Cardano (ADA) price has reached a long-term support area. Still, the Fib levels and wave count suggest that more downside is expected prior to an eventual bullish reversal.

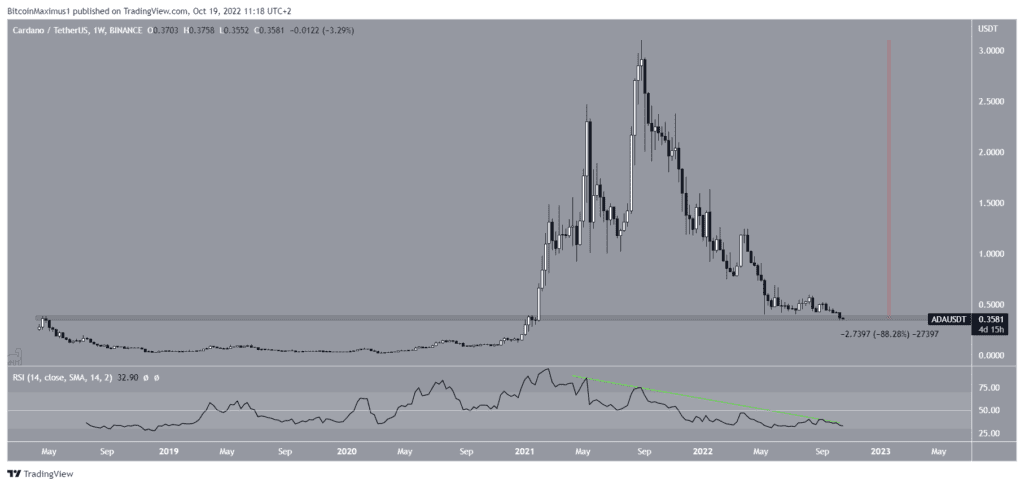

ADA price has been moving downward since reaching an all-time high of $3.10 in Aug. 2021. The downward Cardano price movement has led to a low of $0.35 on Oct. 13. Measuring from the all-time high, this amounts to a decrease of 88%.

Currently, ADA price is trading inside the $0.37 horizontal support area. This is a crucial support level since it has previously acted as resistance in May 2018 and Feb. 2021. After Cardano price finally managed to break out, it greatly accelerated its rate of increase towards the 2021 all-time high.

Nonetheless, the RSI does not yet support a potential bullish reversal. The main reason for this is that the bearish divergence trendline that led to the current downward movement is still intact (green line).

Until the RSI manages to break out and move above 50, the price of ADA price trend cannot be considered bullish.

Cardano Price: When Bottom?

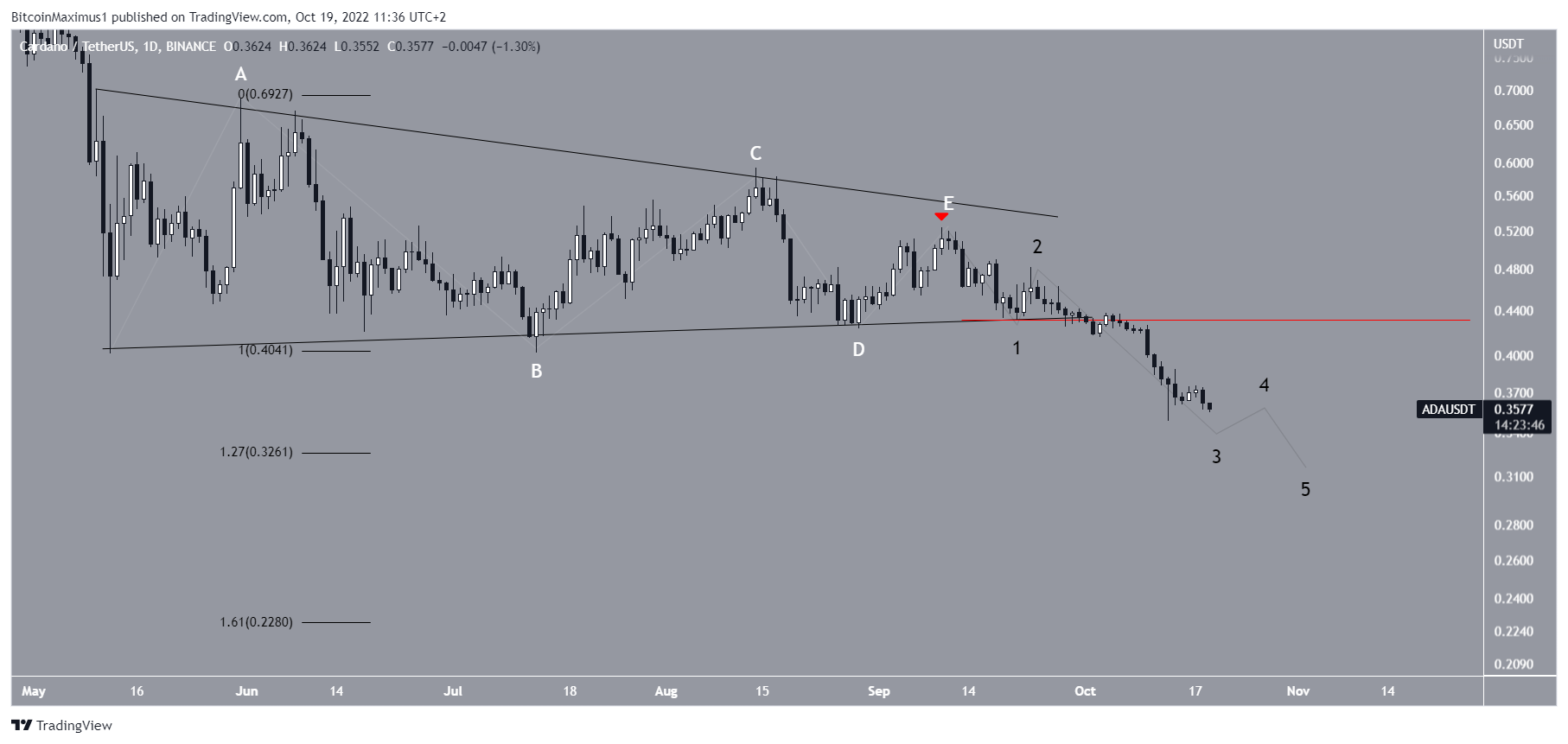

A wave count technical analysis shows that ADA price has been falling at an accelerated rate since completing the count for a symmetrical triangle (white) on Sept. 10 (red icon). Since then, the sub-wave count has been given in black. It suggests that Cardano price is either in sub-wave three or five.

The short-term Fib level for the bottom is at $0.32, created by the 1.27 external Fib retracement used on the height of the triangle. If the sub-wave five extends, Cardano price could continue falling all the way to $0.23, the 1.61 external Fib level.

An increase above the sub-wave one low (red line) at $0.43 would invalidate this Cardano price prediction and instead suggest that the correction is already complete.

ADA Price Prediction for 2025

While it is difficult to make an ADA price prediction more than two years in advance, the current crypto market cycle could offer clues as to where the Cardano price will be in 2025.

It seems that ADA price has completed a five-wave upward movement beginning in March. It is now correcting as a result. So far, the correction has taken 0.786 the time of the upward movement (white).

The weekly chart also supports the findings from the wave count. It suggests the bottom will either be reached at the $0.32 or $0.23 levels. There is channel support for the former (green circle) and Fib support for the latter (red circle).

In case the ADA price decreases towards the latter, the Fib time zone tool predicts a bottom in Feb. 2023. In the case of the former, the bottom will be reached within the next few weeks.

It is worth mentioning that the next BTC halving will occur at block 840,000, which is estimated to be on March 21, 2024. The previous halving was the catalyst for the current bullish cycle. So, it is possible that the same will occur this time around.

It is possible to draw a resistance line connecting the 2018 and 2021 highs. Depending on when the ADA price reaches it, the resistance line will be close $5. If ADA manages to break out above it, the rate of increase would likely accelerate, taking it towards $10.

If, however, the ADA price fails to reach a bottom and drops below the 2020 lows at $0.017, it would invalidate this Cardano price forecast.

For the latest BeInCrypto Bitcoin (BTC) and crypto market analysis, click here

Disclaimer: BeInCrypto strives to provide accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. You comply and understand that you should use any of this information at your own risk. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.