Despite the general non-fungible token (NFT) slump in 2021 and even 2022, Cardano’s NFT space is expanding quickly. In fact, Cardano became the 3rd largest NFT protocol as a result of an increase in NFT trade volume. They are directly behind Ethereum and Solana, the two titans.

One of the crypto market’s most advanced ecosystems is said to be Cardano. In spite of the FUD spread around Cardano, the protocol keeps making news amid the crypto bear run. According to a survey by blockchain and decentralised apps (dApps) analytics company DappRadar, Cardano is the third-largest NFT protocol by trading volume as of this quarter.

The report added,

“Cardano is currently one of the top three blockchains by NFT trading volume”

Poor Performance of NFTs in General

NFTs, or “digital art and collectibles recorded on blockchain,” showed a sharp decline in trading volumes. It decreased by 97% from a record high in January of this year to a mere $466 million in September. The largest NFT trading platform by volume, OpenSea, suffered a 75% decline in sales from just two months earlier.

Trending Stories

According to a Bloomberg statement, the quickly tightening monetary policy is depriving speculative assets of investment flows, contributing to a larger $2 trillion wipeout in the cryptocurrency sector, which includes the waning NFT frenzy.

Cardano’s Rise in the NFT Market

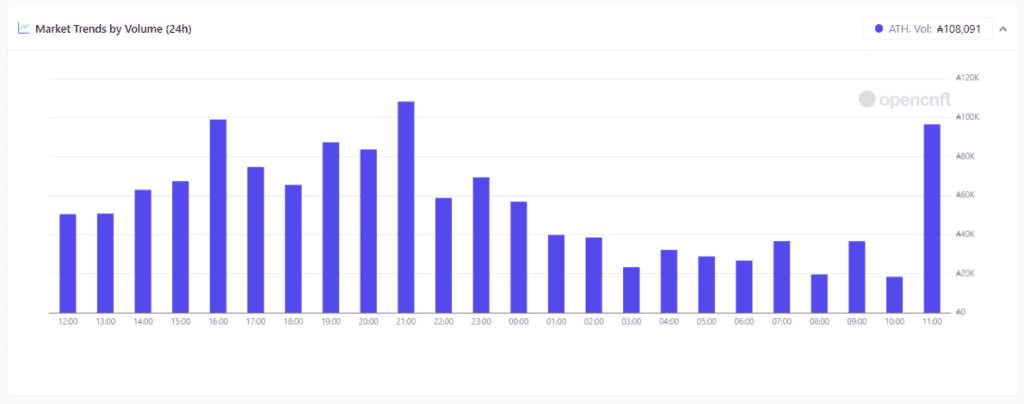

But, with $191 million in NFT volume over the previous 30 days, Cardano is now the third-largest NFT protocol behind Solana and Ethereum. The NFT market tracker OpenCNFT clearly shows the surge in the past 24 hours timeframe.

The floor price of 10,000 ADA was attained by The Ape Society, Cardano’s largest NFT project in terms of collection share by 24-hour volume. The most transactions on the Cardano network have occurred since May, totaling 82,880. With these figures, the blockchain network saw a 75% increase from month to month.

The network’s Vasil update, which went online on Sept. 22 after a series of delays but doubled the network’s operating capacity, is mostly responsible for the spike in trading volume. The update sparked the release of Plutus v2, the network’s smart contract language, which facilitated chain development for developers.