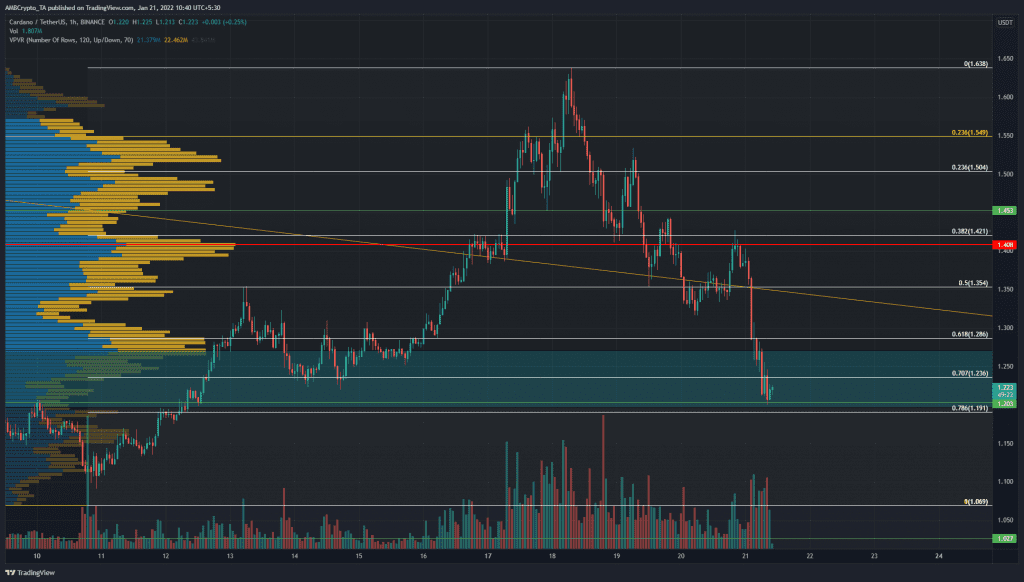

Bitcoin dropped below the $40k mark in recent hours. Cardano saw a strong move on the lower timeframes in the past week as it rallied from $1.23 to $1.63 and appeared to break out of a downtrend. However, at the time of writing, the price has dropped and was back beneath the trendline resistance from late November.

Source: ADA/USDT on TradingView

The recent move down from $1.63 has reached the $1.2 support level. The short-term rally from $1.069 to $1.63 was used to plot Fibonacci retracement levels (white). At the time or writing, the 70.7% retracement level at $1.23 has been retested as a level of resistance.

However, the price was within a longer-term demand area. Hence a bullish reaction, even if it is short-lived, can be expected.

On ADA’s earlier move up to $1.63, the $1.28 level has acted as resistance. This could be an area where sellers once again step in with strength.

Rationale

Source: ADA/USDT on TradingView

The RSI had dropped below 30 and was oversold on the hourly chart. This could see some relief and a small, brief bounce for the price of ADA.

The OBV had been in a downtrend during ADA’s fall from $1.63 to reflect the strong selling volume. However, in the past couple of days, it suggested that some buying volume has been present. This is a reaction that can be expected in an area of demand. The $1.2 and $1 area higher timeframe support levels as well, so a reaction at this area is expected. Yet this does not signal that buyers are in control of the market.

Conclusion

Cardano had appeared to break out of a longer-term downtrend last week. Bitcoin was also hovering above a level of support at $40.5k, but in the past few hours, this level had given way to bearish pressure. It was not yet clear where this downtrend could reverse. In the near term, the $1.28 level was an important level where ADA could retest and drop once more, or consolidate and flip to support.