Since the inception of bitcoin, bull and bear markets have been a natural part of its growth. However, like with anything that lasts a long time, the market has evolved, and so has the concentration of various things in the market. One of these changes has come in the form of the funding rates and what portion of it was controlled by different exchanges. In the last bear, BitMEX had proven to be a significant part of the bear market, but things have changed.

BitMEX Dominance Drops

Now, derivatives have become more popular among bitcoin and crypto users over the past year. Nevertheless, they remain very complex to the point that the instruments used to fund calculations by different platforms can vary widely. This even pushes further the collateral structure of the derivatives on each platform.

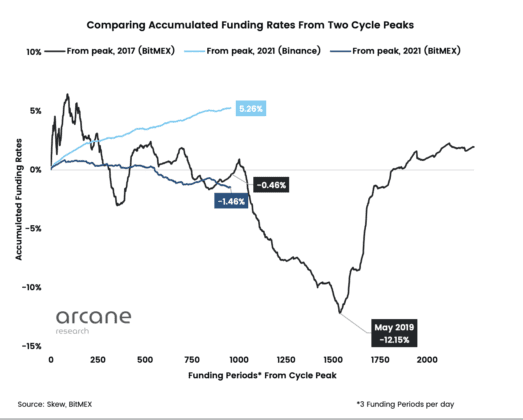

Back in 2017/2018, when the bear market had taken hold, BitMEX had been at the forefront of the derivatives market. A report from Arcane Research uses the first 318 days after the start of the 2018 bear market, where it found that the crypto exchange had accounted for more than half of all derivatives volume at the time. It had also seen the accumulated funding rates reach -0.46%, which, today, tells a much different story.

Funding rates from two cycle peaks | Source: Arcane Research

However, over the years, the crypto exchange has lost its dominance of the derivatives market share. As more prominent competitors popped up, BitMEX has seen its share of the bitcoin open interest drop to 3.3%, and its accumulated funding rate drop another 1.46% in the present-day market. This means that the crypto exchange is now much less important to the bitcoin bear market than it used to be.

Impact On Bitcoin

Looking back at the performance of bitcoin in the perpetual markets, it seems to be the opposite of the last bear market. The first example of this is that back in the 2018 bear market, BitMEX funding rates sat at 0.46%. At this time, the funding rates were very volatile, and the shorts were mostly paying the shorts.

BTC recovers to $19,100 | Source: BTCUSD on TradingView.com

However, in today’s market, the reverse has been the case. The report shows that shortening the BTCUSDT perp pair since November 10th would see a return of 5.25% as of today. This goes against the 2018 trend, and now the longs are paying the shorts.

It is also important to keep in mind that funding rates from the last bear market were actually more volatile than they are today. For example, BitMEX had bottomed at -12.15% in accumulated funding rates during the cycle peak back in 2019.

Featured image from Coingape, charts from Arcane Research and TradingView.com

Follow Best Owie on Twitter for market insights, updates, and the occasional funny tweet…