Chainlink is one of the few altcoins which hasn’t marked a new all-time high (ATH) in almost a year. It is currently 73.39% down from its ATH in May 2021.

Chainlink is overvalued

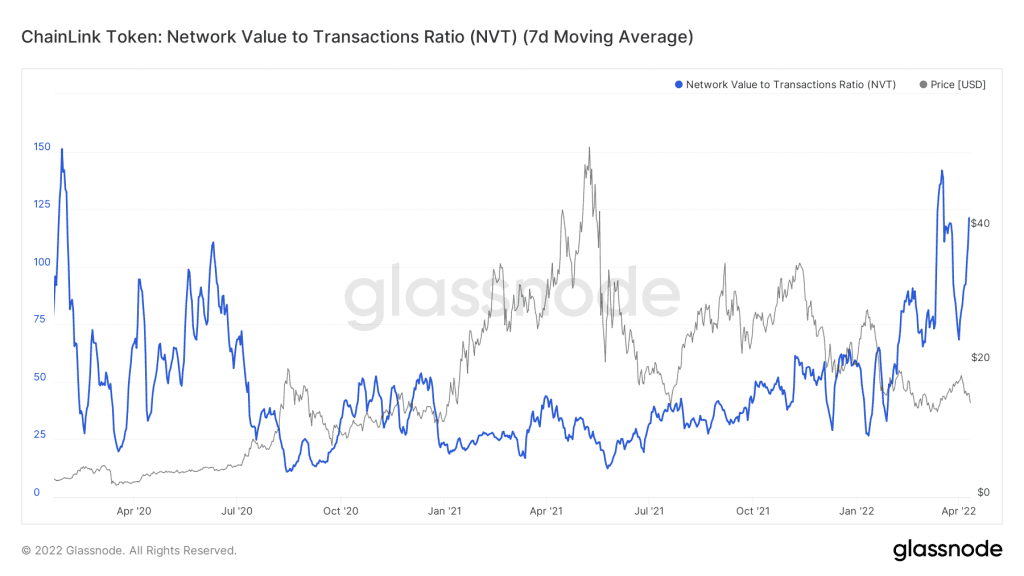

While on the other hand, the coin’s Network value to transaction ratio is up by 365% from the same date. The value is also at its highest since February 2020. It simply indicates that LINK at the moment is highly overvalued. And, this can’t be considered a good sign for the coin.

Chainlink NVT ratio | Source: Glassnode – AMBCrypto

Historically, higher value accompanied by low on-chain movement has resulted in price plunging, and that is what has been happening for the last 11 months now.

Consequently, LINK is trading at $14.02, stuck once again in the downtrend with all the indicators hinting at a further fall in the near future.

The Parabolic SAR’s white dots have been hovering well above the candlesticks for a week now. And, the ADX, which was supporting the uptrend has lost its strength post-February 2022.

Should ADX rise above 25.0 in a downtrend, LINK will fall through the lower trend line of the 11-month long downtrend wedge.

Chainlink price action | Source: TradingView – AMBCrypto

This will force the investors to witness much higher losses. Thus, the confidence and interest of LINK holders might decline to a great extent.

In fact, over 412k investors are already facing losses. Furthermore, a significant portion of them are simply waiting for a recovery of 24% since these investors bought their holdings at around $14 to $16.

Now, investors in the $14-$16 zone hold about 40.5 million LINK worth almost $570 million. Once LINK crosses the $16 mark, these 40.5 million LINK will be saved from losses even if the investors don’t see profits.

Chainlink investors out of money | Source: Intotheblock – AMBCrypto

However, it should be noted that smart investors cashed out at the right time soon after the 42% rally of March. As a result, most of the transactions last month were in profit.

Chainlink transactions in profit | Source: Santiment – AMBCrypto

Well, after the network-wide supply of LINK fell into losses a few days ago, on-chain transactions might witness a state of complacency until the trend reverses.

Chainlink network-wide supply in profit | Source: Santiment – AMBCrypto