As the broader market continues its steady slump, Shiba Inu and IOTA see a breakdown below the 61.8% Fibonacci level. Moreover, Cardano bears breached the crucial $1.26-mark while the near-term technicals for all these cryptos demonstrated a bearish bias.

Cardano (ADA)

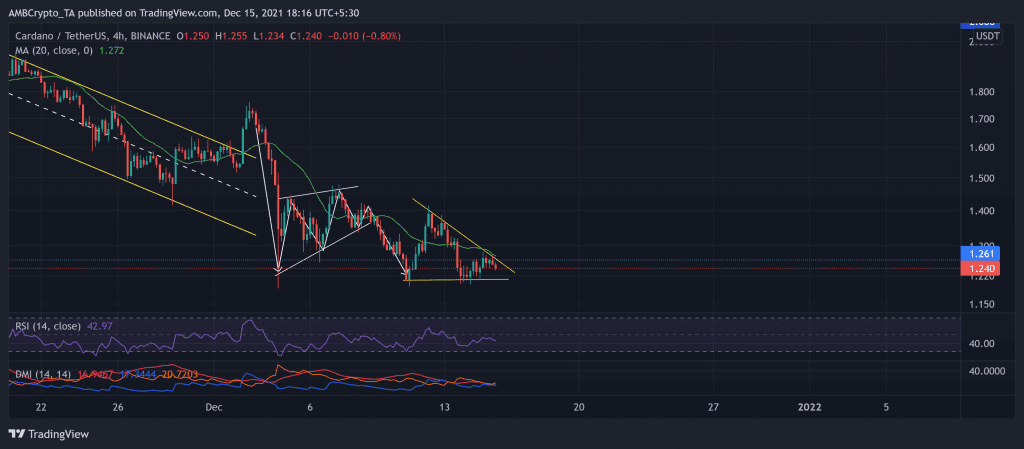

ADA continued its bearish streak and formed a descending triangle on its 4-hour chart over the past five days. As the alt saw a 13.05% breakdown from the rising wedge, the price action steeply plunged to poke the $1.19-mark on 11 December.

The bears retested the $1.26-mark (20-week resistance) four times before sustaining the price below that level. Over the past two days, ADA bulls tried to test the above mark thrice but failed to surpass it. This sustained selling pressure has accelerated the alts’ long-term bearish movement.

At press time, ADA traded at $1.24. The RSI exhibited a bearish inclination and seemed to head south. Further, the DMI implied a seller’s market but flashed a weak directional trend. Now, the immediate hurdle for the bulls stood at the upper trendline and the 20-SMA (green).

Shiba Inu (SHIB)

SHIB saw a breakdown from its V-top on 2 December and formed a descending channel (yellow) over the past 11 days. The alt witnessed an over 37% 15-day decline in its value.

This fall breached the golden 61.8% Fibonacci level while the bears also snapped the crucial $0.000035 resistance. Now, the midline (white, dashed) of the down-channel along with the aforestated level became immediate hurdles for SHIB bulls to conquer.

After attaining its lifetime milestone, SHIB lost over 62% of its value in the past 48 days. At press time, SHIB traded at $0.00003318.

Throughout this month, the RSI failed to sustain itself above the midline. The DMI, however, displayed a slight bullish preference but its lines seemed to be on the verge of a bearish crossover. Besides, the ADX displayed a weak directional trend.

IOTA

IOTA saw a substantial up-channel breakdown on 4 December and marked a falling wedge over the past ten days. Like SHIB, IOTA breached the golden Fibonacci level below its two-month resistance at the $1.18-mark. With this downfall, it invalidated its long-term bullish trend.

IOTA slackened aggressively after hitting its two-month high at $1.66 on 25 November. It lost nearly 37.2% of its value in just 20 days.

At press time, IOTA traded at $1.0451. The near-term technicals hinted at increasing bearish power. The RSI visibly chose the bears after a sharp plunge looking to head south. Further, the DMI lines looked in the opposite directions and confirmed the increasing bearish vigor.