Cardano, over the last two months and all of November, has not been able to chart any significant gains, either in terms of price movement or network development. In fact, its market cap has been mostly oscillating within the $65 – $70 billion bracket, despite the same falling to $63 billion at press time.

Even so, its investors just do not seem to be giving up.

Cardano investors going strong

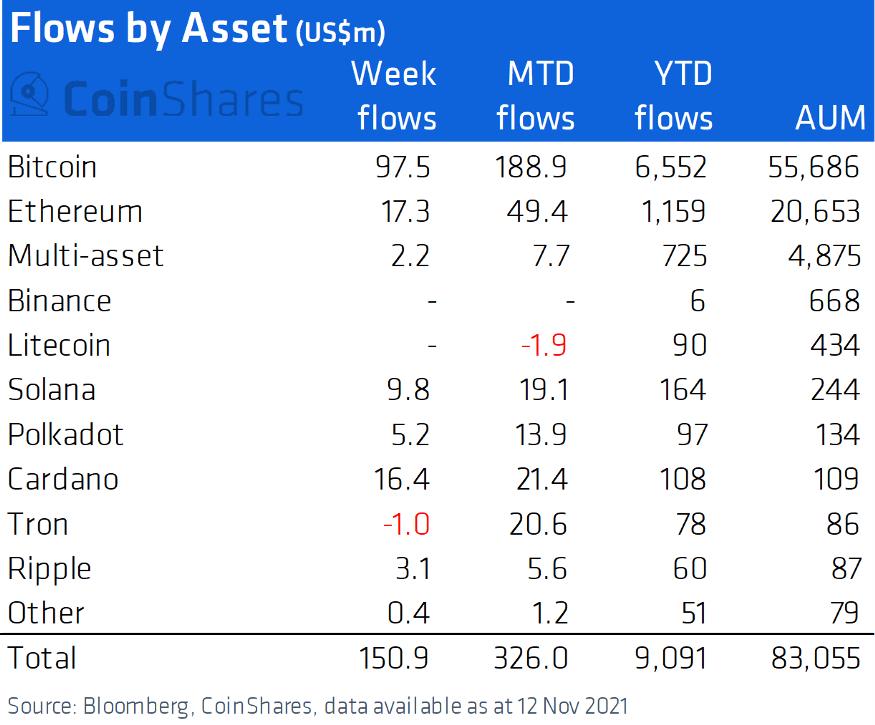

This week, the altcoin managed to pull in $16.4 million in weekly inflows, with its MTD flows now flashing a figure of $21.4 million.

Inflows by asset | Source: CoinShares

After Ethereum, this is the highest figure for any other altcoin in the market. This might be interpreted as a sign that even though ADA is down, it hasn’t fallen yet.

However, all this would’ve mattered more had Cardano investors not been suffering at the hands of a lack of price movement.

Since 20 September, ADA has been stuck under the $2.28-resistance. This has been an important level for a very long time. Notably, despite multiple attempts, ADA has failed to close above it. Even day trades touching highs above the resistance point couldn’t help Cardano in any way.

Cardano price action | Source: TradingView – AMBCrypto

Regardless of its short-term consolidation, ADA managed to keep above the support level of $1.90. However, this is now being tested.

Over the last two months, ADA has seen corrections worth 38%, 18.8% out of which came in the last week alone.

What’s up with investors?

Well, investors are suffering massively. In just two months, 52% of all Cardano addresses lost their profitability. On top of that, risk-adjusted returns for Cardano have continued to drop, lying in the negative 2.08 zone at the time of writing.

Cardano addresses’ profitability | Source: Intotheblock – AMBCrypto

However, even so, investors continue to be drawn over to the altcoin as active addresses were at a multi-month high on 15 November. In fact, the same has been rising since.

Cardano active addresses | Source: Intotheblock – AMBCrypto

In addition to that, the number of transactions hit 242k yesterday. This marked the all-time highest transaction count for the altcoin.

Cardano number of transactions | Source: Intotheblock – AMBCrypto

Simply put, as the overall market continues to be in a state of greed, it won’t be surprising if Cardano manages to pull in more volumes. As for its investors, it is difficult to assess when they would return to profits.