Post the market-wide retracements, Enjoin Coin flipped the 20 SMA from its support to immediate resistance. Further, Cardano and MANA fell below their 20-50-200 SMA.

After poking the $45,900-mark, Bitcoin registered a 3.8% jump over the past few hours. Consequently, the aforestated cryptos bounced back from their immediate supports. Their RSIs were in the recovery phase after dipping into the oversold territory.

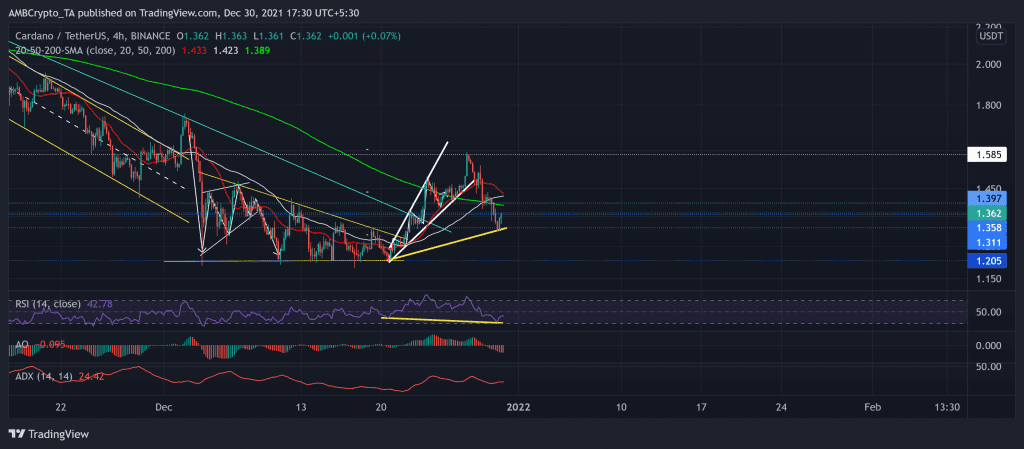

Cardano (ADA)

As ADA oscillated in an ascending broadening wedge (reversal pattern, white), it invalidated its long-term bearish trendline (Cyan). Then, it saw an expected breakdown from its month-long resistance at the $1.58-level.

The alt retraced by nearly 18.11% in the last three days. As a result, the price action poked its weekly low on 30 December.

After finding immediate support at the 1.31-level, ADA bounced back and crossed the $1.358-mark at press time. While the 20 SMA (red) stood above the 50-200 SMA, ADA needed to cross the $1.397 hurdle to confirm a strong reversal.

At press time, ADA traded at $1.362. The RSI bounced back from the oversold region and showed decent revival signs. The price action marked green candles after a bullish divergence (yellow trendline) between the RSI and price action. While the AO depicted a shift in momentum in favor of bears, the ADX displayed a slightly weak directional trend for ADA.

Decentraland (MANA)

After falling in a down-channel (yellow), MANA halted its downturn at its one-month support at the $3.02-mark. As the price bounced from this level, it saw for nearly ten days until it breached the $3.6-mark.

The alt marked a 16.94% retracement after touching its three-week high on 27 December. With this fall, MANA fell below its 20-50-200 SMA. The immediate testing point for the bulls now stood near the 20 SMA (red) at the $3.4-mark.

At press time, MANA traded at $3.3405. The RSI flashed a bearish bias and found resistance at the 42-level. While the MACD visibly preferred the sellers, its histogram approached the equilibrium. This reading indicated the near-term possibility of a bullish comeback.

Enjin Coin (ENJ)

Since its ATH on 25 November, ENJ saw an over 55.34% retracement as the price action fell in a down-channel until 20 December. After the down-channel breakout, the alt saw an impressive 51.75% recovery until it poked its three-week high on 27 December.

However, the $3.08-mark stood as strong resistance as the price broke down from its up-channel (white) trajectory. Accordingly, after a 22.42% retracement, the alt flipped the 20 SMA from its support to immediate resistance.

At press time, ENJ traded at $2.732. The RSI dipped from the oversold territory as it seemed to head north. Also, the MACD chose the selling strength but hinted at its decreasing influence.