Selling pressure had been mounting on public bitcoin miners over the last couple of months. This was a direct result of the decline in the price of the digital asset, which saw the cash flow for bitcoin miners plummet significantly. It came out to an over 60% decline in profitability, and given that miners continue to incur ongoing expenses, they had to look towards their bitcoin holdings for cash flow, which led to a massive selling trend.

Bitcoin Miners Offload Coins

Over the last three months, bitcoin miners have been pushed into a tight spot when it comes to holding their mined BTC. Production had remained roughly the same since the majority of public bitcoin miners had not been able to increase their hashrate during this time.

It started in June when the price of bitcoin fell almost 50%. Bitcoin miners had turned to their holdings to smooth over jagged parts of their operations, selling more BTC than they were producing. By the end of the month, public bitcoin miners reported that they had sold almost 400% more BTC than they had produced for the month. Total BTC sold came out to more than 14,000 for the one-month period.

This trend would continue into the month of July, when public miners, once again, sold more coins than they had produced. This time around, the miners sold a total of 6,200 BTC in a month, which was about 160% more BTC than they had produced for the month.

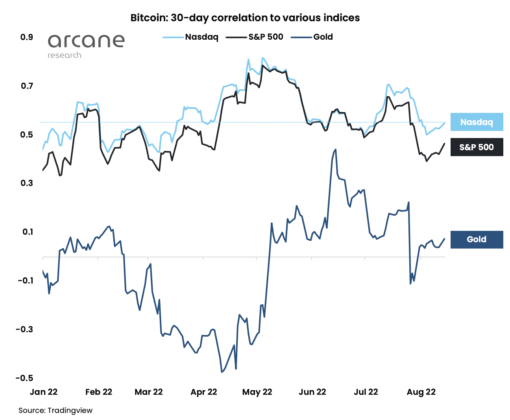

BTC correlation to stock market weakens | Source: Arcane Research

Both of these months are now on the record as the months with the highest BTC sale from public companies. Despite the large selling sprees, bitcoin miners are in no way out of the woods yet, but the selling pressure may be dropping.

Miners May Stop Selling

Going into the month of August, Bitcoin’s price had been doing significantly better than it was in the last two months. This recovery had significantly impacted the cash flow of bitcoin companies, putting them in a much better position compared to June and July. This has not completely eliminated the selling pressure on public miners, but it has begun to ease it over time.

BTC trending at $23,000 | Source: BTCUSD on TradingView.com

With the price of bitcoin up more than 10% in the last month, this ease had not been significant. Forecasts are that bitcoin miners will need to continue to sell BTC to keep their operations going, and Arcane Research puts this between 100% and 150% of total production. So going by July’s numbers, public miners could be dumping between 4,000 and 6,000 BTC each month going forward.

However, there could be a reprieve if bitcoin was able to once more make its way above $30,000. This price point is critical both for the miners and investors in the space. It’ll reduce the need for public miners to sell so much BTC, hence fewer coins being put in circulation.

Featured image from Investopedia, charts from Arcane Research and TradingView.com

Follow Best Owie on Twitter for market insights, updates, and the occasional funny tweet…