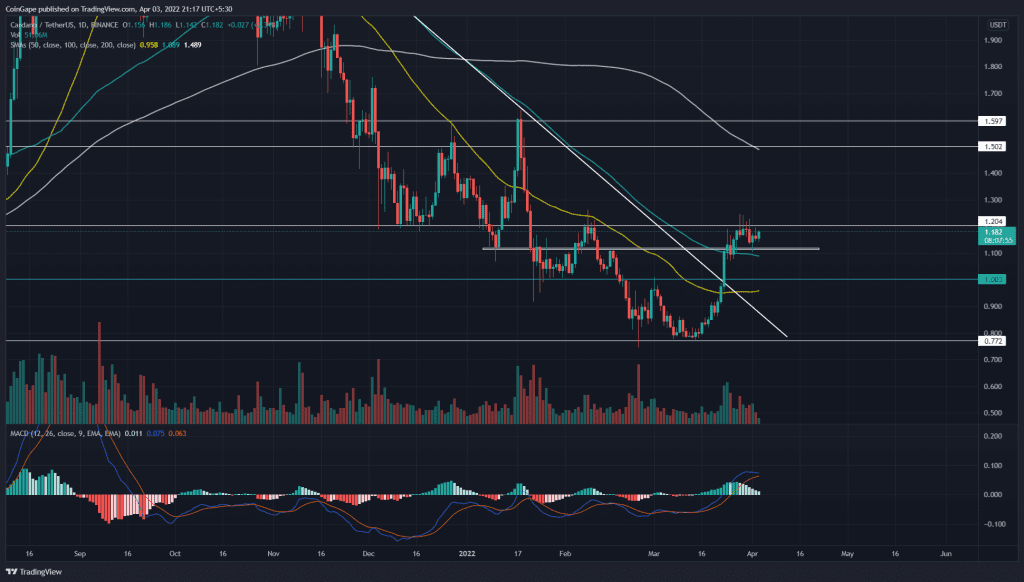

The ADA price approaching the overhead ceiling of $1.2 undermines the multiple rejections the buyers faced earlier this week. However, the buyers would need a genuine breakout to provide closing and sustainability above the $1.2 mark to confirm a continuation of the bullish rally.

Key points:

- The ADA price has gained 3.8% in the last three days.

- The intraday trading volume in the ADA coin is $1 Billion, indicating a 16.9% loss.

Source- Tradingview

On March 23rd, the Cardano(ADA) buyers gave a massive breakout from the confluence of technical resistance, i.e., $1 psychological level, dynamic resistance trendline, and 100-day SMA. As a result, the parabolic rally marked a high of $1.25, its highest since Mid-February.

However, the sellers mounted stiff resistance at $1.2 and did not allow a daily candle closing above it. Even so, the sellers couldn’t extend the downfall below the 100-day SMA($1.12), resulting in choppy price action the whole week.

The ADA price rebounded from the 100-day SMA line, preparing to rechallenge the overhead resistance. A bullish breakout and closing above $1.2 would indicate the buyers are ready for another leg-up and could appreciate the altcoin by 24% to $1.5.

Alternatively, another failed attempt from buyers to overcome the $1.2 mark would suggest weakness to the bullish momentum and may trigger a minor pullback to the $1 mark.

Technical Indicator

The MACD indicator is nearing a bearish crossover as the gap between the MACD and signal gets thinner. However, the potential breakout from the $1.2 resistance may prevent this bearish signal.

The 50-and-100-day SMA moving sideways indicates a positive shift in traders’ sentiment. Moreover, the prior dynamic resistance 100 SMA is now providing strong support level.

- Resistance levels- $1.2, and $1.8

- Support levels-$1 and $0.78