Bitcoin (BTC) could be seeing renewed interest from big buyers as data shows large tranches of coins leaving major exchange Coinbase.

As shown by monitoring resources including Whale Alert and CryptoQuant on March 11, an unknown wallet has received almost 30,000 BTC from the U.S. platform.

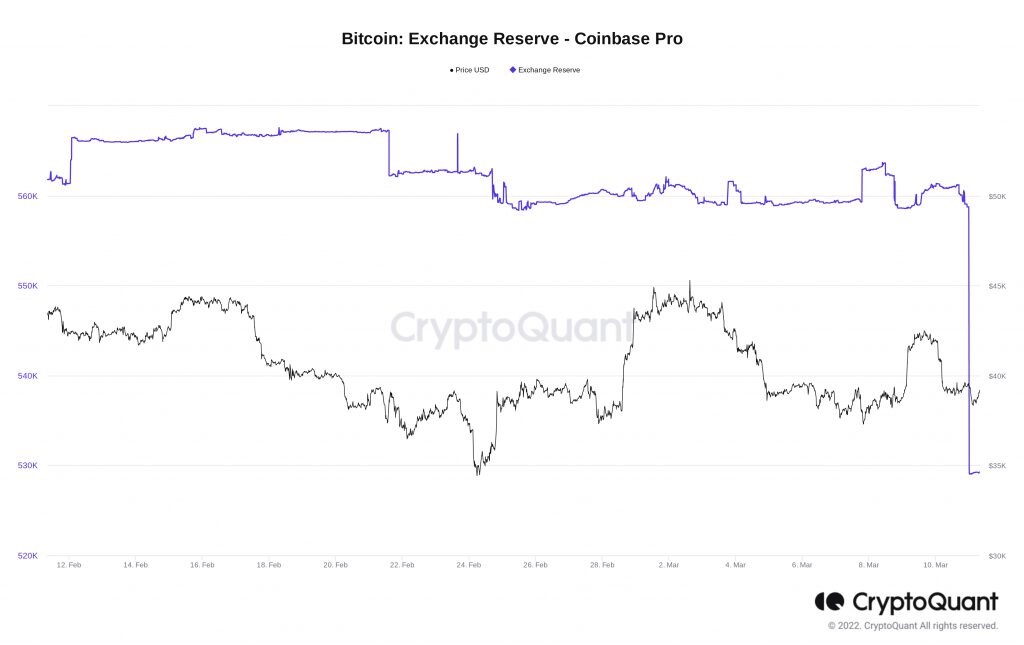

Coinbase Pro $1.15 billion lighter

The potential buy-in came in the form of three separate transactions on Coinbase Pro, Coinbase’s professional investment arm.

According to Whale Alert, these were for 9,843 BTC, 9,901 BTC and 9,867 BTC, respectively, for a total of 29,620 BTC.

9,843 #BTC (390,782,938 USD) transferred from #Coinbase to unknown wallethttps://t.co/uYSlIeugzF

— Whale Alert (@whale_alert) March 11, 2022

9,901 #BTC (393,077,696 USD) transferred from #Coinbase to unknown wallethttps://t.co/1OoPwliWF9

— Whale Alert (@whale_alert) March 11, 2022

9,867 #BTC (391,721,155 USD) transferred from #Coinbase to unknown wallethttps://t.co/AI5yos1rPr

— Whale Alert (@whale_alert) March 11, 2022

While having no impact on price performance, if confirmed as a genuine buy and not an in-house transaction, it would mean that a Coinbase Pro entity appointed over $1.1 billion to BTC at current prices around $39,000.

The transactions were completed in swift succession, as shown by Coinbase Pro reserves per mined Bitcoin block overnight.

More broadly, exchange reserves in general have continued to decline through both this month and last, once again at multi-year lows.

The combined BTC reserves of the 21 exchanges tracked by CryptoQuant stood at 2.357 million BTC as of Friday.

The Accumulation Trend Score by fellow on-chain analytics firm Glassnode adds that on balance, however, the market is in a state of uncertainty and not yet trending towards accumulation.

Bitcoin still boring for the mainstream

Looking at interest in Bitcoin beyond exchange users, meanwhile, it becomes clear that those buying are not newbie investors entering the space en masse.

Related: Gold-backed cryptos are shining in 2022, market cap hits $1B for the first time

According to data from Google Trends, search requests for “Bitcoin” remain low — and barely moved throughout the second half of 2021.

Only last May’s dive below $30,000 managed to catch mainstream attention, and so far, the trend shows no sign of changing despite current geopolitical events.

The source of the most requests on a relative basis over the past 12 months has been El Salvador, which made BTC legal tender last year.