Key Takeaways

- The Cardano network has witnessed one of the most important updates in the Basho era – Vasil hard fork.

- The Cardano ecosystem welcomed the first DeFi Lending Projects – AADA Finance.

- $36M ~ 20% TVL of the Cardano ecosystem has been blown away in only one day due to the Nomad hack, concentrating in WingRiders DEX.

Introduction

After a prolonged market decline in Q2, the crypto market had been much more dynamic in this quarter with historical news from different blockchains in the crypto environment. However, despite such news, the macroeconomics with rising inflation and a climbing interest rate have erased all of the hype of the market in this period.

The Cardano ecosystem is having many memorable milestones too, both in contributing or devastating aspects. With regard to the contributing events, the Cardano network has just experienced the Vasil hard fork, which would improve the scalability. Moreover, for the 1st time, the Cardano ecosystem is having a “real” DeFi Lending project, contributing to the capital efficiency of the money flow.

However, in the last Q3, there was an astonishing event in the crypto market which also had an adverse effect on our ecosystem. The $36M value of the wrapped asset on WingRiders has gone to complete zero, and our ecosystem has nothing to do with it.

Network Activity

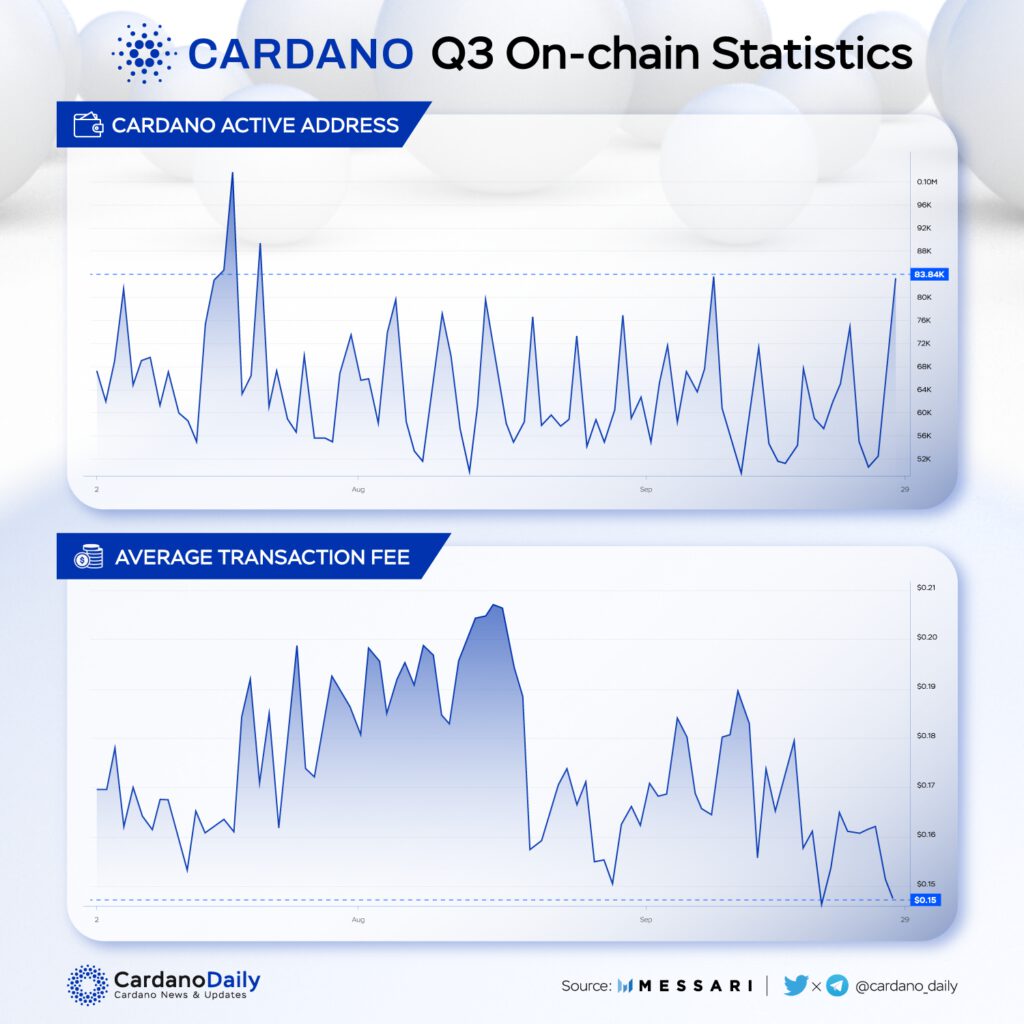

The Cardano active wallets in Q3 always showed fluctuation around an average number, estimating about 68K active wallets each day in Q3. This shall be considered a positive figure since the last 6 months witnessed a major money withdrawal trend out of the crypto market.

However, the transaction fee showed another scenario about the network. To some degree, low transaction fee means there is fewer transactions being executed, showing a lagging tendency of a network.

Ecosystem Breakdown

The event mentioned in this section is discussed in a chronological order with effect on a specified sector.

DeFi

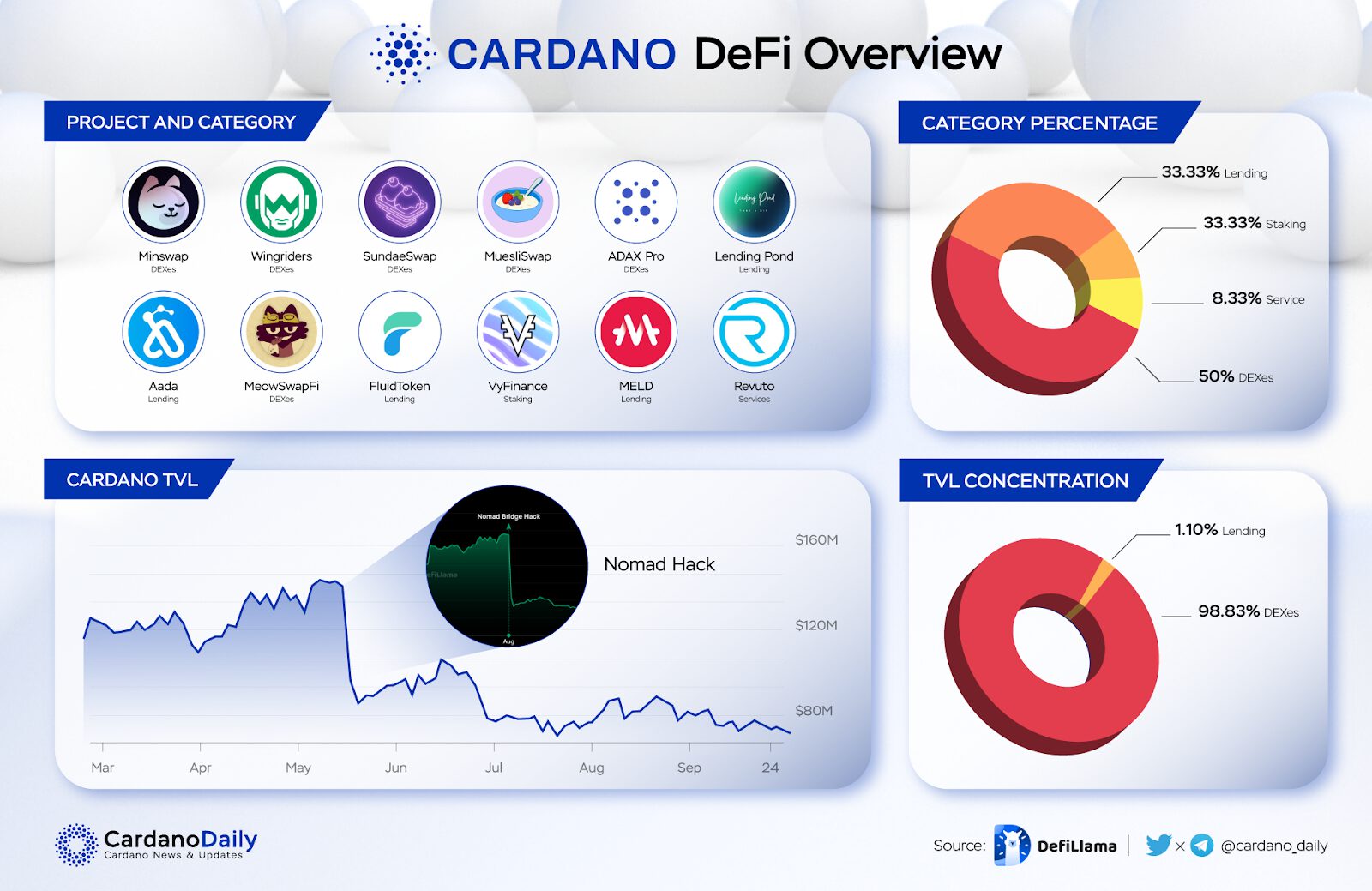

With regard to TVL aspects, the Cardano statistic shall be divided into 2 periods of time: Before and after the exploitation of a cross-chain bridge Nomad (“ the hack”).

Before the hack, the Cardano ecosystem handled around $137M TVL, and the top 1 TVL in this period was WingRiders DEX.

However, with a huge portion of TVL coming from the Nomad bridge, the Nomad assets on WingRiders had gone to zero after the hack, blowing away 20% of TVL of the ecosystem at that time.

After the hack, the top 1 in terms of TVL in Cardano is Minswap, always handling more than 50% of the TVL of the ecosystem.

The DeFi sector of Cardano also does have another milestone in its development – the 1st appearance of a “real” DeFi Lending project on Cardano: AADA finance.

Unlike other ecosystems, the new lending projects always attract a huge amount of money, contributing around 25-30% TVL of the ecosystem at the time the project was released. AADA finance only attracts a small amount of TVL, around $400K – approximately 5% of the ecosystem.

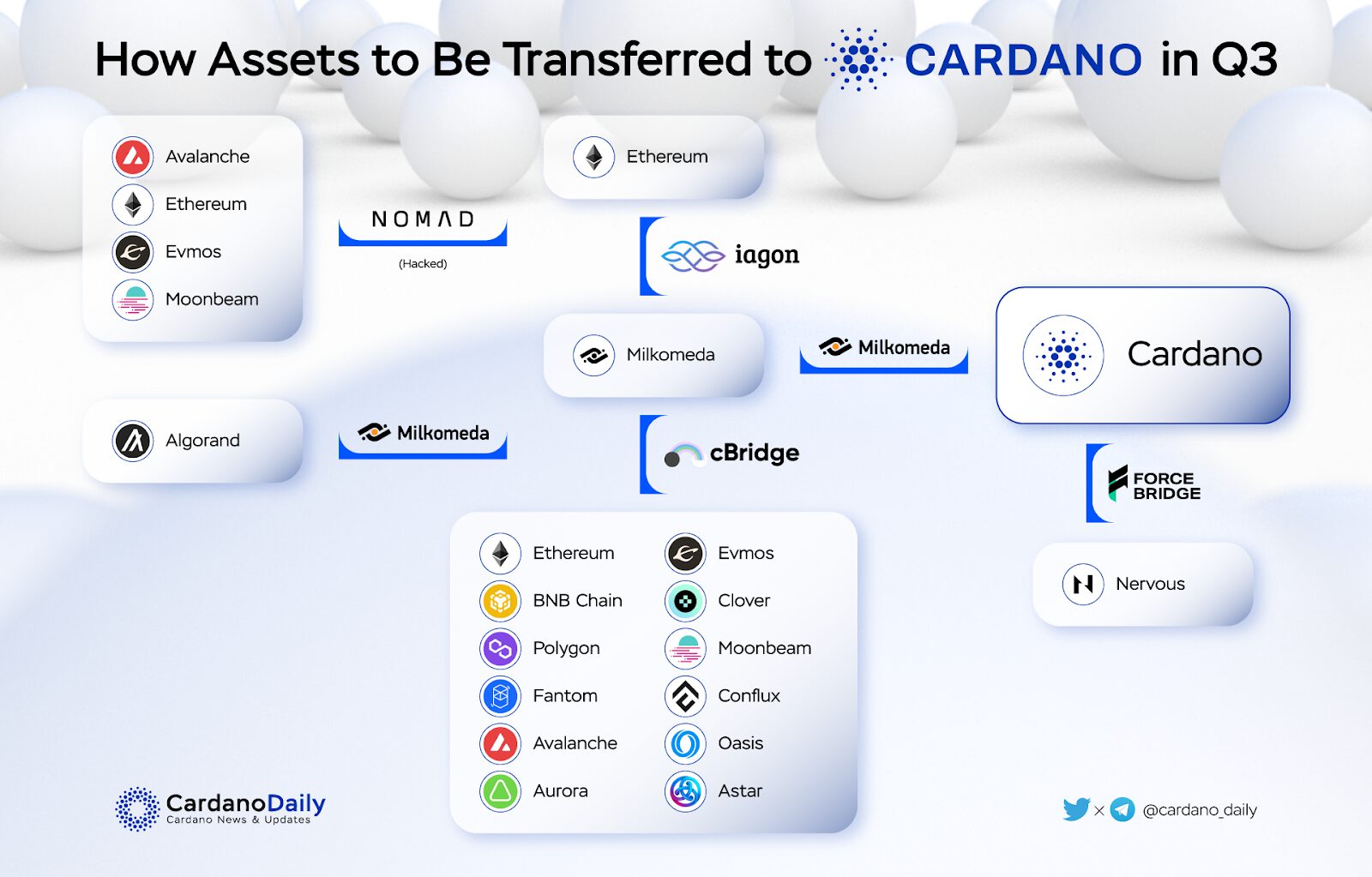

Bridge

Fortunately, Nomad was not the only way for an asset from outside to be able to transfer to the Cardano ecosystem.

Thanks to the rapid development in infrastructure of the Layer 2 of our ecosystem – Milkomeda, the assets on Cardano ecosystem can be interacted with also most all other ecosystems in the crypto environment and vice versa. Obviously, this only happens when there shall be projects offering the service to the wrapped-assets.

Infrastructure

The Cardano network has witnessed one of the most important phases in the Basho era – the Vasil hard fork. The hard fork focuses on the scalability of the network, specifically upgrading the size of each block for more data.

Actually, we shall only experience the Vasil hard fork effect on the Cardno ecosystem in such a long term, not in other shorter periods of time, so please see the PROJECTION section for more discussion.

You can have a better understanding about the Vasil via these threads:

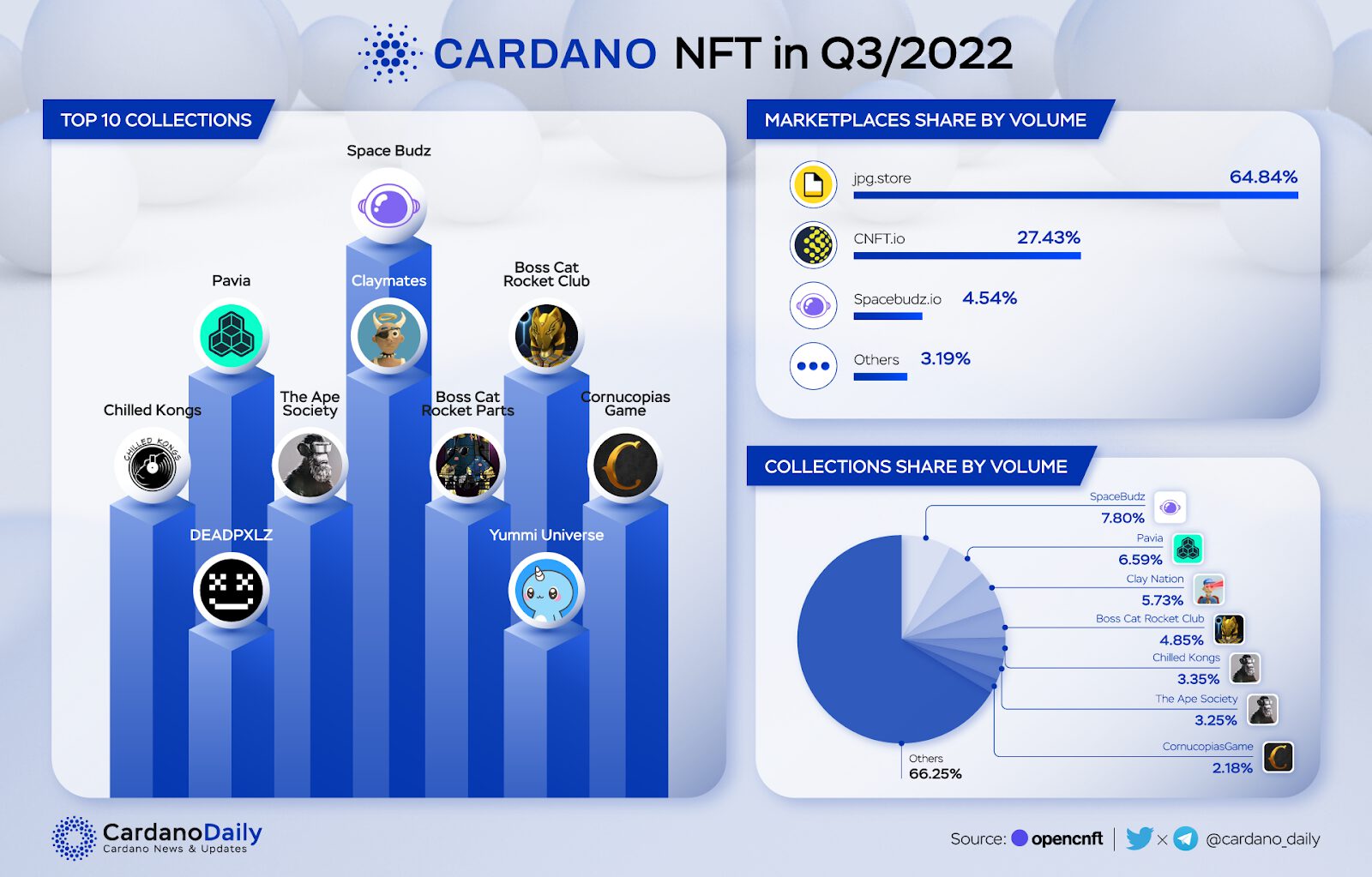

NFT

To be honest, the NFT sector of Cardano is much more outstanding than the DeFi one.

Our ecosystem has enough resources for the development of NFT: Launchpad, Marketplace, Analytic platform, Giant number of projects,…

With regard to percentage in each field, the Cardano matches the statistics with other developed NFT sectors from other ecosystems, such as Solana or Ethereum. The top marketplace always takes two-thirds of the entire trading volume and the top 10 contribute one-third volume of the all existing collection.

Project Catalyst F9

In Q3, there was another important event of Cardano which shall be the premise for development of the ecosystem in the long future.

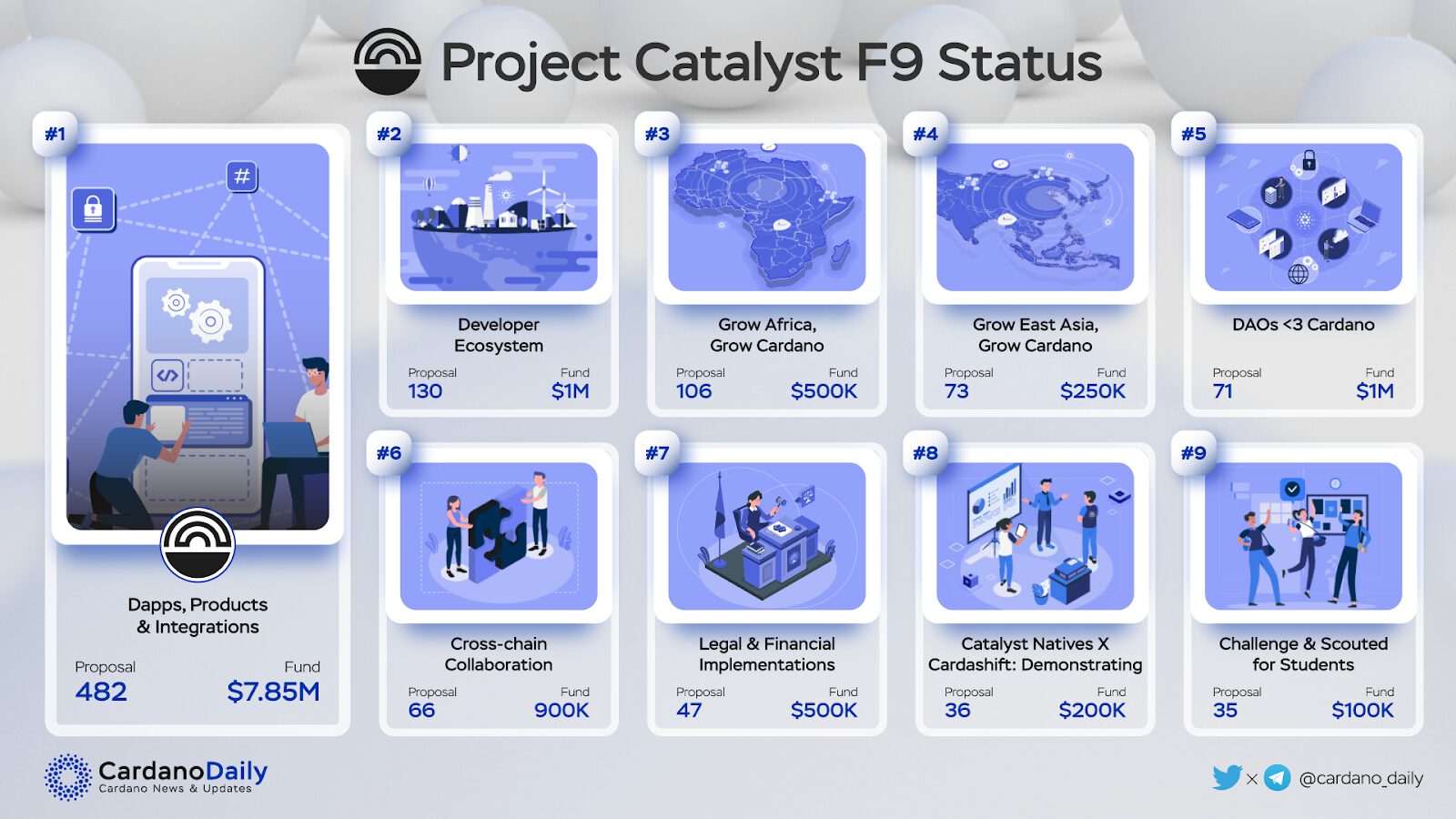

With the total grant of up to $1.3M, there were more than 500 proposals participating in the Project Catalyst F9, which concentrated the most in the Dapps, Products & Integration Category.

Comparison

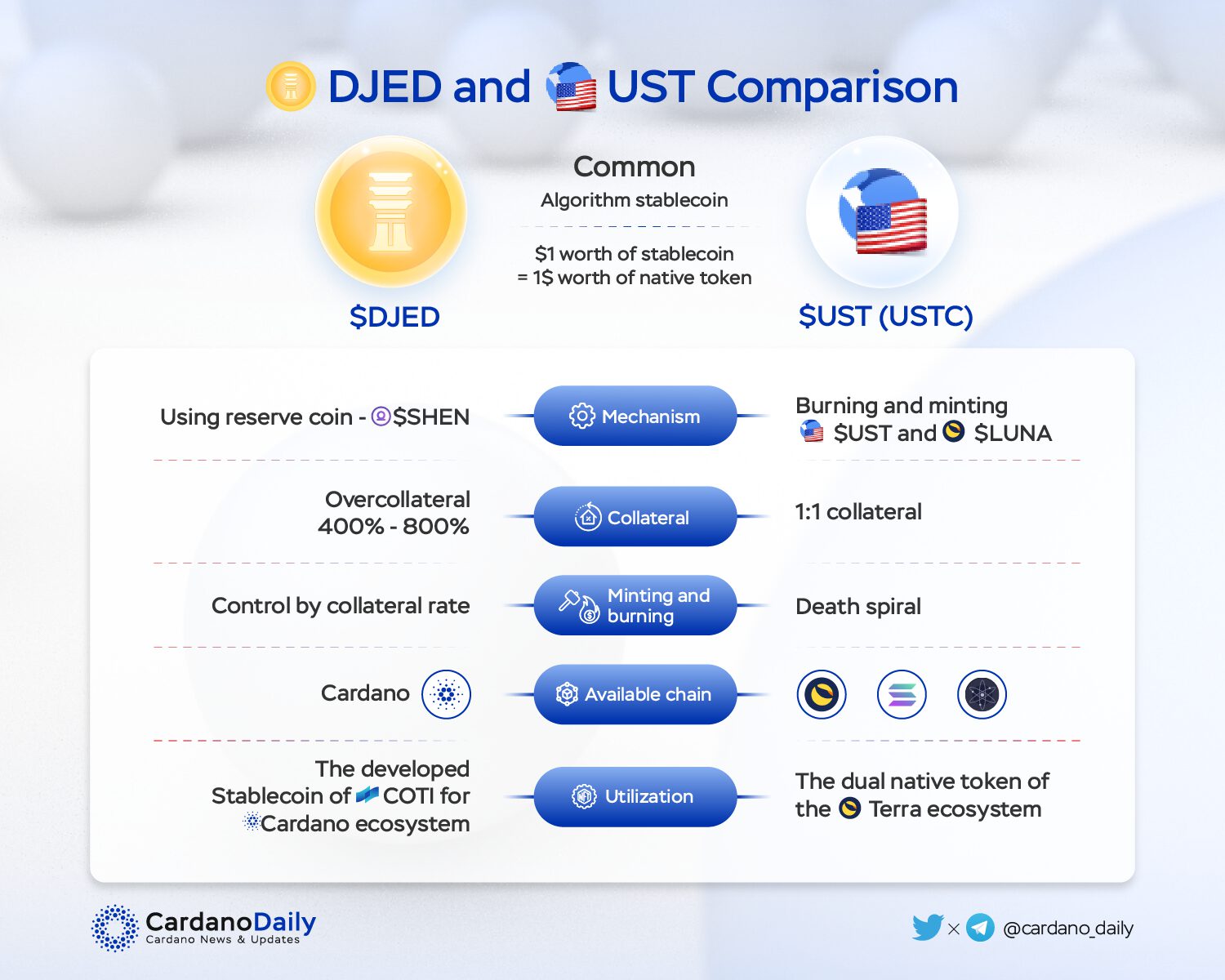

Stablecoin

When mentioning Stablecoin, we always have to compare it with the historical lesson – $LUNA – $UST.

$DJED stablecoin shall be expected to go mainnet after the Vasil hard fork. And the comparison shall be well-discussed in the above infographic or view the below thread: $DJED v. $UST comparison.

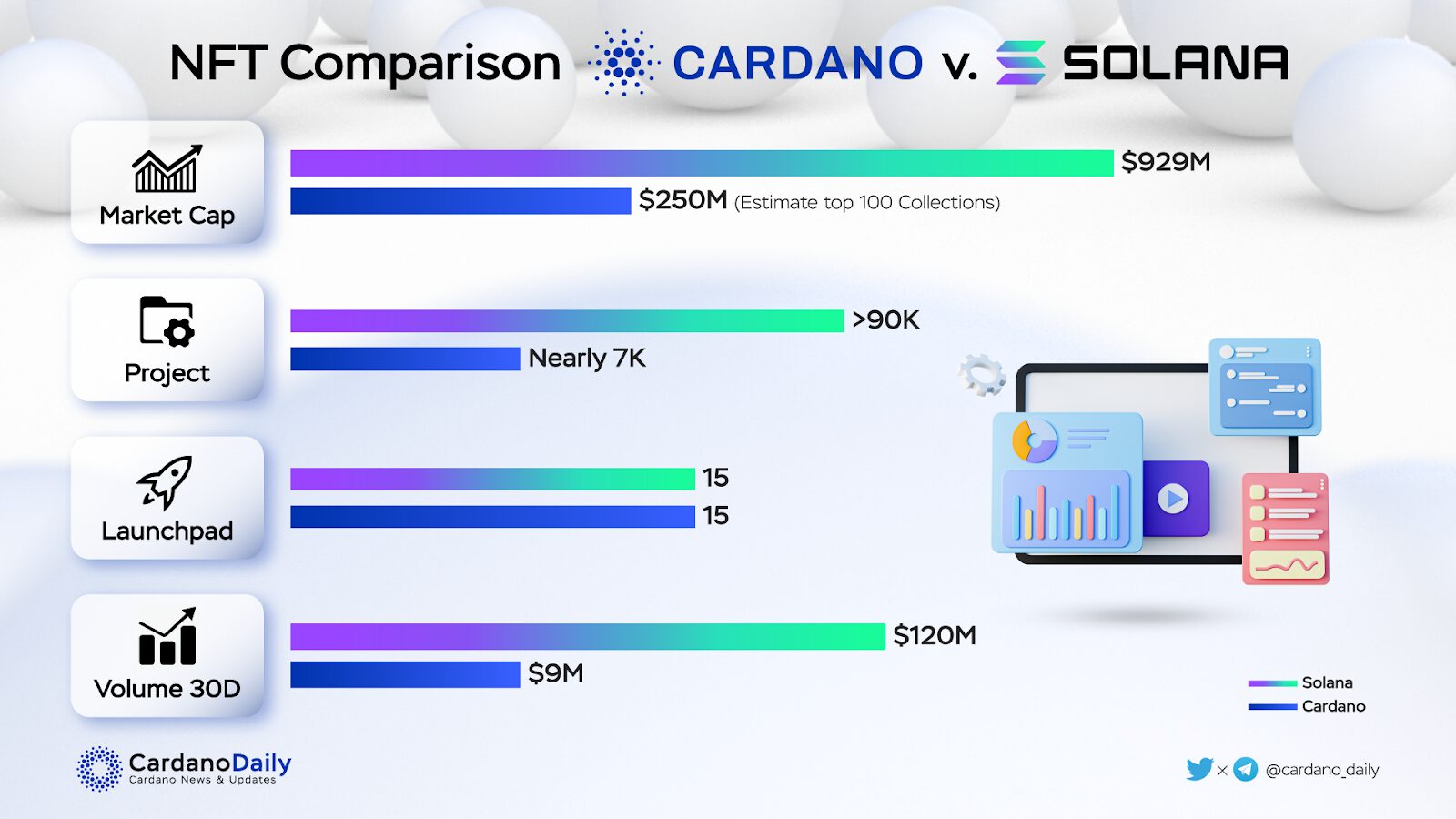

NFT

To be better at something, we shall look at the comparison towards the nearest competitors of ours – Solana, which had been a formidable opponent of Ethereum.

Although the statistics in the chart have been shown in a relative ratio, our ecosystem shall have much to do before reaching this level of development of Solana, not even mentioning Ethereum.

PROJECTIONS

After Vasil?

As mentioned, the Vasil hard fork shall bring along the benefits to the network in the long term rather than in the short term. We shall only experience such benefits for about 4-5 months or even one more year.

Since one block contained more data than before, there shall be more information being recorded on the Cardano blockchain. The network is able to handle more transactions at once time, leveling the TPS of the network.

One of the direct effects of the Vasil hard fork is to improve the efficiency of

Djed, an algorithmic stablecoin developed jointly by IOHK and the COTI Group, increasing the number of transactions carried out on the Djed platform and thus helping position Cardano as a prime contender for stablecoin transactions.

1st DeFi Lending Project?

This pattern happened the same to every ecosystem when having its own lending and borrowing sector. More capital is being utilized, creating a more dynamic money flow running within an ecosystem, and even access to other ecosystems throughout a cross-chain bridge.

Right now, the AADA finance team has only been on launch for about 2 weeks, and they have time to build, diversify their lending instruments. Sooner or later, more lending projects shall appear in the Cardano ecosystem thanks to the success of AADA finance.

At that time, a much more competitive environment of the lending sector would push the ecosystem into other needs for other deficient sectors to complete an entire ecosystem, such as staking or yield farming.

Conclusion

In conclusion, the Cardano ecosystem has much potential to develop in the future in any kind of sector, especially the NFT sector. There are sufficient resources for us and the community to build a better Cardano.

In Cardano, we trust!

Disclaimer

The information provided in this report does not constitute investment advice, financial advice, trading advice, or any other sort of advice. Do conduct your own due diligent research and consult your financial advisor (if any) before making any investment decisions.

Cardano Daily does not recommend that any cryptocurrency should be bought, sold, or held by you. The vision of the article depends a lot on the subjective perspective of Cardano Daily’s Writer. The data here below are acquired from third-party sources, including data aggregator platforms and team projects.