Cryptocurrencies still remain weak in light of the immense bloodshed after the dramatic crash of the stablecoin TerraUSD. This sudden fall triggered a sell-off and chaotic situation within the crypto market. Despite the traumatic turn of events, investors have managed to maintain some faith in digital assets.

Reportedly, digital asset investment products saw record weekly inflows that amounted to $274 million around the period of 13 May.

Change is the only constant

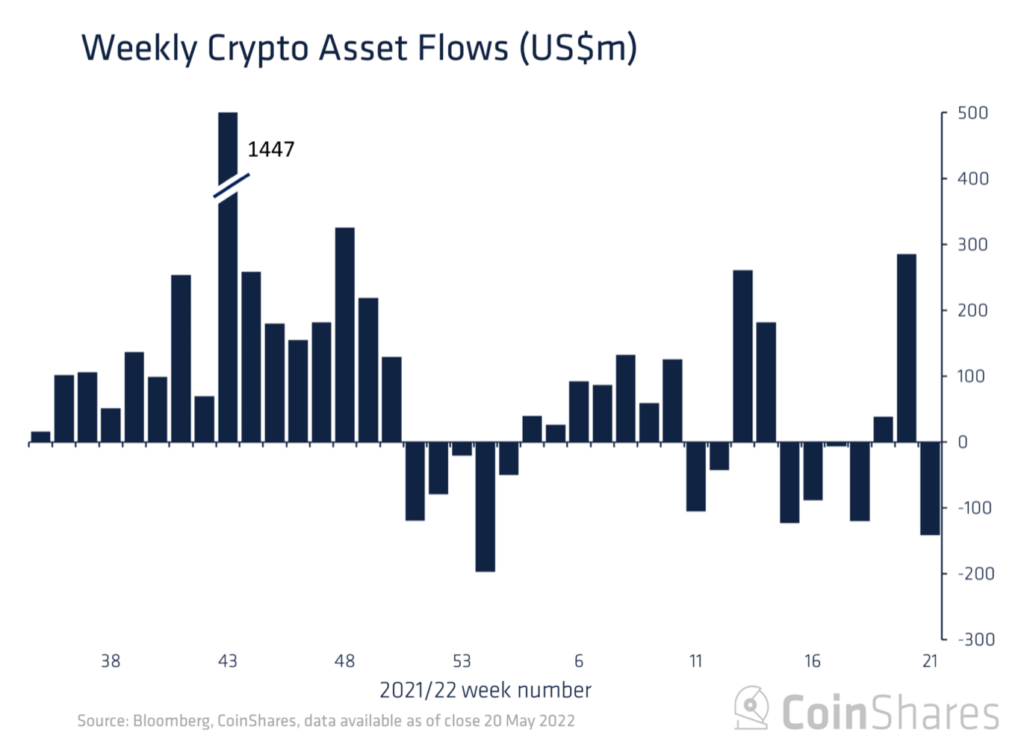

Digital asset products failed to reciprocate a similar narrative as they sustained a major loss. CoinShares’ latest Digital Asset Fund Flows weekly report highlighted this grieving scenario. The crypto market stayed under overall pressure as digital assets investment products registered $141 million in net outflows last week.

The ongoing volatility has led to panic-selling, but the dip is also being seen as an opportunity by a section of investors. While the aggregate sentiment is predominantly bearish. James Butterfield, head of research at CoinShares shared a geographical insight that stated,

“Outflows totalling US$154m were seen in the Americas while Europe saw inflows totalling US$12.4m. Total assets under management (AuM) are now at US$38bn, their lowest point since July 2021.”

But what about the coins?

Well, BTC, the star of the previous report, fell miserably. After the previous week of strong inflows, the Bitcoin funds failed to keep the momentum going. The outflows totalled $154 million last week, while short Bitcoin saw outflows totalling $1.1 million.

Even so, there is something to rejoice about- Year-to-date and month-to-date flows remain net positive at $307 million and $187 million respectively.

Also, instead of opting for a single crypto-focused product, investors have opted for multi-crypto investment products last week. Butterfield noted,

“Multi-asset (multi-crypto) investment products remain the stalwart with inflows totalling US$9.7m last week. Inflows year-to-date represent 5.3% (US$185m) of AuM. The investment products have seen only two weeks of outflows this year, much lower relative to its peers.”

Investors saw multi-asset investment products as safer relative to single line investment products during volatile periods. Besides, there were also some minor inflows across the broader altcoin category. Altcoins such as Cardano and Polkadot saw inflows that stood around a total of $1 million each.

Thus, it goes without saying, but the extreme volatility following the collapse of the Terra ecosystem triggered the ongoing scenario in the market.