Disclaimer: The findings of the following analysis are the sole opinions of the writer and should not be considered investment advice

The 2021 hype behind Cardano saw the price register enormous gains. Yet, the majority of the newly arrived investors of the past year appear to be at a loss. The inability to hold on to the psychologically important level at $1 in the past couple of months meant that the asset could slide southward once again. The coin has a +0.76 correlation with Bitcoin. At the same time, it doesn’t respond as strongly to a bullish Bitcoin as to a bearish one. These factors could see selling pressure mount once again for Cardano.

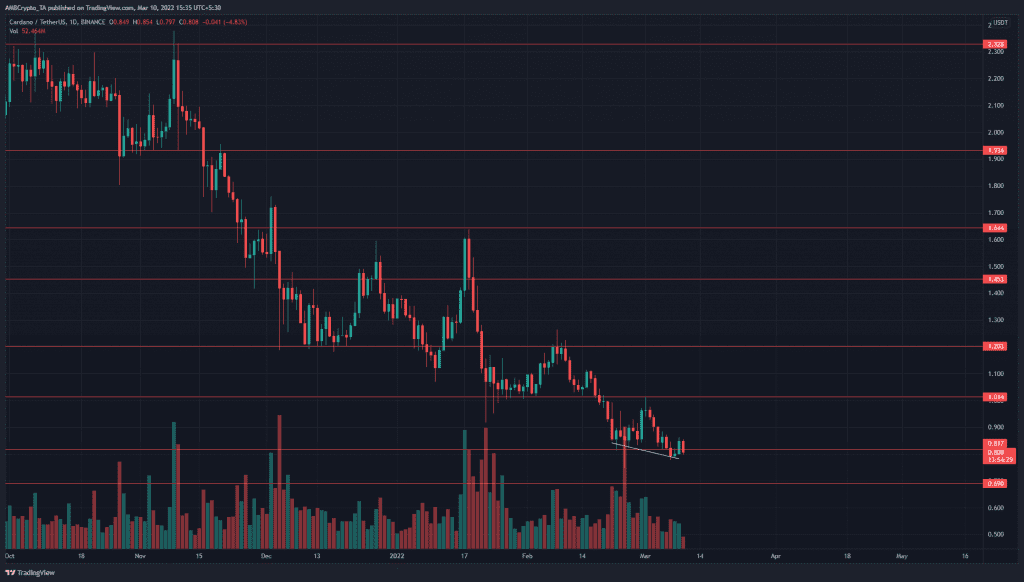

ADA- 1D

On the charts, the relentless downtrend of the price in the past few months was clearly visible. In December, the $1.2 support was hailed as a must-hold level for the bulls. In late January and early February, the $1 level was held in the same regard. Both of these levels have been broken. At press time, the price appeared to be on its way to a daily close below the $0.817 level.

In order to flip the longer-term bias from bearish to bullish, ADA must flip the $1 to support. The price has seen some short-term demand at $0.75 but this was unlikely to keep ADA afloat on the charts.

Rationale

The RSI formed a bullish divergence (white), as the RSI made higher lows while the price made lower lows. However, the predominant trend in recent weeks has been bearish- hence this divergence will likely not change the trend. Besides, the price was already beginning to descend.

The Awesome Oscillator stayed well below the zero line. Hence, momentum was firmly on the side of the bears. The OBV has also been moving southward, an indication that selling volume has been higher than the buying volume on the daily timeframe. The CVD indicator was also in bear territory.

Conclusion

Overall, the indicators highlighted that momentum and selling volume both pointed to the downside. The market structure was also bearish, and the $1 resistance zone would have to be beaten. As things stand, this was an unlikely outcome. To the south, $0.75 and $0.69 could see a minor bounce.