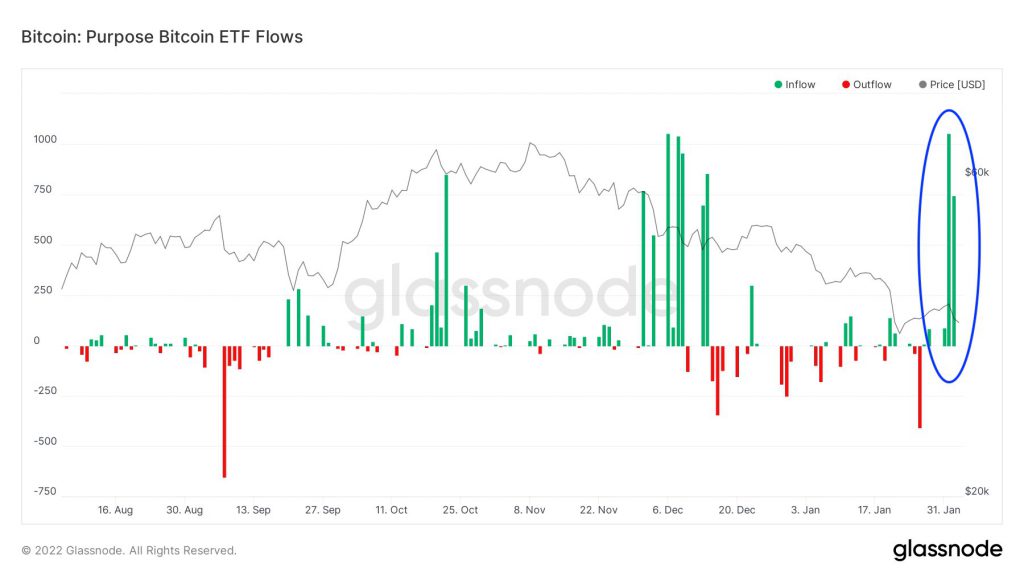

While retail investors remain confused over the recent Bitcoin price volatility, industry giants are silently making big moves. Canada’s Purpose Bitcoin ETF has filled its bags by accumulating more than 1750 Bitcoins just over the last two days, as per data from Glassnode.

Yesterday, the Purpose Bitcoin ETF registered its biggest inflow by accumulating more than 1000 BTC in a single day. This shows that institutional players have been accumulating the dips thereby squeezing liquidity from the retail players.

We have recently seen how MicroStrategy announced its fresh BTC purchase and bought the dip. The company added 600 more Bitcoins to its balance sheet. Similarly, El Salvador purchased the Bitcoin dip over the last two weeks.

What’s the Bitcoin Traders Mood

On-chain data analysis firm Santiment reports that Bitcoin trader sentiment has turned positive over the last two weeks, for the first time in three months. However, it adds that as the trader sentiment turns euphoric, Bitcoin witnesses a price fall.

A similar thing has been witnessed this time as well since Bitcoin has corrected more than 5% in the last 24-hours. As of press time, BTC is trading at $36,448 with a market cap of $690 billion.

Although the bitcoin price made a recovery earlier this week, it still trades below its 50-day moving average. Crypto analyst Lark Davis explains:

Bitcoin has had a nice rally from the 33k dump back up to 39k, but we have still failed to break the down trend, still a few thousand away from the 50 day MA, and ages away from the real bull bear line (200 day MA) at 49k.

Also, as per the Bitcoin Fear and Greed Index, the market is currently in the “extreme fear” zone. Ex expect that it will take some time for retail buyers to resume some confidence after a strong correction last month.