Cardano (ADA) saw holdings among large traders hit an all-time low during its latest rally. The token surged from 2022 lows on increasing interest in proof-of-stake (PoS) blockchains, as well as an influx of institutional traders.

The token rose 33% from annual lows, going as high as $1.22. It was last trading around $1.18, recently overtaking Terra (LUNA) to become the seventh-largest crypto token by market capitalization, at $40.6 billion.

ADA whale holders hit record low

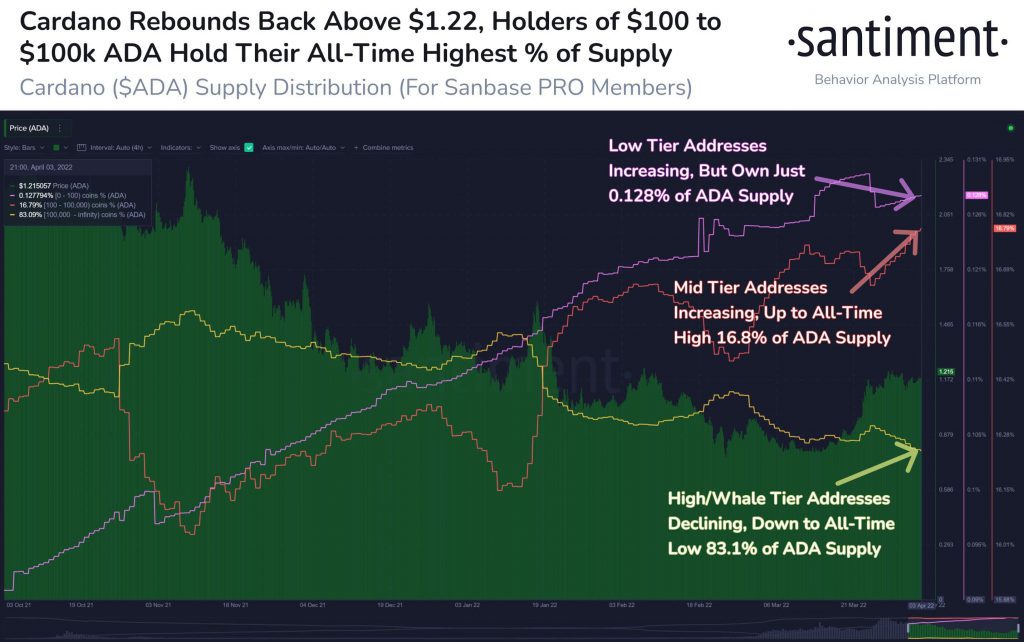

Recent data from blockchain research firm Santiment showed that ADA supply appeared to be moving out of addresses worth over $100,000- which the firm considers to be whale-tier. Whales currently held about 83.1% of overall supply, which is a record low.

On the other hand, low to mid-tier holders appeared to be accumulating ADA at an accelerated pace. Buying by wallets with between $100 to $100,000 worth of the token surged in the past two weeks, and represented a record-high 16.8% of total supply.

Low-tier addresses, ie wallets with less than $100 of ADA, also appeared to be around record levels. But the tier represented only 0.12% of total supply.

The trend can be observed since the beginning of the year, and represents a healthy amount of diversification among holders. It implies that ADA will be less prone to outsized, volatile swings, and also reduces the potential for price manipulation by any one party.

Institutional demand a major factor in ADA rally

But even while ADA whales are reducing holdings, large-scale trading is a key factor behind ADA’s latest rally. Data had earlier shown 99% of ADA’ s volumes were through transactions above $100,000- a sign that big trading houses were likely exposed to the token.

This increased interest can be attributed to a recent fund launched by digital wealth manager Grayscale, of which ADA makes up nearly 25%. Increased institutional interest could see the token poised for a price explosion like Bitcoin (BTC), given that buying by trading houses was a major factor for BTC’s 2021 rally.

Increased interest in PoS tokens, ahead of Ethereum’s (ETH) shift to the model, has also benefited ADA.