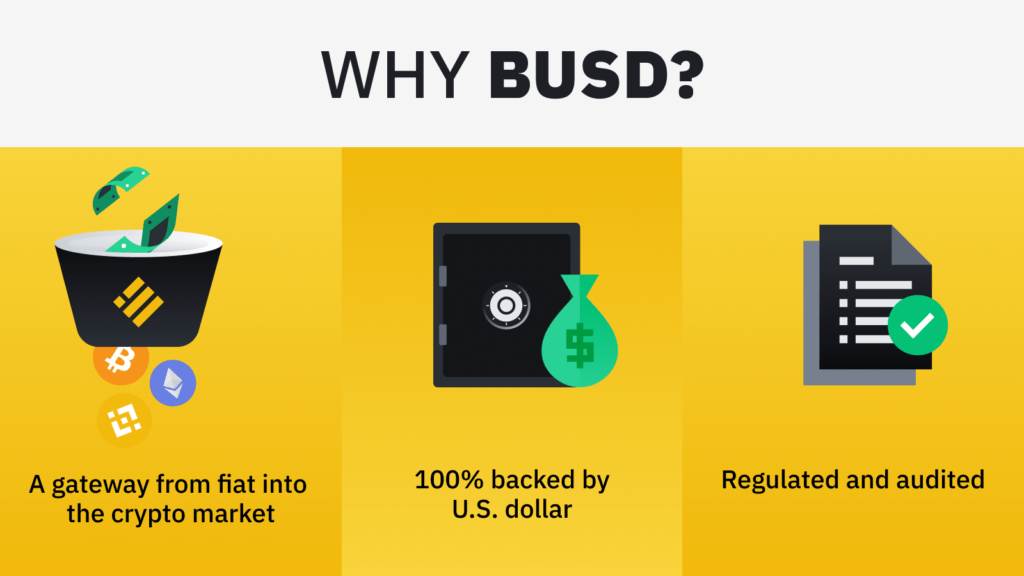

Binance USD or BUSD is a 1:1 USD-backed stablecoin issued by Paxos on the Ethereum blockchain and approved by the New York Department of Financial Services.

The fully licensed status and regulated nature of the coin make it a great bet for users looking for a stablecoin that has a ton of benefits to offer. BUSD, by design, works on maintaining a stable market value while also providing users with a low-volatility on-chain asset.

Unlike algorithmic stablecoins, BUSD strives to offer a product that verifies, protects, and ensures the reserves while also maintaining its US dollar peg.

3 Keystones of security

In order for a stablecoin to be successful, there are three key areas of focus: regulations, audits, and sound reserves.

- Fiat-backed stablecoins stand out from all possible reserve assets as it is unlikely to lose their value. BUSD focuses on this and maintains 96% of its reserves in cash and cash equivalents while the other 4% of reserves are held in US Treasury Bills.

- BUSD is audited regularly by Withum and the attestations are made available to users on a monthly basis. This helps in building trust and reassuring the users that they can have access to the collateral that backs the coin at their convenience.

- Apart from the periodical audits, BUSD provides users with the protection of being issued by a regulatory authority. The coin is also green-listed by NYDFS (New York State Department of Financial Services) which makes it pre-approved for custody and trading by any of its virtual currency licensees.

Major use cases of BUSD

BUSD not only provides users with a plethora of use cases but also access to various ecosystems, dApps, and services:

- The stake and earn mechanisms on Binance Launchpad offers BUSD holders a chance to discover, farm, and hold the newest tokens in the market.

- Users can explore the Binance NFT marketplace and pay for digital collectibles.

- Throughout the BNB ecosystem, BUSD is used widely in liquidity provision. This gives users a chance to provide liquidity either through Binance or a DEX.

- By staking BUSD, token holders get access to a range of APYs depending on their risk level. Flexible Savings is also an option that lets token holders earn 10% APY.

0% maker and transaction fee

BUSD offers 300+ spot and margin trading pairs available without any maker fees for users who place an order on the orderbook. Additionally, no transaction fee is applied for swaps between BUSD/USDT, USDC/BUSD, TUSD/BUSD, and USDP/BUSD.

As the stablecoin is 1:1 redeemable with USD, users can easily transact with it with the help of their credit/ debit cards or through their local bank accounts via SWIFT network. For every transaction, the deposit and withdrawal fees are $0USD and $15 respectively.

The daily withdrawal limits are $50,000 to $200,000 depending on the KYC level of the user. The limit can be increased by any qualified user by either increasing their KYC level or sending in a reasonable request.

The future of stablecoins relies on cooperation with regulatory bodies in the crypto space and BUSD gives users the criteria of holding it with confidence without any worry or hassle.

For more information on BUSD, please check out their official website.

Disclaimer: This is a paid post and should not be treated as news/advice.