- The largest Bitcoin whales are extending the distance between them and other smaller whales.

- Five addresses hold a combined 776,000 Bitcoins in what appears to be a steady accumulation spree.

- The decline of Bitcoin over the last few months has seen retail traders liquidate significant portions of their holdings as bearish sentiment holds sway.

Bitcoin (BTC) is going through a tumultuous season, striking fear in the hearts of retail traders around the world. Despite the panic, the largest Bitcoin whales are deftly adding to their positions with their holdings setting a new record for the network.

Giga-Whales are flexing their muscles

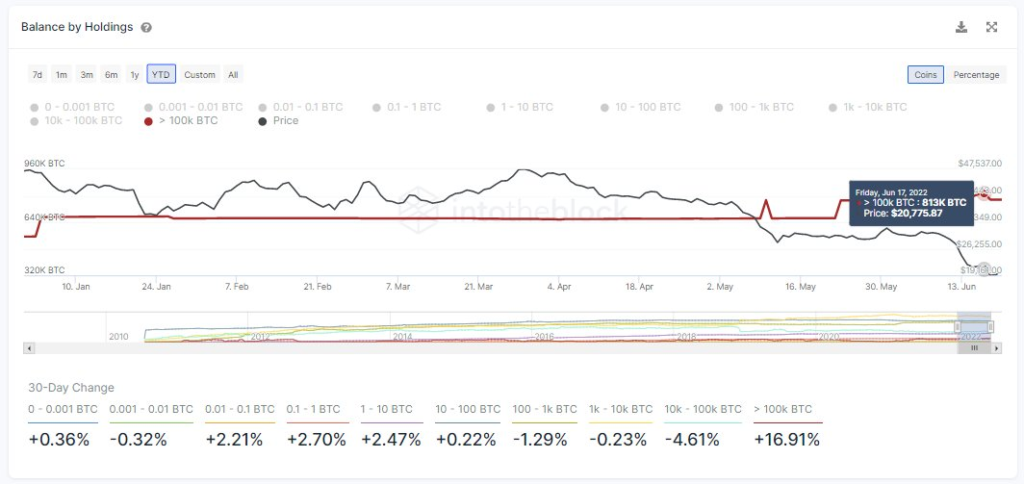

The largest Bitcoin whales are adding to their holdings in an aggressive fashion and have hit an all-time record. According to data shared by IntoTheBlock, a blockchain analytics firm, giga-whales with over 100,000 BTC have increased their holdings by 16% in the last 30 days.

The report noted that “over 776K BTC is held by a grand total of 5 addresses” in a show of strength by the giga-whales. Since the start of the year, whales have been on a Bitcoin shopping spree and a Santiment report noted that the last 20 weeks saw whales accumulate assets by 12.8%.

“The mega whale addresses of Bitcoin comprised partially of exchange addresses, own their highest supply of BTC in a year,” read the Santiment report. The latest data from IntoTheBlock shows that amongst the whales, the largest ones are sticking to the strategy of buying the dip.

In the last 30 days, BTC reached a low of $17,708 while its market capitalization fell below $1 trillion in the face of freezing crypto winter. Sentiments quickly switched from optimistic to bearish as retail traders sold their BTC in panic but the whales took advantage of falling prices to buy even more.

“You came to crypto because you didn’t have a seat at the fiat table,” said one Twitter user in response to the data.” Now you sell your coins so you don’t have a seat at this table either. Genius!”

Whales have a profound effect on the crypto ecosystem as the mere reports of whales dumping assets can cause prices to tank. Conversely, the reports of Bitcoin whales HODLing can create a scarcity, leading to an increase in asset prices.

The largest holders

According to data from BitInfoCharts, the largest Bitcoin whale is a Binance cold wallet with 252,597 BTC and is closely followed by Bitfinex with 168,010 BTC. Michael Saylor’s MicroStrategy has a holding of over 129,000 BTC after its last purchase of $191 million worth of BTC.

Other leading holders of Bitcoin include publicly listed companies like Tesla, Galaxy Digital Holdings, and Square Inc. The Winklevoss twins, Micree Zhan, Chris Larsen, and Changpeng Zhao are rumored to be among the largest Bitcoin holders.