During November, most cryptos dipped to touch their multi-week support levels. The bulls, however, ensured those levels and attempted to trigger an upturn. Consequently, ADA and MATIC registered 24-hour gains.

Moreover, MATIC breached its long-term resistance to touch its six-month high on 3 December. On the other hand, The Sandbox flashed mixed signs.

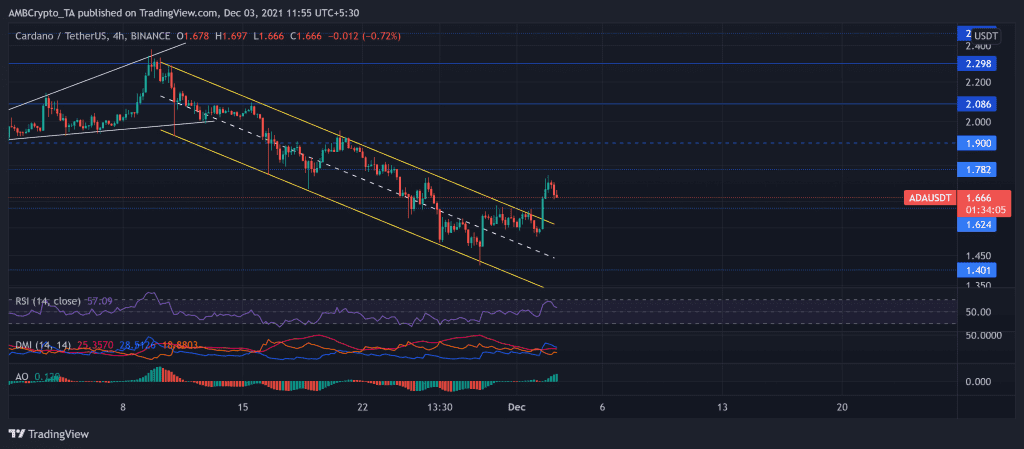

Cardano (ADA)

After a firm down-channel decline for over 25 days, ADA finally broke out of the downtrend. The descending channel occurred after the price inclined in a rising wedge to hit its one-month high on 9 November.

This sell-off phase led to a price dip of over 35% (from 9 November) as the price poked its 16-week low on 28 November. After which, the price action obliged the trend by stepping back into it.

For the past four days, bulls retested the $1.62-mark (immediate support) thrice after they eventually breached it on 2 December. Consequently, ADA noted a 9.3% 24-hour gain and traded at $1.66 at press time.

The RSI rose to its three-week high near the overbought region. Now, after flashing a bullish bias, it showed some slowing signs. This behavior possibly hinted at the bears attempting to test the $1.62-mark. Nevertheless, DMI and AO reaffirmed the bullish power.

MATIC

After a three-day retracement phase, MATIC witnessed a staggering 46.25% ROI (from 28 November low) in just the past five days. The alt grew after marking a rising wedge on its 4-hour chart.

MATIC more or less followed the market trend as it downturned after a relishing October. After losing over one-third of its value (from 29 October high), the price touched its one-month low on 18 November.

However, bulls ensured seven-week-long support at the $1.43-mark. Accordingly, after a 48.9% 14-day jump, the price breached its six-month-long resistance at the $2.22-mark. This incline bolstered MATIC to touch its six-month high on 3 December.

At press time, MATIC traded at $2.23 after noting a 4.5% 24-hour gain. The RSI was vigorous after retesting the overbought territory for over three days. Further, DMI and MACD reaffirmed the previous conclusions.

The Sandbox (SAND)

SAND saw monstrous gains since 28 October. The altcoin saw a soaring 350% ROI from 28 October to 3 November. Then, it rallied in an ascending channel post a symmetrical triangle breakout.

Moreover, the developments in the metaverse over the past month strengthened its bullish force. The alt saw a further 315% ROI from 11 November to 25 November. As a result, the price action touched its ATH on 25 November.

However, at press time, the alt traded at $6.5341 after noting a 9.6% seven-day loss. This decline led to an up-channel breakdown for the first time in 19 days.

The RSI flashed neutral signs after swaying near the mid-line. Further, the DMI and AO displayed a bullish bias. But the ADX depicted a substantially weak directional trend.