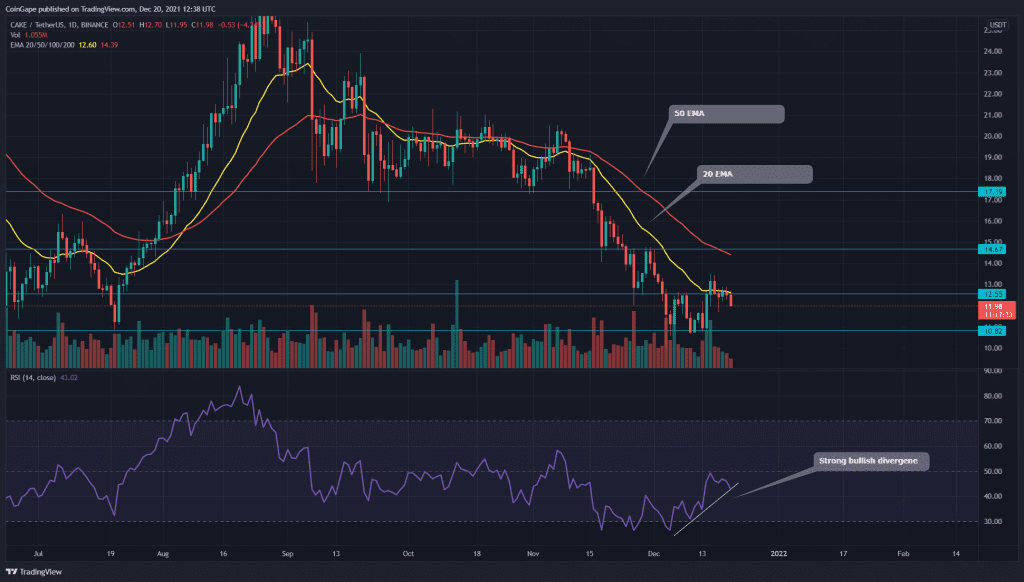

The technical chart indicates the CAKE token is still under a short-term downtrend. Last week the price attempted a bullish reversal when it breached the $12.6 resistance.

However, the intense selling rejected the price immediately, resulting in a beartrap. Thus, the token would plunge to the $10 mark, where the buyers and sellers will decide the CAKE token’s fate.

Key technical points:

- The CAKE token price obtains strong resistance from the 20-day EMA

- The intraday trading volume in the CAKE token is $172.8 Million, indicating a 3.82% loss.

Source- Tradingview

The last time when we covered an article on CAKE/USD, the token price plummeted to the crucial support level of $10. The token spends almost two weeks near this support trying to identify sufficient demand pressure.

On 14th December, the token bounced from this bottom support, with a bullish engulfing followed by a breakout candle from the $12.6 resistance. However, the pair couldn’t sustain above this level, which resulted in a fakeout.

The CAKE token maintains a bearish alignment among the crucial EMAs (20, 50, 100, and 200). Moreover, the 20 EMA line acts as a strong resistance level for the price.

The daily Relative Strength Index (42.9) shows an evident bullish divergence in its chart, indicating the bulls are trying to take over the wheels again.

CAKE/USD 4-hour time frame chart

Source- Tradingview

The CAKE token price still hasn’t provided a daily candle closing below the $12.6 mark. If the price sustains this breakdown, the price will retest the $10.6 again. Anyhow, the bullish divergence in RSI cannot be ignored, and therefore the crypto traders need to wait and observe the price action at this level for a possible bullish reversal.

The traditional pivot suggests the nearest resistance level for CAKE price is $12.3 and $13.7 to play an important role. Whereas the support levels are at the $11 and $9.5 mark.