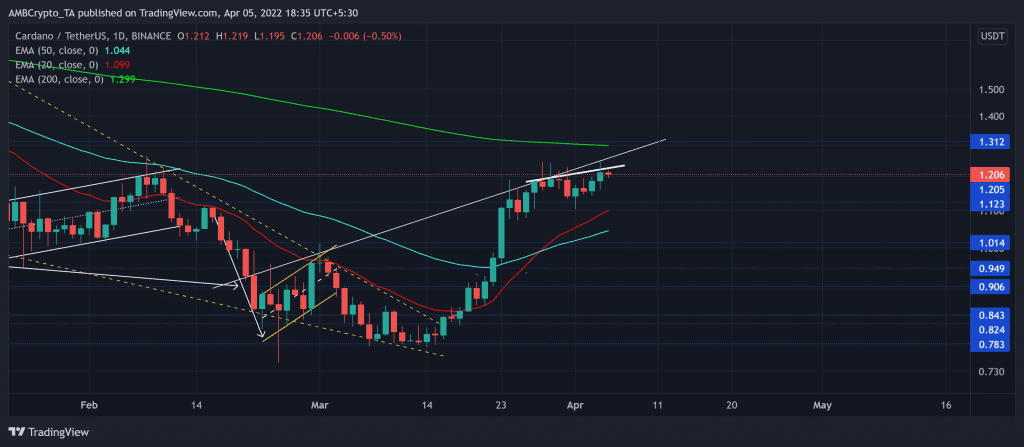

After a long-term struggle to topple its 50 EMA (cyan), Cardano (ADA) finally flipped it from resistance to support after the latest bullish rally.

Henceforth, it eyed at a possible further upside in the coming days while the 20 EMA (red) jumped above the 50 EMA in its northbound trajectory. Before that, it could see some minor setbacks towards the $1-mark owing to certain divergences with its technical oscillators.

ADA Daily Chart

ADA formed seven-month-long trendline support (yellow, dashed) while the alt was on a steep downtrend. As a result, it lost more than half of its value since its ATH. Meanwhile, it formed a falling wedge over the last three months on its daily chart.

The bulls overshadowed the bearish signals to ignite a strong recovery from the 13-month $0.783 support. After finally recovering from its multi-month lows in February, ADA broke out of the falling wedge on 16 March. The alt registered a 55.7% growth in the last 22 days as the bulls gained a sizeable pace to trigger a solid rally that reclaimed the vital $1-mark support.

Historically, the bullish crossover of the 20/50 EMA is succeeded by a golden cross of the 20/200 EMA. Thus, keeping the continued recovery hopes alive for the bulls in the coming days. The $1.2-mark has posed problems for the alt for over ten weeks. So any close below this level could trigger a near-term setback toward the 20 EMA before continued bullish movements.

Rationale

The RSI is now on a retracement phase since the past week from the overbought mark. Consequently, it saw lower peaks while the bulls provoked higher highs on the price chart. Thus, revealing a bearish divergence and affirming the chances of a near-term setback.

Also, the CMF was on a slight downtrend and depicted decreasing money volumes in the last week. During this phase, the price refrained from retracements.

Conclusion

Considering the historical tendencies of ADA, a continued recovery towards the $1.3-mark seemed plausible. But some bottlenecks on the RSI and CMF could cause a retest of the $1.1-zone before this trajectory.

Finally, ADA shares a monstrous 97% 30-Day correlation with the king coin. Thus, traders/investors should keep a close watch on Bitcoin’s movement to make a profitable move.